How to apply for the NEW 200 euro aid for individuals with low income and assets

The application for the new aid of 200 euros for individuals with low income and assets is submitted using the electronic form available on the AEAT website. The application period for the grant begins on February 15 and ends on March 31, 2023.

Access and submission of the form requires identification with Cl@ve , certificate or electronic DNI . In addition to the holder of the declaration, it may also be submitted by a third party acting on his/her behalf by means of a power of attorney (submission: GC50P and query: GC50C) to carry out this procedure or through private social collaboration (agreement 001, 002 and 008) and public social collaboration (agreement 098 and 097).

After identifying yourself, you will access the data completion screen. Please note that, to ensure correct completion and to avoid errors and delays in processing, the boxes marked with an asterisk (*) are mandatory.

Those who, as of December 31, 2022, receive the Minimum Vital Income ( IMV ) or a pension or whose income obtained in 2022 (including that received by cohabitants) exceeds 27,000 euros in total are not entitled to aid.

-

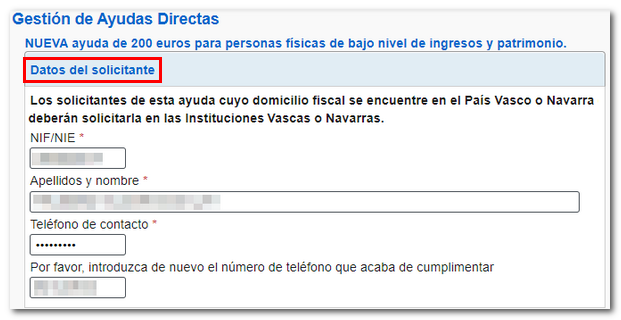

Applicant's details :

Fill in the identification details of the applicant for aid, NIF or NIE , surnames and first name (in this order) and a telephone number that you will have to repeat again in the box that opens below. Please verify the phone number as it is a valid piece of information.

Please note that if the applicant's tax domicile is in the Basque Country or Navarre, you must submit the application for this aid to the Basque and Navarrese institutions.

-

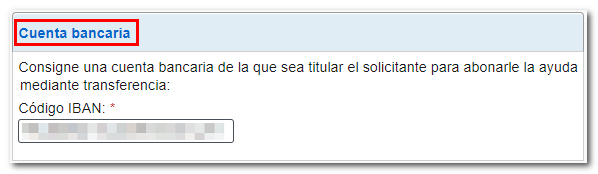

Bank account:

Enter the code IBAN without spaces of a bank account in which the applicant is the account holder and where the payment will be made. When validating the request, you may see warnings regarding IBAN ; Please note that these are notices that must be reviewed but do not prevent submission. However, if you have copied and pasted the IBAN from the Bank's website or APP , the account number may not be complete or in the correct format. The code IBAN must be completed without spaces between the digits.

-

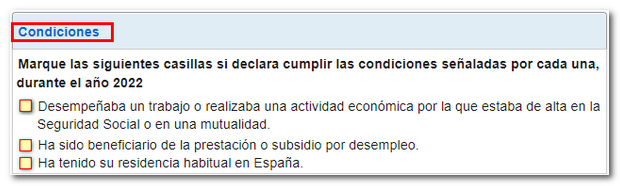

Conditions:

Check the boxes that reflect the applicant's situation during 2022.

You must check at least one of the first two options. In addition, you must check the box confirming that you have had your habitual residence in Spain:

-

He was working or engaged in an economic activity for which he was registered with Social Security or a mutual fund.

- You have been a beneficiary of unemployment benefits or subsidies.

-

He has had his habitual residence in Spain.

