Consult processing status of the VAT refund request submitted (Form 360)

This service is primarily intended for entrepreneurs or professionals established in another Member State who have endured VAT in Spain. However, it can also be used by business owners and professionals established in the TAI, the Canary Islands, Ceuta and Melilla that have endured VAT in other Member States (in this case they would be provided with the information exchanged by the returning State with Spain).

This query does not require an electronic certificate.

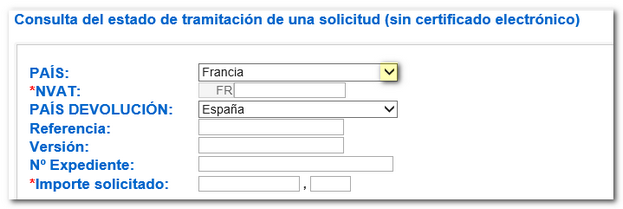

To access the query you must indicate the country, NVAT , refund country, amount requested and the "File Number" or, failing that, the "Reference and Version", in accordance with the following:

COUNTRY: It is the Member State where it is established. Click on the drop-down to choose the Member State.

NVAT : When selecting the country, the identifying letters are automatically filled in, so that you only have to enter the rest of the digits of NVAT in the State of establishment.

For example, if the country where you are established is France, it already appears in NVAT "FR" you only have to fill in the rest of the digits of your NVAT .

RETURN COUNTRY : It is a drop-down menu where you select the Member State where you have supported the quotas of VAT and that processes the return of the request, in this case, Spain (ES).

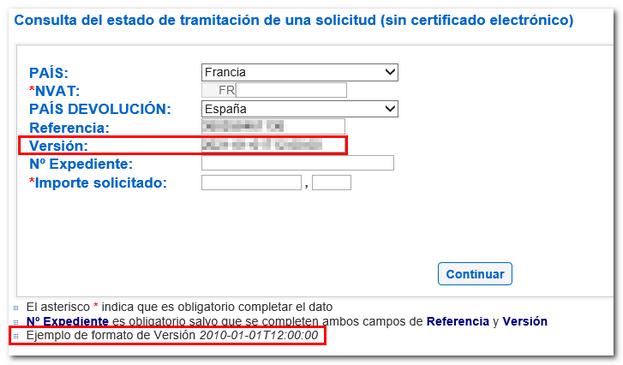

REFERENCE : It appears on the proof of submission of the application.

VERSION: It appears on the proof of submission of the application. See the format example for that box.

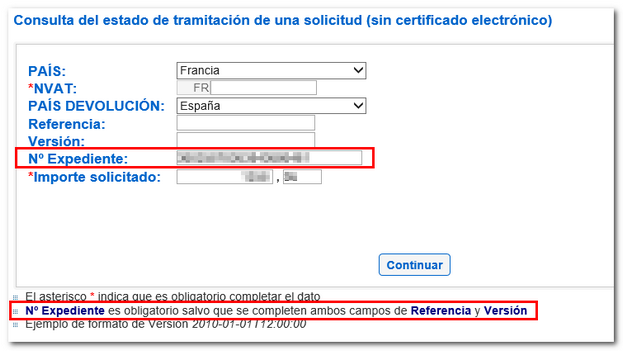

CASE NO : It corresponds to the number assigned to you by EMDEV that will process the request, so you will only know it if you have received any requirement or document related to that request. If you don't know it, you will need to fill in the "Reference" and "Version" fields.

AMOUNT REQUESTED : The requested amount is stated without periods or commas, only numerical digits. The whole number part is on the left and the decimal part is on the right of the decimal point.

The data required to carry out the query can be found in the proof of the declaration submitted, which you can download from the link "Query of submitted declarations" within the procedures of model 360. The NVAT , the country to which the refund is requested and the amount requested are located on the first page of the submitted form.

Click "Continue". If any of the data is incorrect, a warning will appear.

The query provides all the data associated with the file, as well as any document or writing that is presented in relation to the file.

For additional information on the return procedure VAT to non-established users you can use the virtual assistant of the VAT.