How to consult VAT importation with payment deferment

You can check the rates of the VAT deferred corresponding to each period, as well as the status of these debts from the option "Consultation of the VAT "import with deferred payment"which you can access by clicking on "All procedures" in the blue box "Featured procedures" and thus access the rest of the options. Find the "Queries" block and click on "Query of the VAT "import with deferred payment".

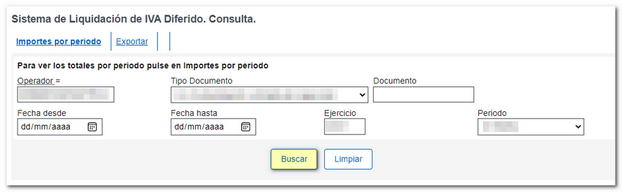

Once you have accessed the operator's electronic certificate, the criteria based on which you want to perform the search will be indicated: document type, date range, fiscal year or period. It is also possible to select "Amounts per period".

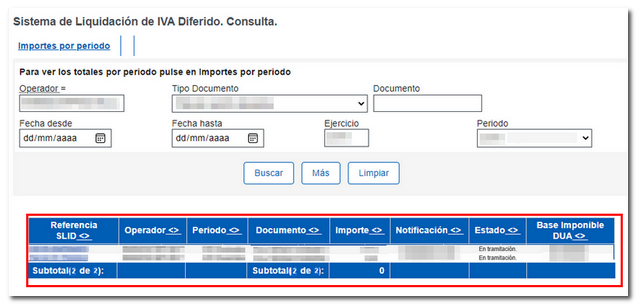

Based on the data entered, search results will be displayed.

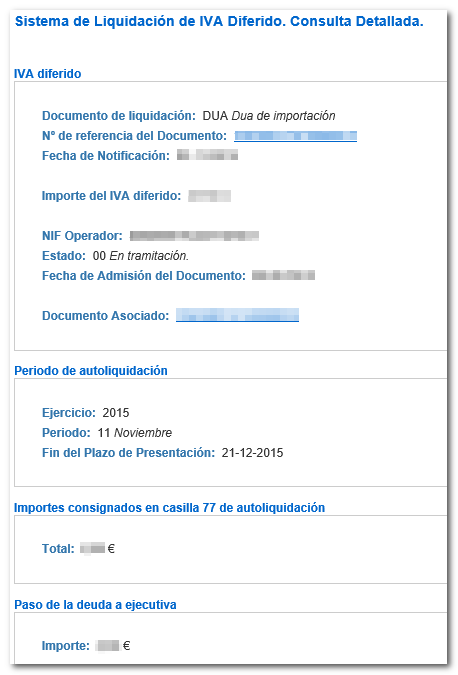

To access the details of the operation, click on the reference number where the data related to the transaction will appear. VAT deferred, Self-assessment period, Self-assessment amounts and executive debt data.

Click on the "Document Reference Number" link to access the query for the import DUA .

The data and possible actions on the DUA will be displayed, such as adding annexes, printing, consulting accounting data, management data, the list of imports and other related queries.