Model 718 - Technical assistance

Skip information indexElectronic submission of Form 718

The Model 718 "Temporary Solidarity Tax on Large Fortunes" is complementary to the Wealth Tax and taxes with an additional rate the assets of individuals of an amount greater than 3,000,000 euros. It is of a state nature and cannot be transferred to the Autonomous Communities ( CCAA ).

Model 718 is available exclusively in electronic format and requires identification with Key or with certificate or DNI electronic.

The holder may be identified in his/her own name, by a person or entity with the corresponding authority, or by a social collaborator.

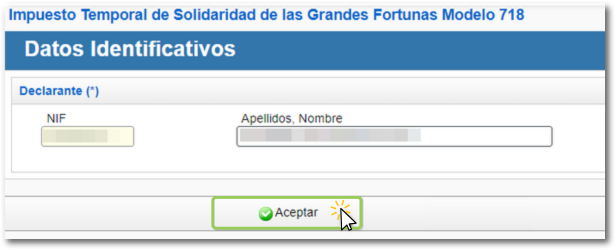

In the first window, fill in the declarant's identification data and press "Accept" to access the form.

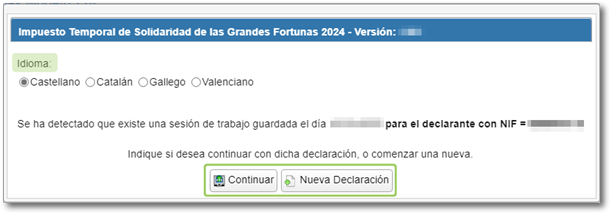

If a previously saved work session is detected, the application will give you the option to "Continue" recovering the data or creating a new declaration from the button "New Declaration". You will also be able to select the language of the declaration.

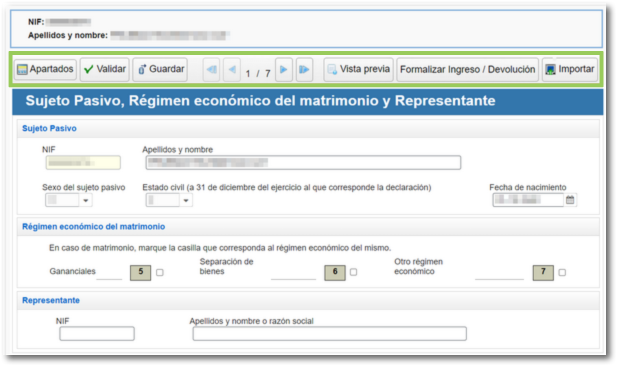

You will access the declaration and find at the top the button panel with the different functionalities of the form.

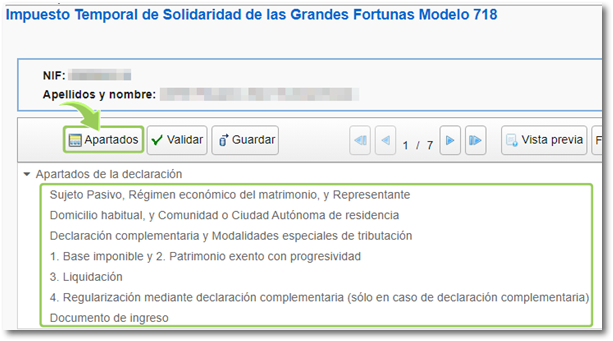

The "Sections" button displays the index with the different pages of the declaration.

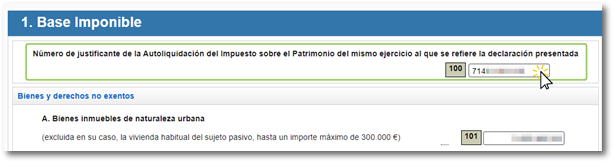

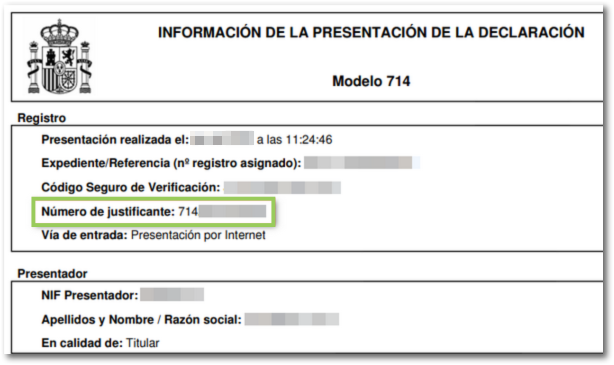

In section 1. Taxable Base, you must indicate the proof number for the Wealth Tax (form 714) for the same year to which the declaration refers.

