Submission of requests for VAT refund to Non-Residents (Form 360)

Skip information indexHow to validate the declaration by performing the simulation or presentation in tests of the 360 model

From the "Simulation of sending the 360 model" option it is possible to make a test presentation of the model file to validate it.

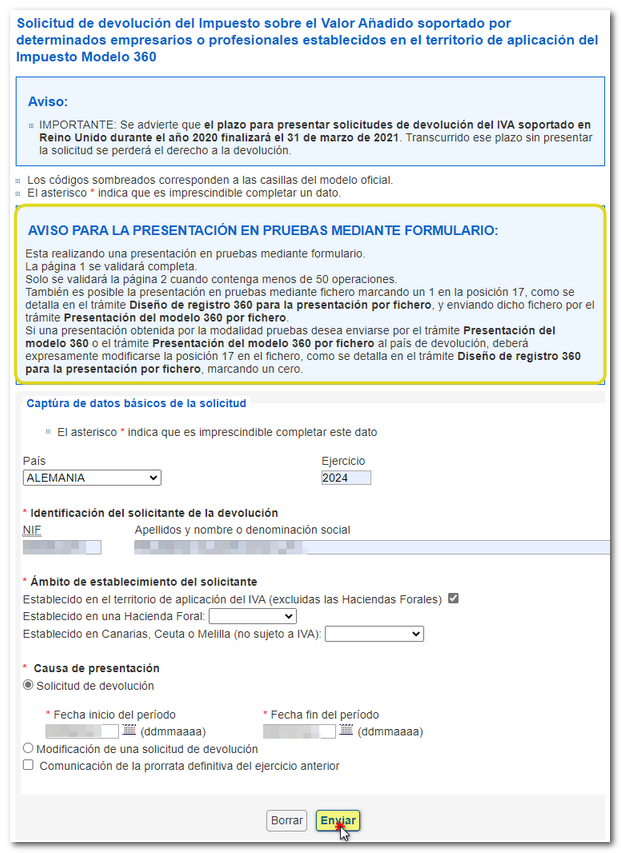

Correctly enter the data on the cover page or "Capture basic application data." Please see the notices above. To continue press the "Submit" button.

Page 1 will be fully validated and page 2 will only be validated when it contains less than 50 operations (less than 24 lines of record type 2 if done from a file).

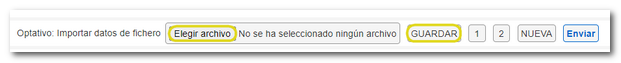

Remember that you can import a .360.txt file for online filing from the "Choose file" or "Browse" button depending on the browser used, or complete the declaration and save the changes from the "SAVE" button.

IMPORTANT:

Incorporate the invoices in such a way that the negative invoices are last so that the sum is not erroneous.

Another alternative way to submit the test is by marking a 1 in position 17, according to the instructions for the registration design of model 360 for submission by file. If after the correct validation of the file you want to process the formal submission of the declaration, it is necessary to rectify position 17 of record type 1 by changing the "1" to a zero "0" and access the file submission option again.