My register details

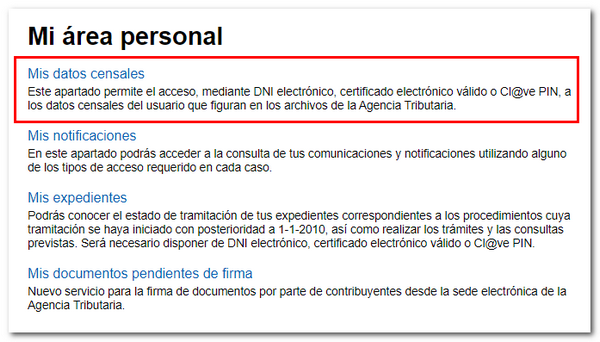

From the "Personal Area" located at the top right of the Electronic Office you can access "My census data", where you have several options for consultation and census management.

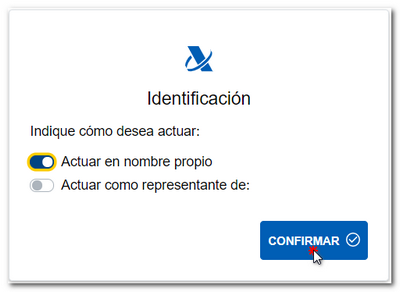

To access you need to have an electronic identification such as the electronic certificate, DNIe or Cl@ve . You can access it on your own behalf or as a representative of a third party for whom you have the necessary power of attorney. If you are accessing as a representative, select "Act as representative of:", and then two boxes will open where you must indicate the NIF and the name and surname or company name.

The agent must have the general power of attorney "GENERALDAPTE" or specific powers of attorney for certain specific personal data active: "CONESTRATRIB", "CONESTRAADU", "CONESTRANOTR", etc.; Depending on the power of attorney, some data or others of the grantor will be displayed.

You can also access "My census data" on behalf of a third party if you are registered in the inheritance register as the successor of deceased individuals or of legal persons or entities without legal personality that have been extinguished, or as the legal representative of persons lacking the capacity to act in accordance with the law.

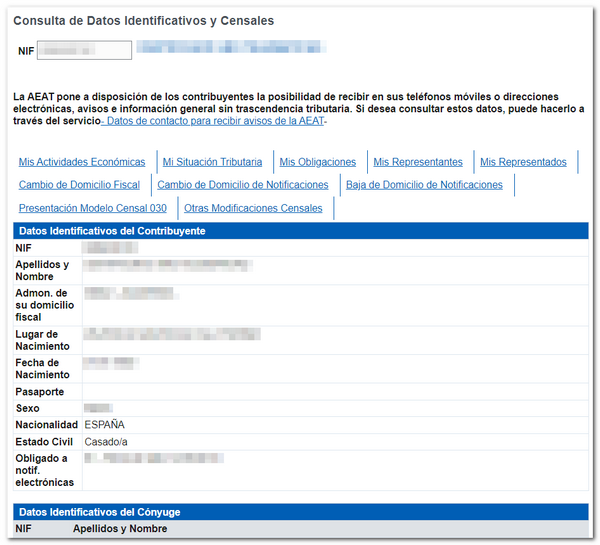

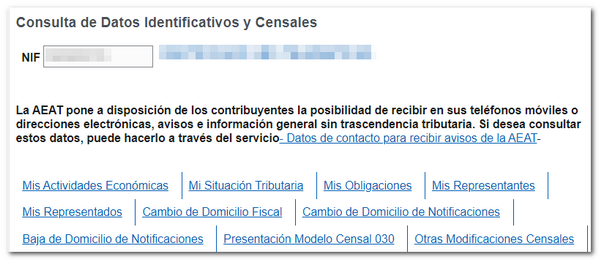

Depending on the NIF you use to access, whether you are accessing on your own behalf or as a representative, whether or not you have economic activities, your obligations, etc., the system will offer some options or others.

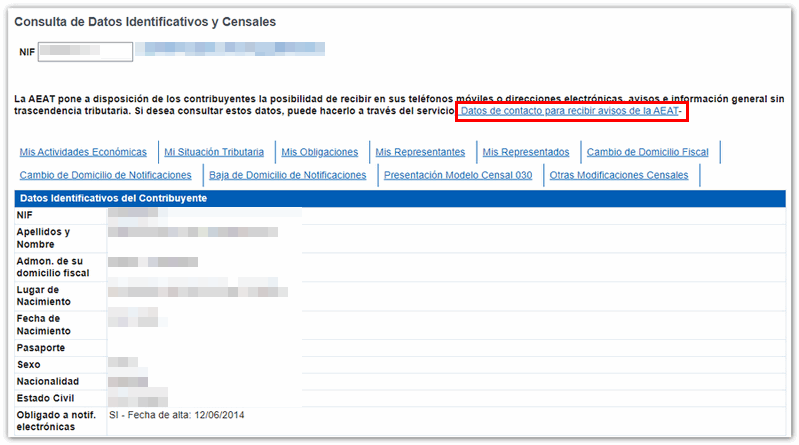

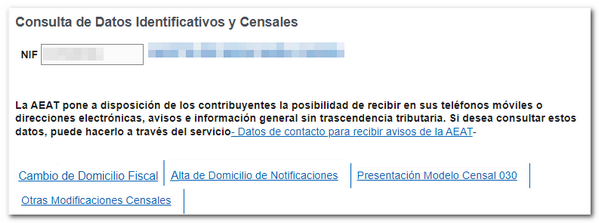

When you access it, in the upper left-hand corner you will find a box with the NIF and the name and surname or company name of the person you are going to make the query, followed by the taxpayer's identification and census data.

In the case of accessing the consultation of a person without economic activities, the consultation and modification options will be the following:

-

Change of tax address : allows you to modify the tax domicile data that appears in the census. Once the modification is confirmed, the receipt of the procedure is displayed with the date and time of submission as well as the CSV associated with the submission and a link to the "Document Comparison" to view the receipt.

-

Registration (or Modification) of Notification Address : Through this option you can add an address for notifications. Allows you to add a postal address or a PO Box.

-

Presentation of Census Model 030 : This option links directly to the procedures of model 030.

-

Other Census Modifications : links with the management of models 036 - 037.

In addition to the above functionalities and depending on the situation in the census of economic activities, you will have the following options:

-

My Economic Activities : displays information about the taxpayer's activities and premises: the status it is in, start date, termination date, etc.

-

My Tax Situation : provides a summary of the tax situation in the regimes of VAT, of the Corporate Tax, of the Personal Income Tax, of the Non-Resident Income Tax in addition to other taxes and special regimes.

-

My Obligations : shows the list of tax obligations, type of periodicity and their status.

-

My Representatives : shows the relationship of your representatives and their situation.

-

My Representatives : shows the relationship between your constituents and their situation.

-

Change of Tax Address : allows you to modify the tax domicile data that appears in the census. Once the modification is confirmed, the receipt of the procedure is displayed with the date and time of submission as well as the CSV associated with the submission and a link to the "Document Comparison" to view the receipt.

-

Change of Notification Address : Through this option you can change an address for notification purposes. Allows you to indicate a postal address or a post office box.

-

Cancellation of Notification Address : Using this option you can cancel your address for notification purposes.

-

Presentation of Census Model 030 : This option links directly to the procedures of model 030.

-

Other Census Modifications : links with the management of models 036 - 037.

In addition, at the top, the AEAT makes available to you the possibility of receiving on your phone or in your email the notices and general information without tax implications of the AEAT .