You will find this information on the proof of filing of Form 714.

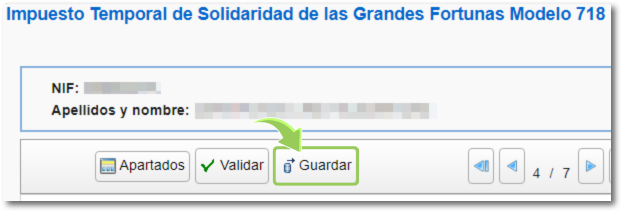

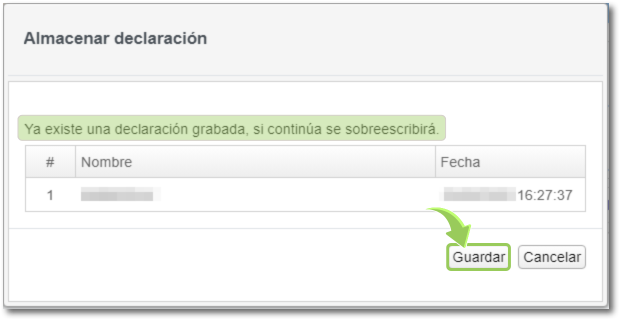

The " Save " option allows you to store the data completed up to that point on the AEAT servers, even if they are not validated (they may contain errors or be incomplete). Please note that if a previously saved statement already exists, it will be overwritten.

The recovery of this data is done by accessing the web form again by clicking "Continue" .

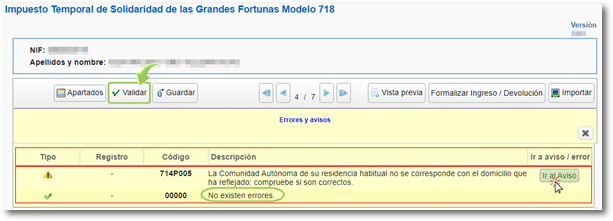

To check if there are any errors in the declaration, press the " Validate " button. If it contains errors or warnings, the "Errors" tab will be enabled with the description of the error or warning and the "Go to Error" or "Go to Warning" button, as appropriate, which will take you to the box to modify or complete.

If the statement contains no errors you will get the message "No errors exist".

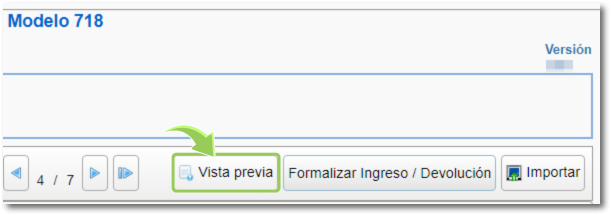

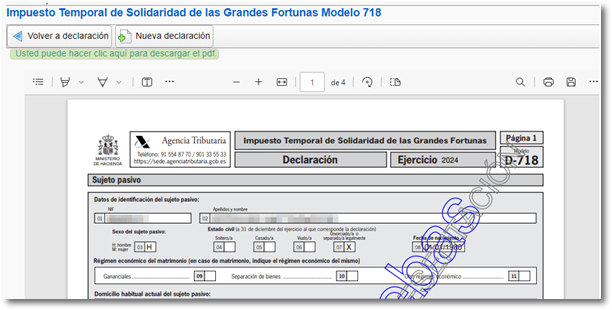

Additionally, if you want to obtain a draft to review the data before filing the return, you have the "Preview" tool, which generates a PDF with the return that is not valid for filing. The draft is displayed on the screen and has a watermark indicating that it is not suitable for presentation, you can save it by clicking the link "You can click here to download the pdf" or by clicking the save icon. At the top are the buttons "Return to declaration" which takes you back to the form and make a "New declaration" .