-

-

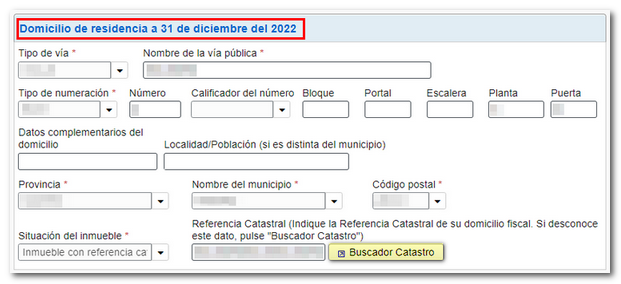

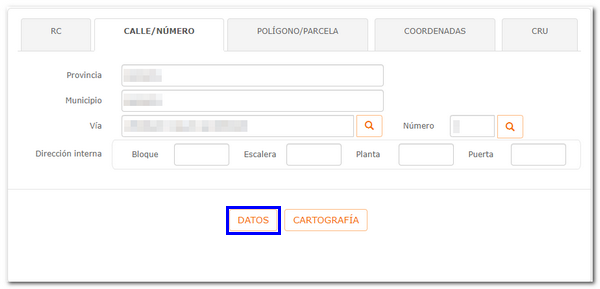

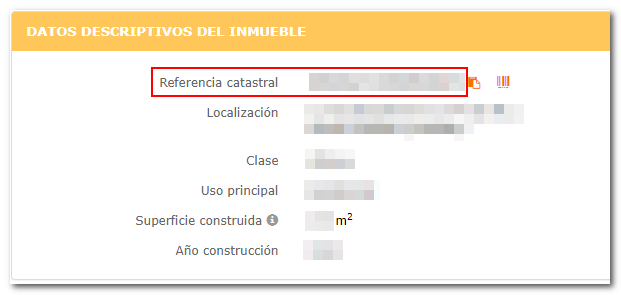

Residence address as of December 31, 2022

Fill in the details of the address that constituted the applicant's residence as of December 31, 2022. Select the location of the property and indicate the cadastral reference of the address, unless the property does not have a cadastral reference assigned. If you do not know the cadastral reference of your address, you have the "Cadastre Search" button that opens a new tab with the cadastre page so that you can obtain the cadastral reference of the property after entering its details.

-

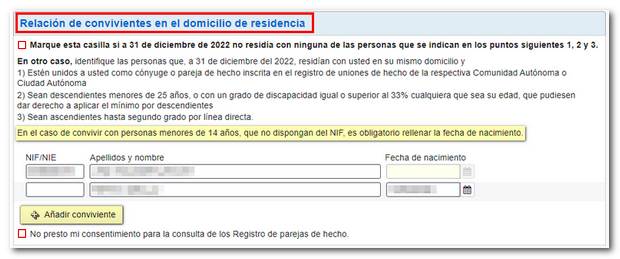

List of cohabitants at the residence address

Fill in the boxes NIF / NIE , surnames and first names (in this order) of the people who resided with the applicant as of December 31, 2022. To add more people, press the "Add cohabitant" button. If any of the cohabitants is under 14 years old and does not have NIF you must fill in their date of birth.

Cohabitants must meet at least one of these conditions:

-

"They are united to you as a spouse or partner registered in the registry of de facto unions of the respective Autonomous Community or Autonomous City"

-

"Whether they are descendants under 25 years of age, or with a degree of disability equal to or greater than 33% regardless of their age, which could give the right to apply the same for descendants"

-

"They are ascendants up to the second degree in a direct line."

For cases of de facto couples, the box "I do not give my consent to consult the Registers of de facto couples" has been enabled. If you check it, you must provide documentation justifying this circumstance through the "Provide additional documentation" section, including the CSV of the proof of the application submitted.

-

-

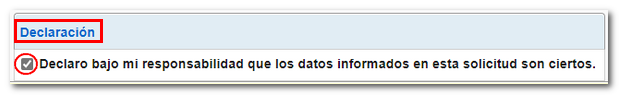

Declaration

To submit the declaration you must check the box in which the applicant declares, under his/her responsibility, that all the data entered in the form are correct.

