How to consult, extend and revoke powers of attorney granted

Check the powers of attorney granted

To check your granted powers of attorney, you can use an electronic certificate. ID card electronic, Cl@ve or the identification system for citizens of the European Union (eIDAS) using the identification of another country.

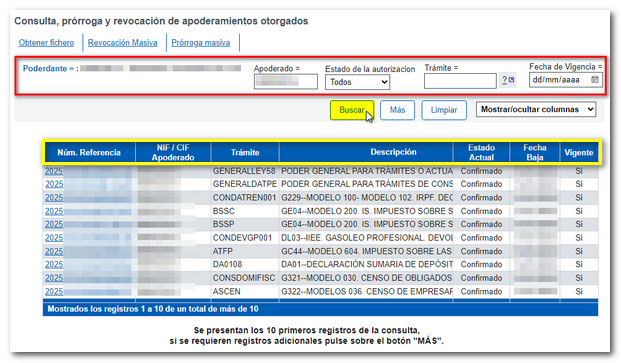

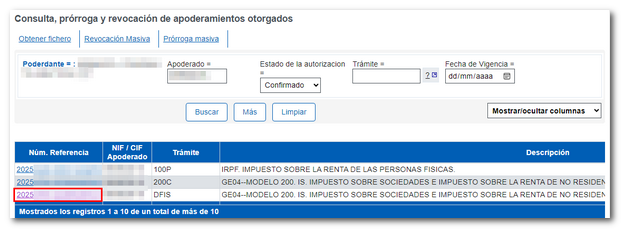

Once you have selected the type of access, you will get the window for consulting, extending, and revoking powers of attorney granted, where the following will be indicated: NIF and Name or business name of the grantor.

You can filter your search by these criteria: "Attorney-in-fact", "Authorization status", "Process" and "Effective date". Press "Search"; The top 10 will be displayed, and if there are more results, click "More" and "Next" to view the rest of the powers. By clicking on the power of attorney reference number, you can access the details of the power of attorney to modify the validity period and/or revoke it.

Extend powers of attorney that are about to expire

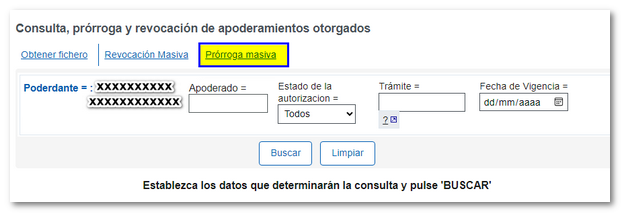

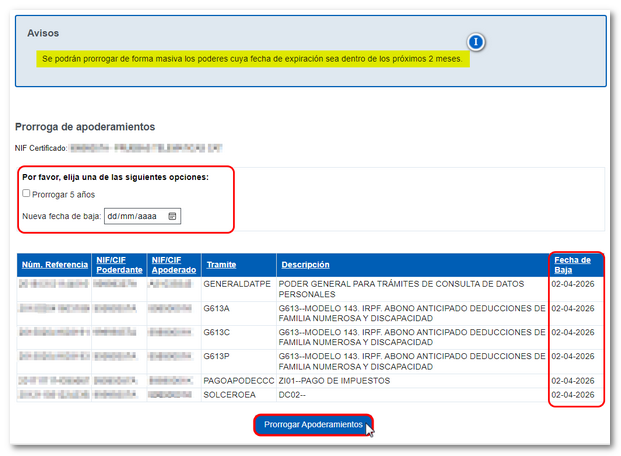

The principal may extend the powers of attorney granted from two months before the expiry date until the expiry date itself. In the menu at the top, access the "Mass Extension" tab.

The system will display the list of procedures that will expire in the next 2 months, along with the corresponding representative, and the expected date for their cancellation.

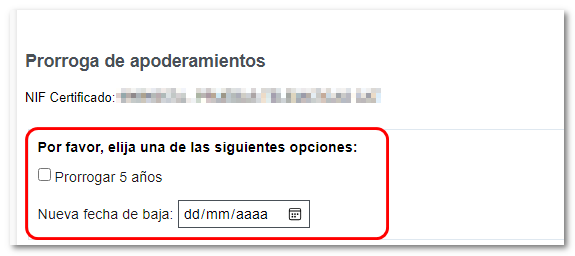

You can choose to extend for the maximum allowed (5 years from the date of the extension) or set a maximum validity date (within the next 5 years). It is not possible to choose both options at the same time.

