How to register a power of attorney for tax procedures using electronic identification

You can register a power of attorney for tax procedures by accrediting yourself through one of these 3 ways:

-

Power granted through personal appearance at the Delegations and Administrations of the Agency and in the case of legal persons or entities lacking legal personality referred to in article 35.4 of Law 58/2003, of December 17, General Tax Law, through appearance of the legal representative of the entity or of whoever holds sufficient power to grant the powers of attorney.

-

Power granted by public document or private document with notarized signature presented to the Tax Agency.

-

Power granted over the Internet through the use of one of the identification and authentication systems provided for in Law 39/2015, of October 1, on the Common Administrative Procedure of Public Administrations.

Empowerment through electronic identification

The power of attorney granted through electronic identification on the Tax Agency website allows any taxpayer to authorize a third party (natural or legal person) to carry out online, on their behalf, any of the procedures and actions in tax matters that are enabled through power of attorney with their own electronic certificate, DNI electronic, Cl@ve or with the identification system for citizens of the European Union ( eIDAS ) using the identification of another country.

You can consult the procedures available for the power of attorney through the Internet in the section "Collaborate with the Tax Agency", "Registry of powers of attorney", "Form and procedure" and, on the right margin, in the "Help" section by clicking on "List of procedures enabled for the power of attorney"

To register the power of attorney for tax procedures, go to "Register power of attorney through electronic identification" within the procedures of the "Power of attorney registry".

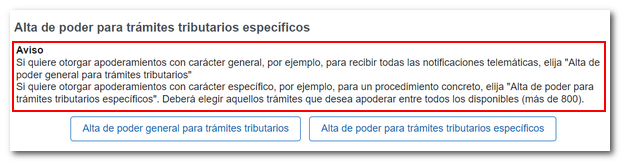

See the notice above. Please note that if you grant a power of attorney to receive notifications for a specific procedure, for that specific procedure the notifications will be directed to the recipient of the document and to the specifically designated representative, and the representative in the general procedure will not receive the notification.

General empowerment

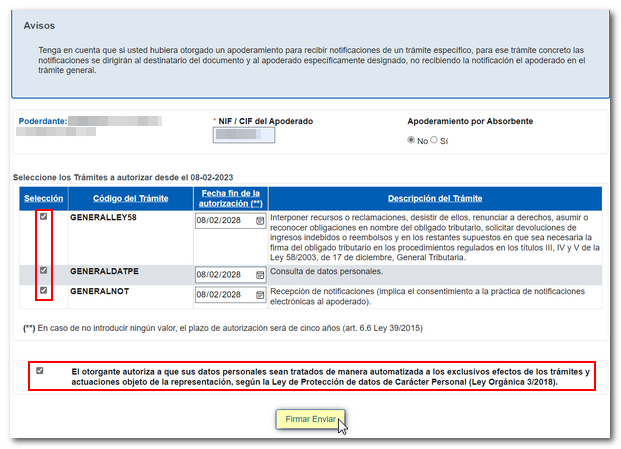

Click on "Register general power of attorney for tax procedures." Fill in the field NIF / CIF of the representative, select the code(s) of the procedures: "GENERALLEY58", "GENERALDATPE" and "GENERALNOT" and indicates the end date of the authorization. If the authorization end date data is not modified, the duration of the power of attorney will be 5 years, this being the maximum duration period of the power of attorney. Check the authorization box and press "Sign and Send."

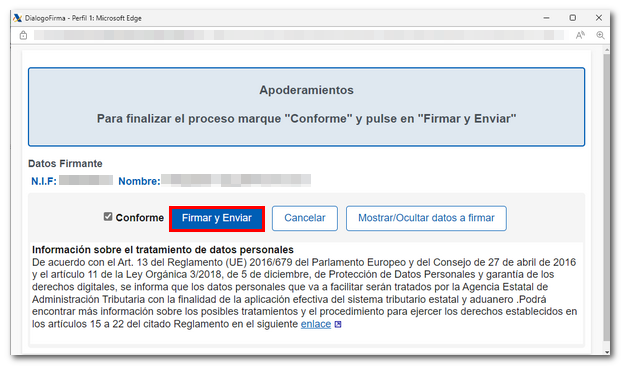

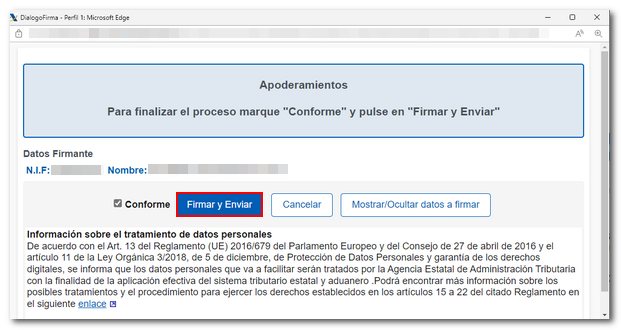

Check the "I agree" box and click "Sign and Submit" to complete the power of attorney.