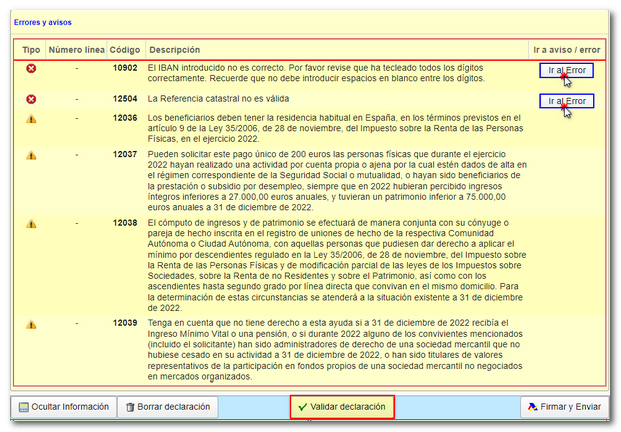

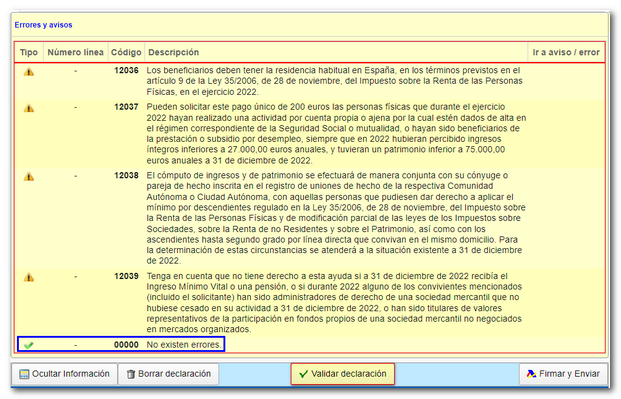

Once all the data has been entered, click on "Validate declaration" to check for errors or warnings. The list of errors and warnings detected will be displayed, which you can access for correction from the "Go to Error" or "Go to Warning" button next to the description of the fault. Remember that the notices provide relevant information that should be reviewed but do not prevent the filing of the tax return. If the declaration contains errors, these must be corrected.

If no errors are detected, the description will report no errors.

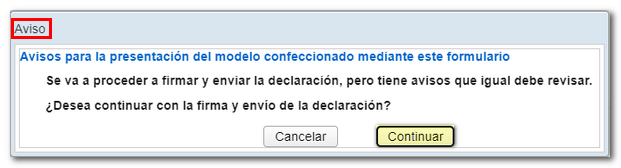

Next, click on "Sign and Send" to submit the completed and validated application.

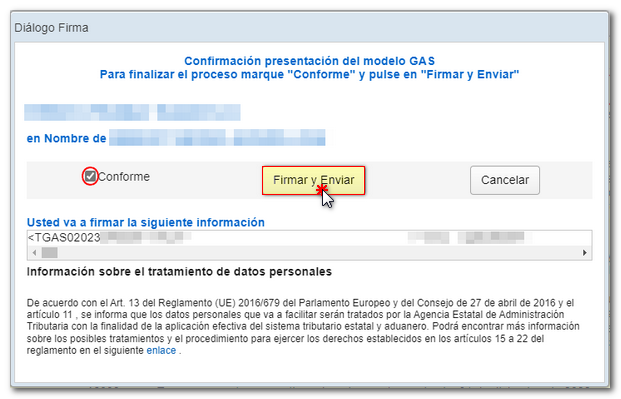

Finally, a window will appear with the encoded information and the data of the presenter and the applicant. Check the "I agree" box and press "Sign and Send" to complete the submission.

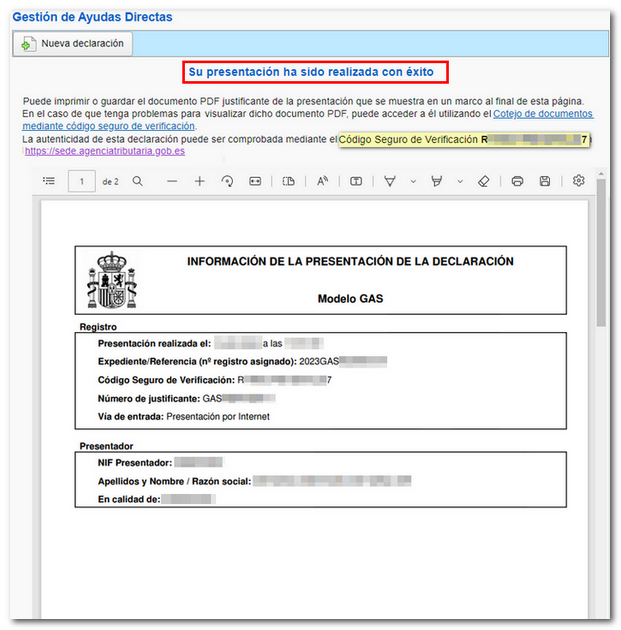

If everything is correct, you will get the response sheet that says "Your submission has been successfully submitted" with an embedded PDF containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on the subsequent pages, the complete copy of the application.