As it is a mass processing tool, it will not be possible to choose which procedures are extended and which are not. Once you have chosen one of the two options, press "Extend Powers of Attorney".

The result will be a page that reports the extended powers of attorney, indicating the new termination date.

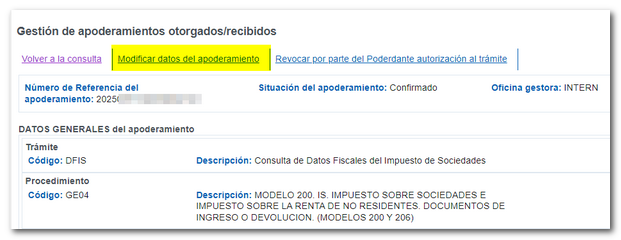

You can also extend powers of attorney individually by selecting the reference number.

In the new window, click on "Modify power of power of attorney data".

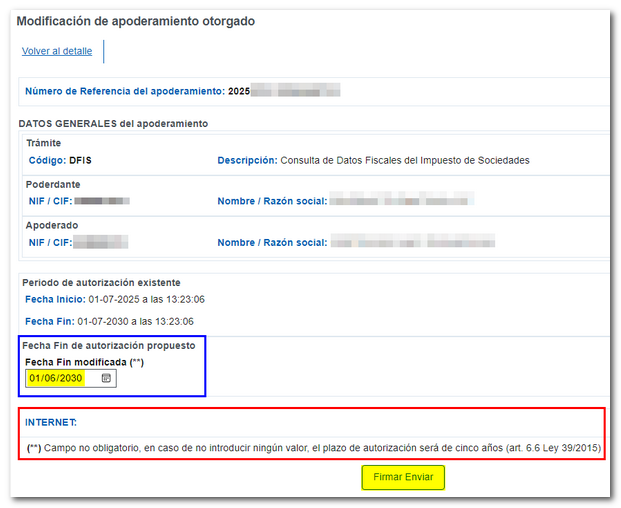

Next, in the "Proposed Authorization End Date" field, you can change the date on which the power of attorney ends, either by typing the date directly or by using the calendar. If no date is specified, the authorization term will be 5 years, as indicated in the notice.

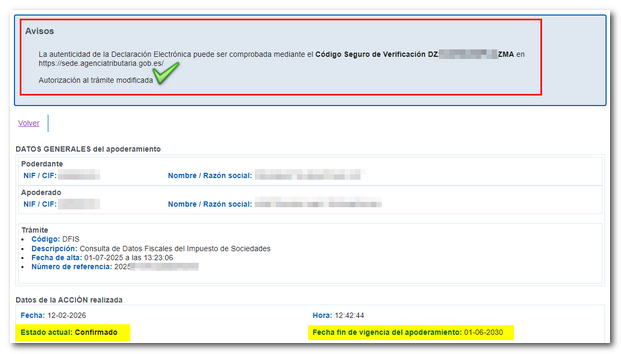

Once you've changed the date, press "Sign and Send". Finally, you'll see a confirmation window with a... CSV assigned.

Revoke powers of attorney granted

The appointing party can revoke the powers of attorney granted at any time. The revocation will take effect as soon as it is duly communicated to the Tax Agency.

Revocation may be carried out by any of the procedures used for its granting:

-

Through the personal appearance of the Grantor at the Delegations and Administrations of the State Tax Administration Agency, using the form in Annex I of the Resolution of March 9, 2018, of the General Directorate of the State Tax Administration Agency (which modifies that of May 18, 2010), which regulates the registration and management of powers of attorney and the registration and management of successions and legal representations of incapacitated persons, for carrying out procedures and actions in tax matters online.

-

By means of a public or private document, with a notarized signature , submitted to the State Tax Administration Agency, which must also conform to the content included in the form of Annex I of the Resolution of March 9, 2018, of the General Directorate of the State Tax Administration Agency (which modifies that of May 18, 2010).

-

Online from the Tax Agency website using the electronic certificate, DNIe, Key or identification eIDAS of the principal. To do this, the principal must access the procedures for powers of attorney and "Consultation and revocation of powers of attorney granted".