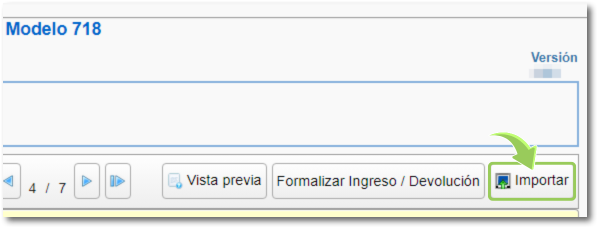

The " Import " button allows you to incorporate a file with the declaration in BOE format that complies with the current registration design.

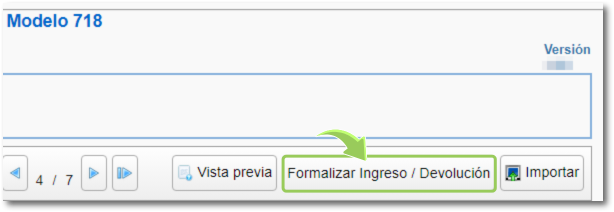

Once the declaration has been validated without errors, press "Formalize Income / Refund" to submit the declaration.

Using the "Export" button, a file with BOE format is generated, which you can save and import into the form using the "Import" button, valid for presentation.

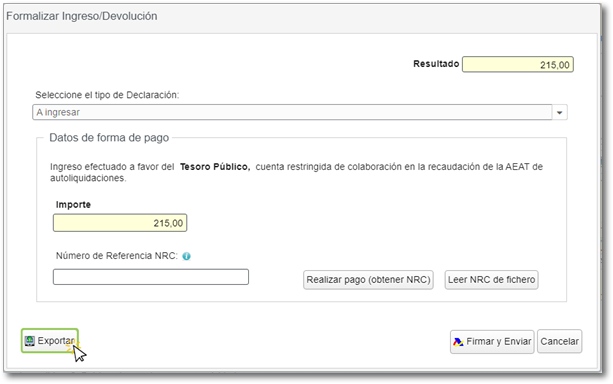

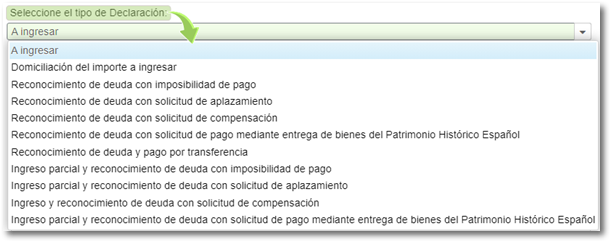

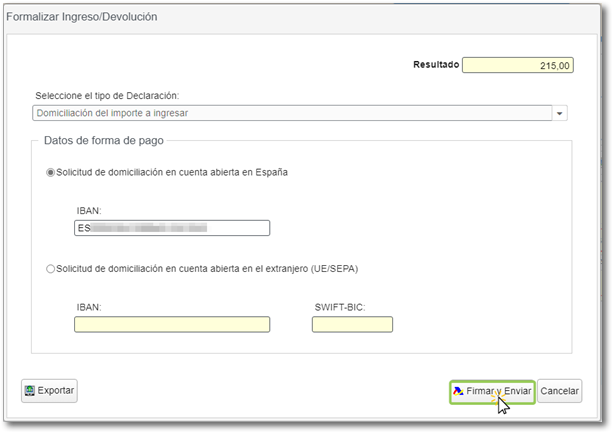

To start the filing process, select the type of return, add the necessary data based on the type of income selected and press "Sign and send" .

If you choose to have your payment paid by direct debit, your payment will be made from July 1st to July 26th, inclusive, and your account will be charged on July 31st. You can select an account IBAN opened in Spain or an account opened abroad (EU / KNOW). You also have options for debt recognition and partial income.

You will get a response screen that includes a PDF with the filing details (date and time, registration entry number, CSV , receipt number and filer details) and the full copy of the return.