Payment of self-assessments with card or Bizum

The declarations and self-assessments required by tax regulations that involve income, and for which direct debit has not been selected as the payment method, require a NRC (Full Reference Number) for their correct receipt by the Tax Agency: code generated to identify the tax income generated.

The Electronic Office offers the possibility of obtaining a NRC through its payment gateway by direct debit, with a card under secure e-commerce conditions, and Bizum.

How to make the payment

-

Once you have prepared the declaration with the result to be paid that you wish to submit electronically, and therefore know the amount of the debt, access the "Pay self-assessments" option within "All procedures" in the "Pay, defer and consult" section of our Electronic Office and choose "Self-assessments - Payment by card or Bizum".

Another alternative to obtain the NRC is to link to the payment gateway by selecting the payment method that corresponds to this type of payment and using the link button available depending on the form or program of the model you are submitting, in the example of this image of model 100.

-

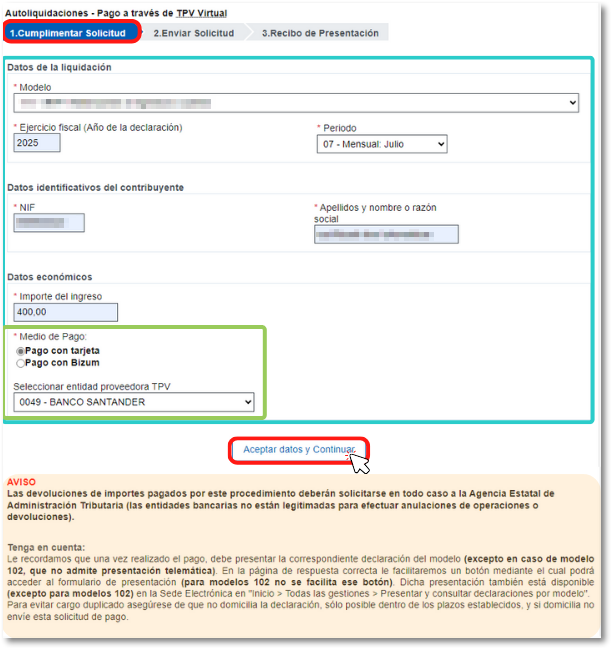

Select the model (currently only available in some models, such as Model 303 and Income), identification and financial data. This information will appear pre-populated if you have linked it from the form or program for the specific model. Next, choose your payment method: "Pay by card" or "Pay by Bizum" and then click "Accept details and Continue."

-

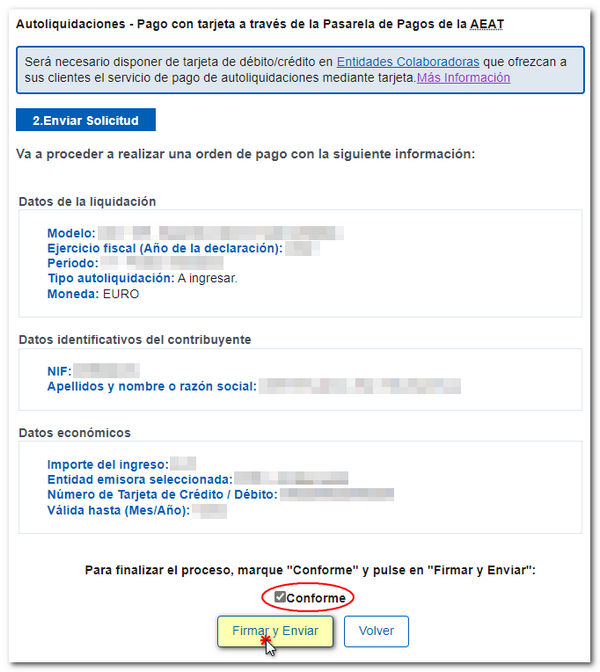

A summary of the data entered will be displayed; Please check that the information is correct, as once the deposit has been made, you will not be able to cancel it online. If it is correct, check the "I agree" box and press the "Sign and Send" button.

-

Next, depending on the type of payment you select, by card or Bizum, you'll need to follow these steps.

-

Card payment

You will receive a summary of the payment details you are going to make to the State Tax Administration Agency (SPAIN), including the amount, date and model, among others. Enter the card number and any other requested information. Click "Pay" and continue with the instructions provided by your financial institution. Once the payment has been made, return to the AEAT page.

-

Payment with Bizum

Enter the phone number registered with Bizum and click the "Continue with purchase" button. Please note that you must have your mobile phone nearby to complete the payment, as you have 4 minutes to complete the transaction.

Next, on the phone, the bank where we have active Bizum will send a notification with the details of the pending Bizum that you need to authorize; Follow the instructions in your bank's app. The appearance of these windows may vary depending on the bank with which the Bizum service is associated.

-

-

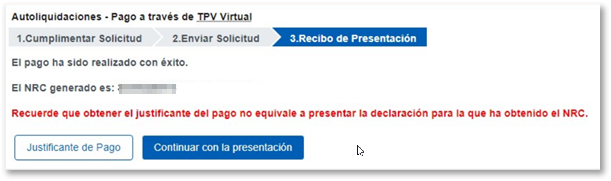

If everything is correct, you will be able to see the assigned NRC on the screen. It is a 22-character code generated as proof of payment for online tax return filings. On this page you will have 2 options:

-

"Proof of Payment": you will download in PDF the receipt of the charge to the account with a summary of the payment details.

-

'File Tax Return': Using this option you will be linked to the procedure at the Headquarters for which you have obtained the NRC to complete the submission.

-

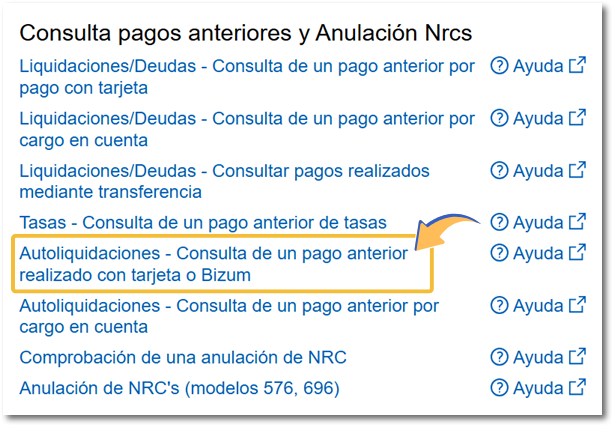

You can check if the payment has been made and retrieve the NRC associated with that payment from our website; In the "Pay, defer, and check" section, access all the procedures and go to "Check debts."

To check the payment of self-assessments made through POS (card or Bizum under secure e-commerce conditions), use the link "Self-assessments - Check a previous payment made by card or Bizum" located in the "Check previous payments and Cancellation Nrcs" section, which does not require any identification system to access. This option allows you to consult and retrieve the NRC of a card payment and collaborating entity in that transaction. There is no option to print the receipt from this service; it is an online consultation.

Another consultation alternative is the "My payments" procedure, for which identification is required with Cl@ve Mobile, certificate / DNI electronic or eIDAS; In this case, all payments made by the identified taxpayer will be displayed, and by clicking on the "Download" link in the "Proof" column, you will obtain proof of payment made in PDF, where you can see the generated NRC .

Please note that if the payment is made by POS, the Financial Institution does not provide the NRC.