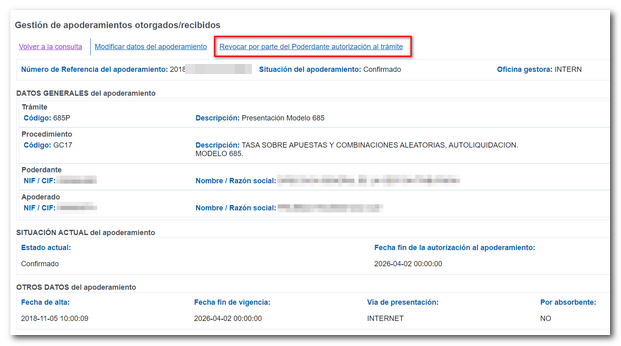

Click on the reference number and then on "Revoke authorization for processing by the Principal" located at the top.

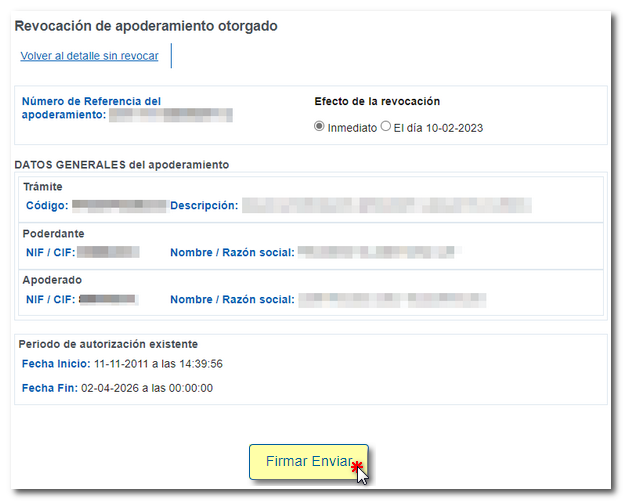

The principal may specify the date on which the revocation will become effective. Then click "Sign and Send."

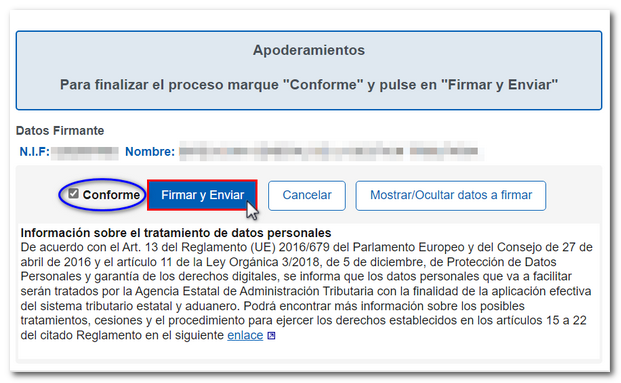

Check the "I agree" box and click "Sign and Send" to complete the process.

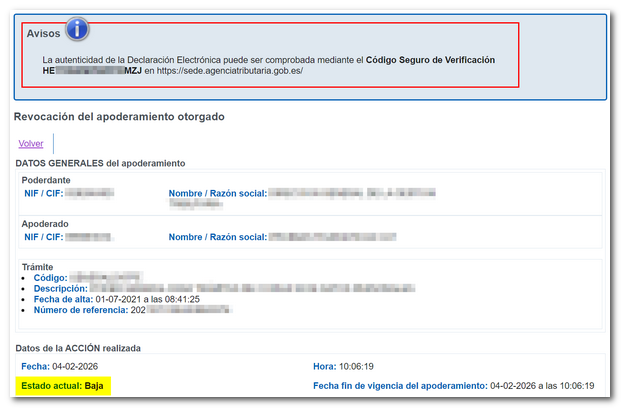

The response will be the revocation confirmation window with a CSV (Secure Verification Code), in addition to the rest of the data of the power of attorney.

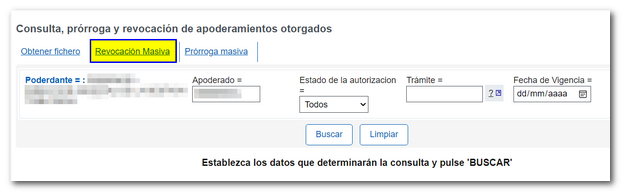

A "Mass Revocation" option has been enabled, allowing you to simultaneously revoke all powers granted to the attorney-in-fact.