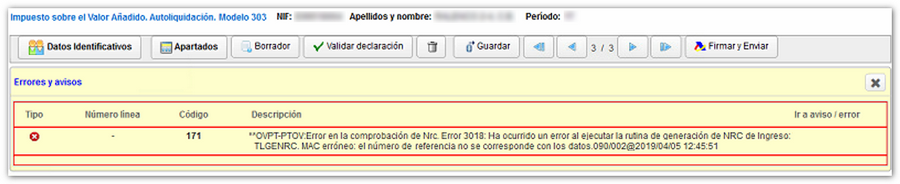

Incorrect NRC

This error may occur when signing and sending a declaration with a result to be entered and is due to the NRC being incorrect or not corresponding to the declared data.

NRC has been incorrectly filled out

Check that you have correctly transferred each of the 22 characters of the NRC obtained when making the payment to the declaration.

The NRC consists of 22 alphanumeric characters, and typically the first three characters match the model number to which the entry corresponds (example: 303…).

The details entered in the tax return do not exactly match those of the payment.

You must access the query of the payment made and ensure that the data ( NIF , model, amount, fiscal year and period) are correct and identical to those recorded in the declaration.

Pay particular attention to the period, as it is common to confuse quarterly periods (Q1, Q2, Q3 and Q4) with monthly periods (01: January, 02: February, 03: March, 04: April, etc.).

It is also necessary to check that the amount paid exactly matches the amount declared (a difference of 1 cent will invalidate the NRC ) and review the rest of the related data to detect possible errors.

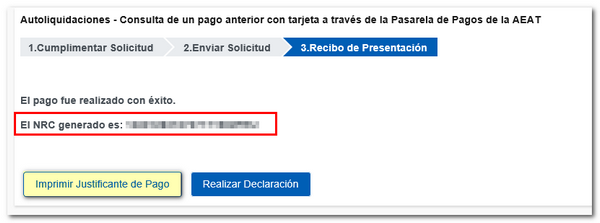

If the payment has been made through the AEAT payment gateway, the proof of the operation can be recovered, with the NRC assigned and all the payment details, from the option " Self-assessments. Query a previous payment" (by charge to account or made with card / Bizum, as appropriate).

If any error is observed in this data, you can contact the corresponding bank directly and request the cancellation of the erroneous NRC , as well as the generation of a new, correct NRC in order to be able to make the submission.

Note: Please note that the cancellation of a NRC requires appearing at the bank or cash office as soon as possible. Otherwise, a "Refund of undue payments" request will be required.