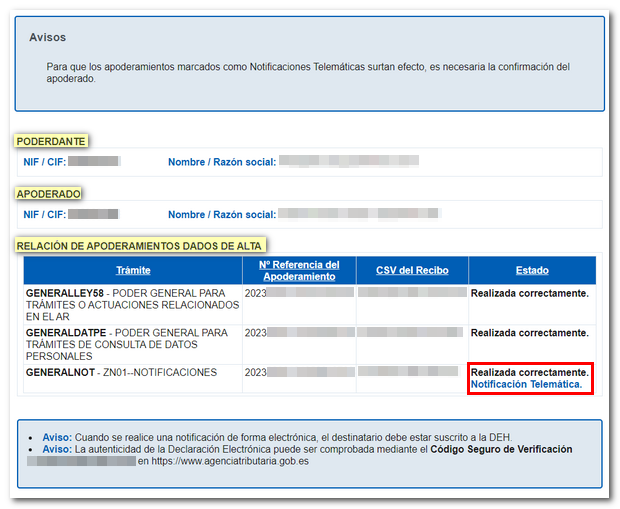

The response window will provide information on the principal, the agent, the list of registered powers of attorney and the CSV (Secure Verification Code) that you can compare in the "Comparison of documents using a secure verification code" section on the website. Furthermore, in the case of a general power of attorney for the receipt of notifications, the "Status" column specifies "Electronic Notification" to indicate that confirmation by the attorney is necessary for it to take effect.

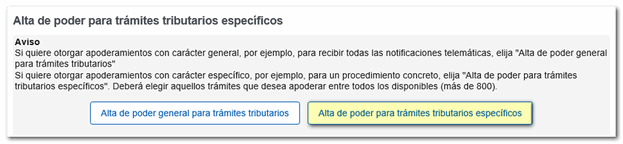

Specific empowerment

Click on "Create power of attorney for specific tax procedures."

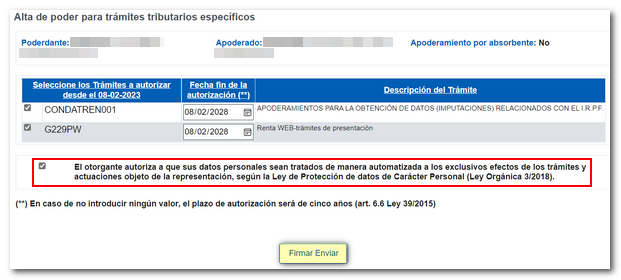

Fill in the field NIF / CIF of the representative, indicate the end date of the authorization and select the code(s) of the procedures for which the power is granted.

Specific procedures are organized by categories. You have a search engine to easily locate the procedure. To expand the subcategories, click on the "+" sign of the corresponding folder. You can select an entire category or a specific subcategory. Click "Accept" at the bottom.

The procedures for which you have granted the power of attorney will be displayed and you can modify the authorization end date (if the value on the previous screen has not been changed, the validity will be 5 years). Check the authorization box and press "Sign and Send."

Check the "I agree" box and click "Sign and Submit" to complete the power of attorney.

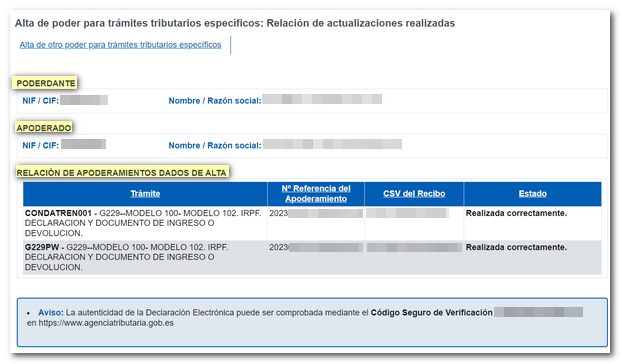

The response window will record the data of the principal and the agent, the list of registered powers of attorney, and the codes CSV (both the general response code and the specific codes for each power of attorney) that you can compare in the "Comparison of documents using a secure verification code" section on the website.

Remember:

-

-

Confirmation by the attorney is required for the powers of attorney to take effect in those cases in which the "Electronic Notification" status is marked.

-

The power of attorney may be granted to one or more persons, both natural and legal.

-

The principal may perform the "Consultation and revocation of granted powers of attorney" by accessing "Power of attorney for carrying out procedures and actions in tax matters online" on the website.

-