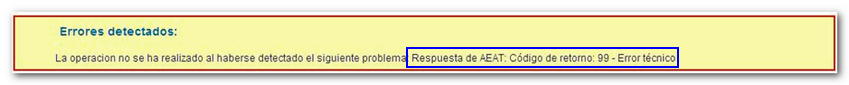

Response from the Tax Agency: Return code 99

The error occurs when making payments or inquiries about them in the AEAT payment gateway. Normally it is an error due to the use of an incorrect signature, either because it is not valid, because the signature window is not loading correctly or because you are using a eDNI and you do not correctly select the authentication or signature certificate.

Check that your electronic certificate is correctly installed and is valid. Check your browser settings in each case:

- In Microsoft Edge access the browser menu (three horizontal dots icon located in the upper right corner of the window), select "Settings", "Privacy, search and services", locate "Security" and press "Manage certificates". The certificate must appear in the "Personal" tab for the installation to be valid. Check the "Expiry date" column.

- In Google Chrome access the browser menu (icon with three dots in the upper right corner of the window), select "Settings", "Privacy and security", "Security", "Advanced", "Manage certificates". The certificate must appear in the "Personal" tab for the installation to be valid. Check the "Expiry date" column.

- In Mozilla Firefox access the "Tools" menu or the three horizontal bars icon located in the upper right corner of the browser; Then go to "Settings", "Privacy and security", "Security" In the "Certificates" section, click on "View certificates” and in the "Your certificates" section, check that your personal certificate is installed and is valid.

- In Safari or Google Chrome on Mac check that the electronic certificate is installed in Keychain Access. To check the installed certificates, start the system application "Keychain Access" from "Finder", "Applications", "Utilities". Go to "Login", "My Certificates" and check if your personal certificate appears in this store.

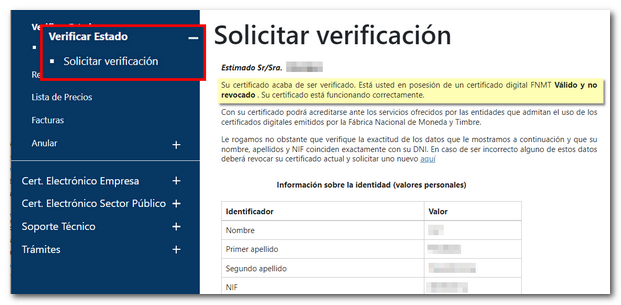

If the certificate is issued by the FNMT or is an electronic DNI , you can check its validity from the CERES website (Spanish Certification). If the certificate is correct, you will see a message reading “Your certificate has just been verified. You are in possession of a digital certificate FNMT Valid and not revoked . Your certificate is working properly".

Deactivate pop-up blocker on the browser. There may be a pop-up window that you have to accept and the blocker prevents it. Once the procedure has concluded, activate this option again:

- In Microsoft Edge , go to "Settings and more" (three horizontal dots icon), "Settings", "Cookies and site permissions", "Pop-ups and redirects" and configure pop-ups by allowing those from the Tax Agency website using the "Add" button in the "Allow" section.

- In Google Chrome , go to "Settings" (three vertical dots icon), "Privacy & security", "Site settings", "Content", "Pop-ups & redirects" and check that the option "Sites can send pop-ups and use redirects" is checked.

- In Mozilla Firefox , go to "Tools", "Settings", "Privacy and Security", "Permissions" and uncheck "Block pop-ups".

- In Safari , go to "Preferences", "Security", "Web Content" and uncheck "Block pop-ups". If it is version 12, go to "Preferences", "Websites", check "Pop-ups" and deactivate the blocking for websites on the AEAT page.

If the certificate is issued by an entity other than FNMT or DNI electronic, you can perform the validation in the REDSARA system.

Also check that you identify yourself at all times with the correct certificate, if you have several installed in the browser, and that the certificate is issued by one of the issuing entities authorized by the AEAT .

It is possible that, by using card certificates (for example DNIe ), you are selecting an invalid certificate to perform electronic signature. The electronic DNI has two certificates: the "Authentication" certificate and the "Signature" certificate. See technical support for DNIe .