"Deferred Validation" status of a VAT refund request sent - Form 360

If the refund request sent has more than 50 transactions, it will be placed in a "Deferred Validation" status. The procedure requires identification with an electronic certificate.

In the procedures for model 360, click on " Verification of the completed presentation of model 360 ".

IMPORTANT:

To access deferred validation, use the Microsoft Edge browser with the necessary settings to run Java. You can consult the related help on Java Virtual Machine.

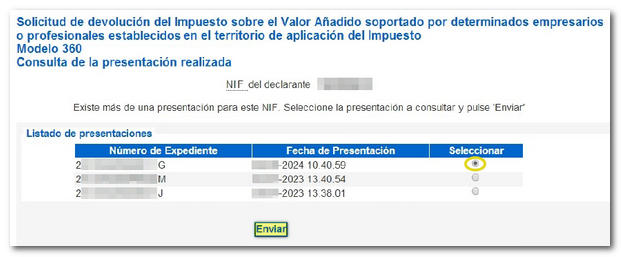

If you have more than one submission, select the file you want to check and press "Submit".

When you click "Submit" you will get a page with a notice at the top, click on "Deferred Submission Validation" located inside the notice box. From here you can get the following possible results:

-

If clicking on "Deferred validation of submission" does nothing, the validation has not yet been carried out and the file has not yet been processed. You will need to try again (the time is not defined, it may take several hours). In this case, the presenter will subsequently receive an email confirming or not the presentation. Generally the declaration will be validated on the same day.

-

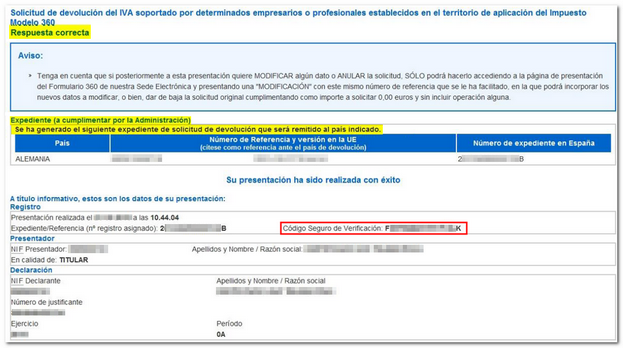

If no errors are detected in the declaration, you will receive the message "Correct response" and the data corresponding to the submission, including the secure verification code, as proof of the submission, along with the message "Your submission has been completed successfully."

-

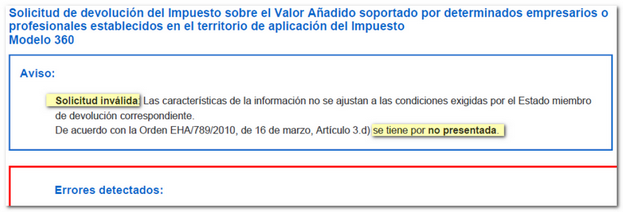

If errors are detected in the declaration, you will get the notice "Invalid request" and the page will display the list of specific errors. In addition, an email is sent to the presenter informing him/her of this circumstance and indicating that he/she must submit the request again. This declaration is listed as not submitted, so it must be submitted again with the errors corrected, by submitting a new application.

If the declaration appears correct but you need to make changes, you can submit a modification to it or cancel it.