Query a previous payment by card or Bizum (self-assessments)

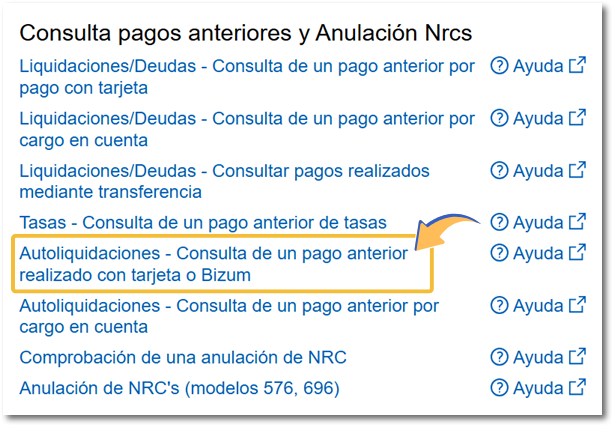

To recover the NRC generated for the payment of a self-assessment made with a card or Bizum, go to "Self-assessments - Query a previous payment made with a card or Bizum", it is not necessary to identify yourself electronically, by entering the correct data in the form you will be able to make the query.

Enter the model, identification, and financial information for which you wish to perform the query, and click "Accept data and Continue." This information must exactly match the information you entered at the time of payment. To avoid errors when recovering the NRC it is important to pay attention to the fields in the "Settlement data" section and select both the fiscal year and the period in the drop-down menu correctly; For example, do not confuse the 1Q period (quarterly) with the 01 (monthly) in a periodic declaration.

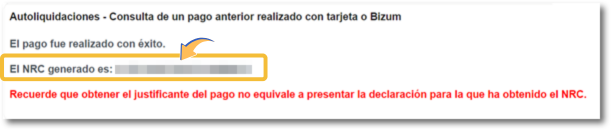

If the payment exists, you will get the NRC generated as proof. There is no option to print the receipt from this window; this is an online consultation.

Remember that after obtaining the NRC , if you have not submitted the declaration, you must access the submission of the corresponding form and manually enter the NRC in the available field.