Payment of settlements and debts by bank transfer

Payment of settlements and debts through the AEAT can be made by transfer, provided that a IBAN corresponding to a non-collaborating entity is used. You can log in with eidas or log in without identification.

The transfer is a non-face-to-face payment option for those obliged parties who do not have an account in their name in any collaborating entity of the AEAT and also accepts financial entities in foreign countries.

Note: Payment by transfer is not enabled for accounts of entities collaborating with AEAT , for which payment services by direct debit and payment by card are available.

Through AEAT the taxpayer establishes a payment commitment and obtains the necessary data to subsequently make the transfer from their financial institution within the established period.

Follow these instructions to obtain the identification details of the AEAT bank account to which the transfer must be made, as well as the payment IDENTIFIER that must be used in the "Concept" field of the transfer. Please note that this identifier will be valid for 30 calendar days from the date it is obtained.

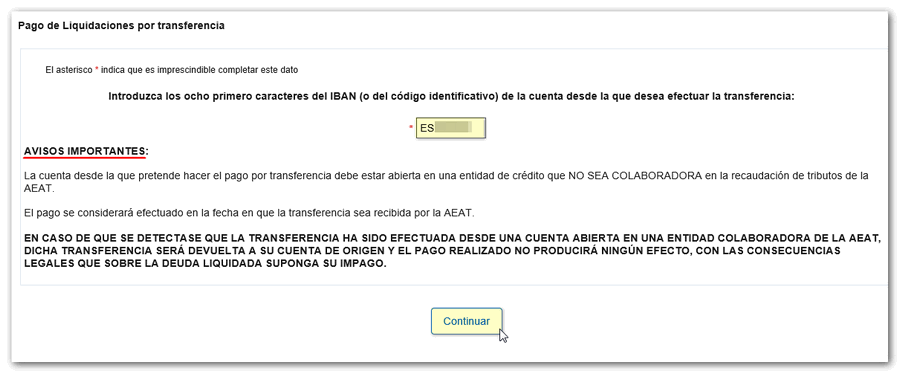

After logging in, you must enter the first eight characters of the IBAN (or the identification code) of the account from which you wish to make the transfer.

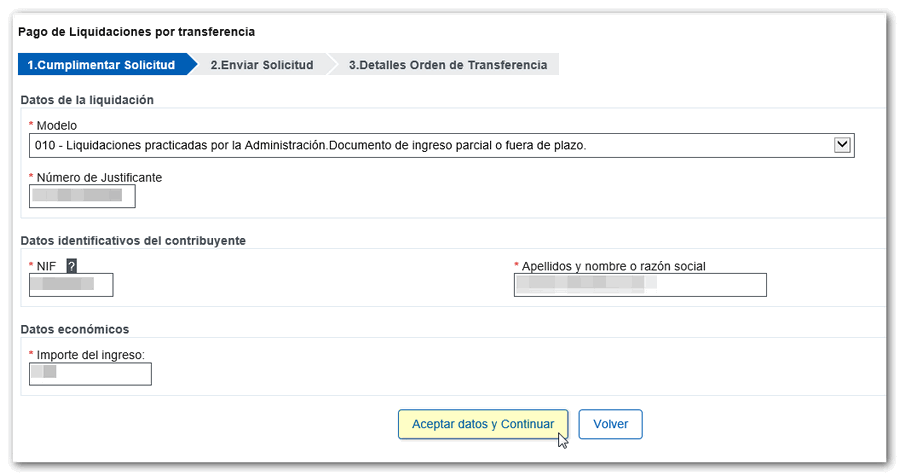

Select the appropriate model, the payment letter receipt number, the taxpayer's identification data and the amount. Then press "Accept data and Continue" .

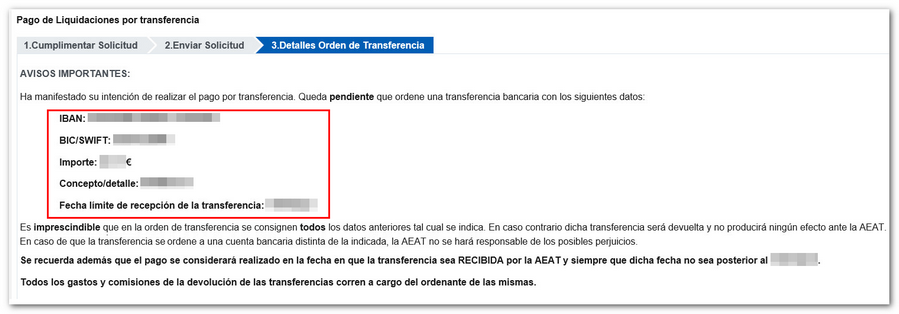

The data with which the transfer must be ordered from the bank will be obtained: IBAN , BIC / SWIFT , amount, concept/details and deadline for receipt.

Particular attention should be paid to the notices to ensure that the transfer is carried out correctly.

Payment will be considered made on the date the transfer is received by AEAT and provided that said date is within the indicated reception limit.