How to apply for a refund of an undue payment

NOTE: The refund of undue income corresponds to payments related to procedures of the Tax Agency. From AEAT no refunds corresponding to payments related to organizations other than the Tax Agency can be processed.

The presentation requires identification with an electronic certificate, DNIe or Cl@ve of the declarant.

In addition to the holder of the declaration, it may also be submitted by a third party acting on his or her behalf, whether it be a social collaborator or a representative to carry out the procedure.

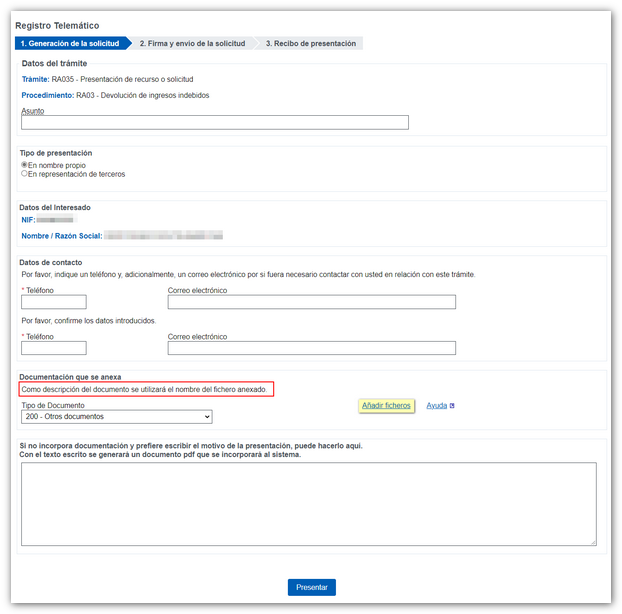

Fill out the form selecting the type of declaration: on your own behalf or on behalf of third parties (in this case it will be necessary to indicate the NIF of the interested party). Click the "Add file" link to select the file containing the documentation you wish to submit. In the "Help" link you can check the list of formats accepted for the presentation of files for this procedure, the maximum size allowed for each file being 64 MB.

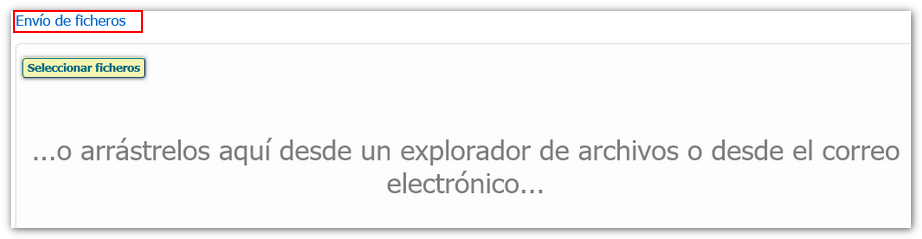

Select or drag the file. It is preferable that the file name does not have punctuation marks and is saved on your local disk, in the folder " AEAT ".

The added file will appear in the "Attached documentation" section.

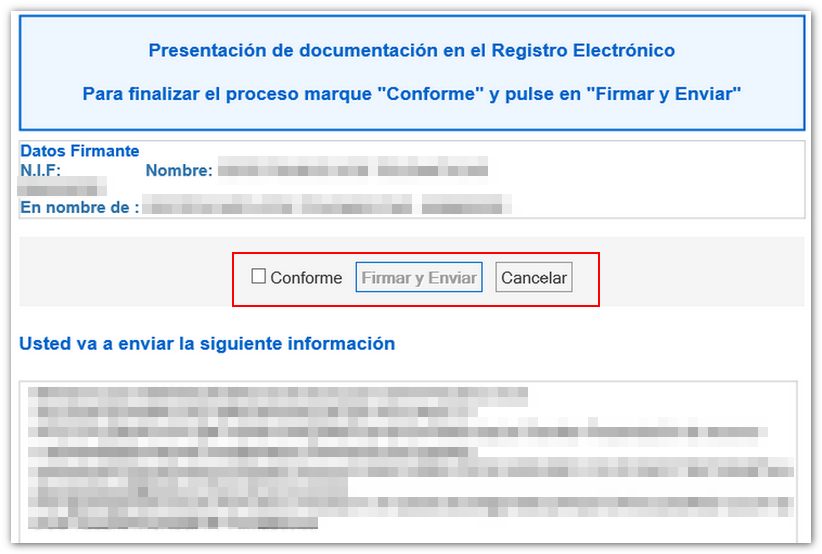

When you finish attaching the files, click "Submit", check "Agree" and "Sign and send"