Cancellation of the VAT refund request submitted (From 360)

The cancellation of data from applications already sent is done from the Model 360 form itself.

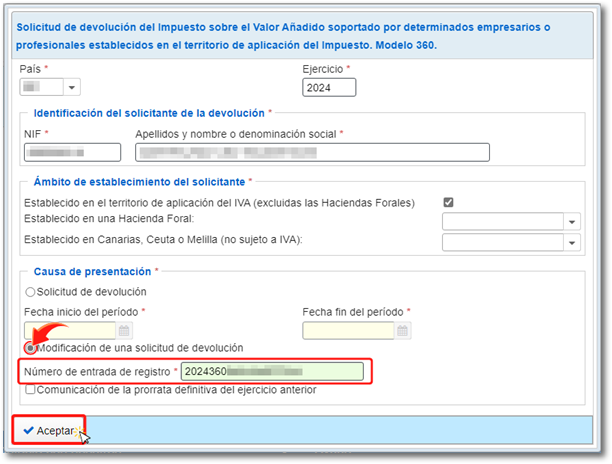

To cancel, complete the basic data entry for the application, taking into account that it must be the same data as the original application ("Country", "Fiscal Year", "Identification of the refund applicant", and "Scope of establishment of the applicant") and select the option "Modification of a refund application" within the "Reason for submission" section. Next, enter the "Registry Entry Number" from the previously filed return.

The record entry number is a 16-digit number whose numbering begins with the fiscal year number plus the model number, 360 (for example, 2024360XXXXXXXXX). This number is found on the response sheet of a correctly completed electronic submission in the "File/Reference (assigned registration number)" section along with the submission date and the Secure Verification Code.

Once in the declaration, leave the fields blank. Additionally, all operation fields must be empty, including dropdowns. No operation needs to be entered. However, it is necessary to complete the bank details in section 6 (page 2) in order to make the shipment.

There are Member States that do not accept modifications, so it may happen that they do not accept the modification sent. In that case, if you have any questions, you should contact the State to which you are requesting the refund.

Cancellation is only possible if procedure has not been completed. If the return has already been made, but you wish to make changes, waivers or any other issue, you must contact the country to which the request was sent.