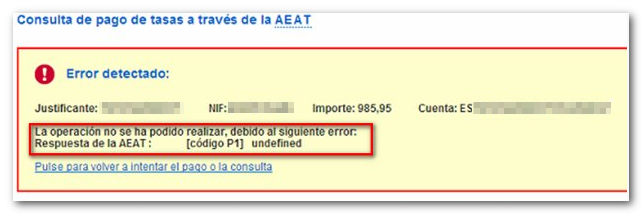

AEAT response code P1 undefined

If when accessing a payment or query of fees or deposits in auctions the error "Response from AEAT appears: [code P1] undefined" check these items on the certificate used.

It is possible that you are signing with an invalid certificate for electronic signatures using card certificates (for example DNIe ). The electronic DNI has two certificates: the "Authentication" certificate and the "Signature" certificate. In the last step, you should select the "Signature" certificate.

This error may also occur when attempting to use a revoked or invalid certificate. If you have multiple electronic certificates installed on the browser, also check that you have chosen the corresponding option with the right certificate, and that you select the right certificate every time the browser prompts you for it.

Bear in mind that if the browser you're using is Internet Explorer, you'll have to close the browser and open it again in order for it to allow you to select which certificate you want to use (if you have more than one installed on your computer) since Internet Explorer selects the last certificate used by default.

If an electronic certificate is revoked, it means a valid certificate is cancelled before its expiry date, generally because the holder may suspect that a copy has been made and that their PIN has been divulged.

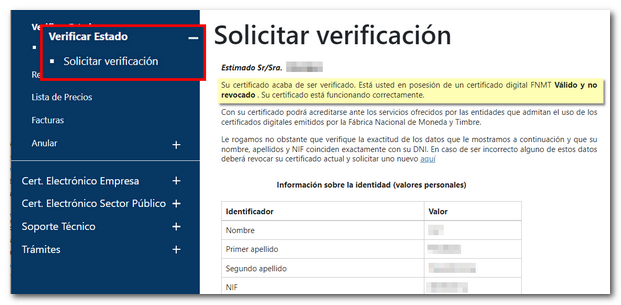

You can check if the electronic certificate issued by the FNMT is valid for work on the Tax Agency website by accessing the CERES website (Spanish Certification). To check the status of the certificate, the message "Your certificate has been verified" will appear. You are in possession of a digital certificate FNMT Valid and not revoked . The certificate is working correctly." If the certificate is not from FNMT contact the issuing entity.