Form 369 - Technical assistance

To electronically submit Form 369 via file, it is necessary to have a file with the declaration to be transmitted that includes the data adjusted to the corresponding registration design. The file TXT will contain the data referring to a single taxpayer's declaration for a given period.

A link to the registration design, instructions on how to fill in the form and some sample files are available in the technical help.

The presentation of this model requires identification with a certificate or electronic DNI , whether of the entrepreneur or professional, of their representatives authorized to carry out the procedure or of social collaborators.

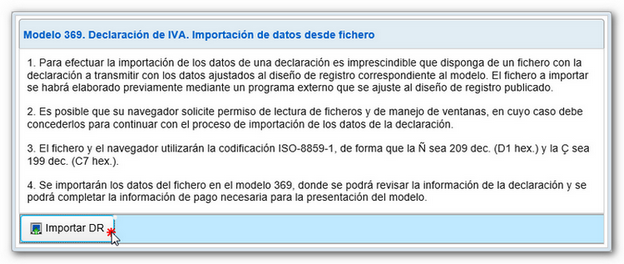

Once identified, a recommended reading alert window will appear. At the bottom press "Import DR" to select the file.

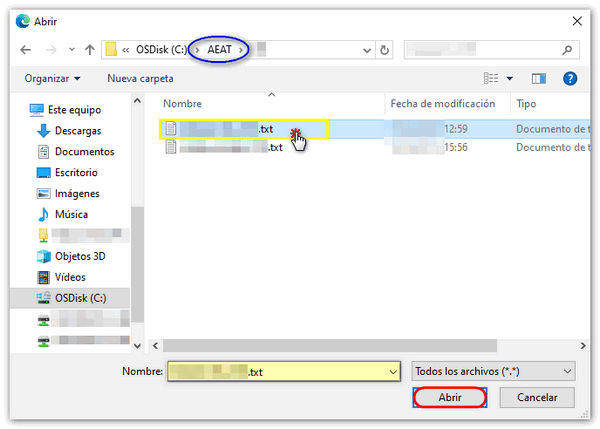

It is recommended that the file be located on the local disk in a folder called " AEAT ". Once you have selected the file, click "Open".

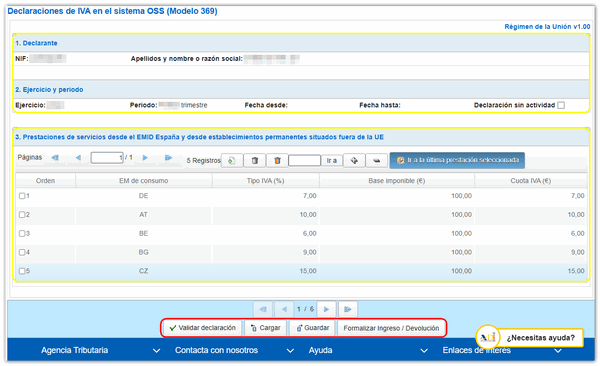

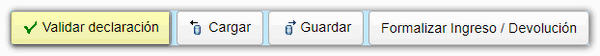

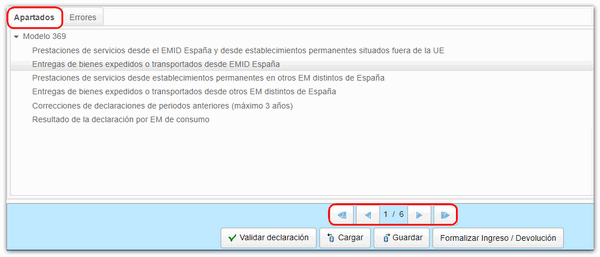

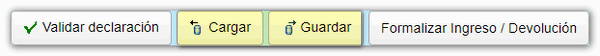

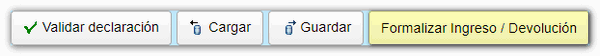

The "Validate declaration", "Load", "Save" and "Formalize payment/refund" functions are available on the bottom button panel. Above the button panel are arrows to move between pages and access the different sections of the declaration.

You can check with the service " ADI . Do you need help?" that appears in the lower right corner if you have questions about completing the form.

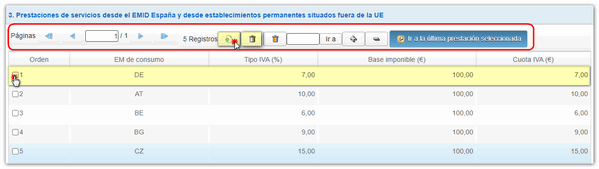

In the function bar of each section, you can add new records or select existing ones to view the details, modify them or delete them.

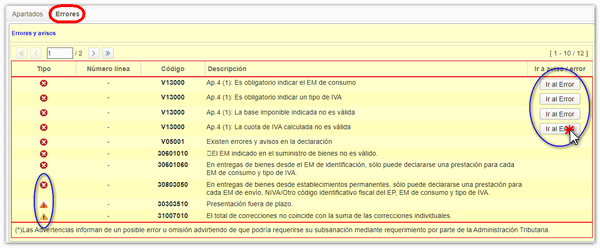

The "Validate declaration" button will display the detected warnings and errors.

The notices (in yellow) are informative and it is recommended that you review them before proceeding with the shipment.

Warnings (in orange) indicate errors that, although not preventing submission, may be grounds for a subsequent request.

Errors (in red) prevent submission and must be corrected. Click on "Go to error" to access the field or page to be corrected.

When validating the declaration, the tab "Sections" is also displayed, from where you can access to complete all the sections that must have content. However, you can use the arrows to move between pages.

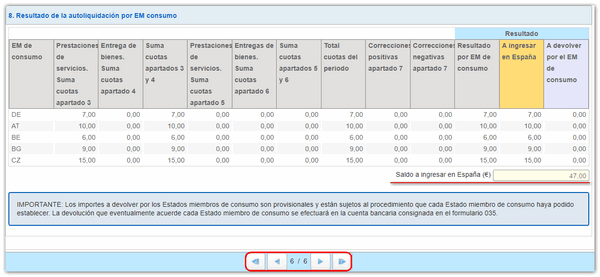

Once all the data has been entered, go to the last page, to the result of the declaration to see the different amounts and the final result.

You can "Save" the declaration data on the AEAT server and use the "Load" button to retrieve it in a later session.

If everything is correct. Click on "Formalize Income/Return"

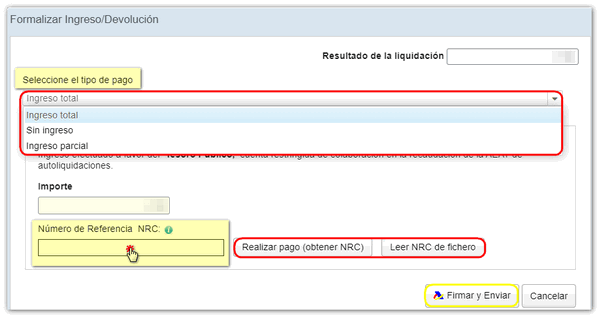

Choose the type of deposit you wish to make. For both full and partial entry you can obtain a NRC from the option "Make payment (Get NRC )" which will link to the payment gateway of the venue. You can "Read NRC from file" if you have previously obtained it and saved the file or enter it manually in the "Reference number NRC " field. Press "Sign and Send" .

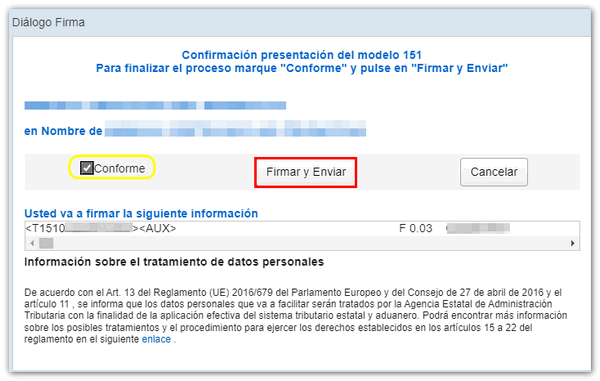

Press "Agree" and "Sign and Send" to submit the return.

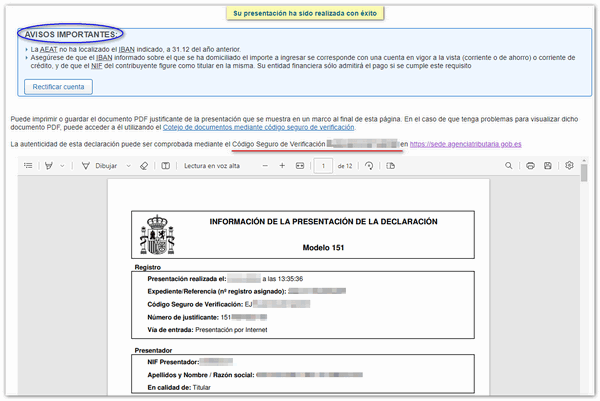

If everything is correct, you will get the response sheet that says "Your submission has been successfully completed" with an embedded PDF containing a first sheet with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on the subsequent pages, the complete copy of the declaration.

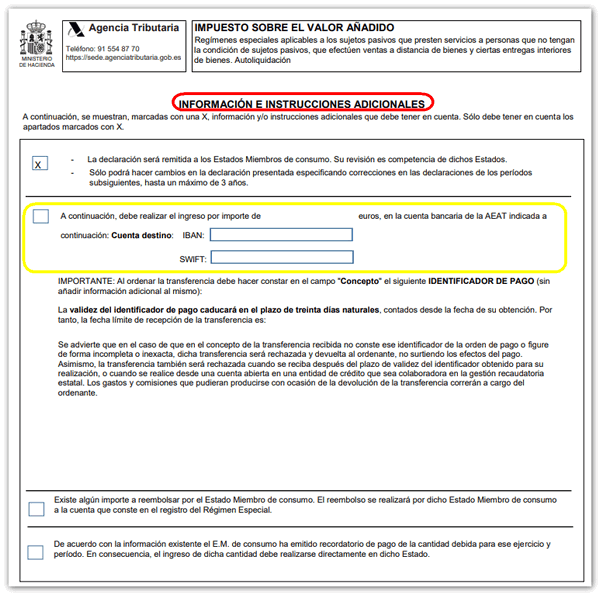

In the cases of "Union Regime" and "External Union Regime", when selecting "Partial Income" or "Total Income" and continuing with the submission, if the declarant is not established in Spain and does not have a bank account with a collaborating entity, in the document of "Additional information and instructions" The information generated with the submission of the self-assessment will indicate how to proceed to make the payment by transfer.

In any of the schemes, if you choose an option other than "Total Payment" and after submitting the self-assessment you wish to pay a balance due in Spain pending payment, you must access the procedure "Additional income from a previously filed return"