3.1.1. Exonerated from filing Form 390

The following taxpayers are not required to submit Form 390:

-

Taxpayers with a quarterly settlement period who, paying taxes only in common territory, carry out activities under the simplified VAT regime and/or whose activity consists of leasing operations of urban real estate.

-

Taxpayers included in the SII.

NOTE : If you carry out any of these activities and additionally carry out another activity for which you are not required to declare, you will not be required to submit Form 390 either.

These taxpayers must declare the operations carried out in each fiscal year and the volume of operations when they submit Form 303 in relation to the last period of the aforementioned fiscal year (i.e., fourth quarter or twelfth month).

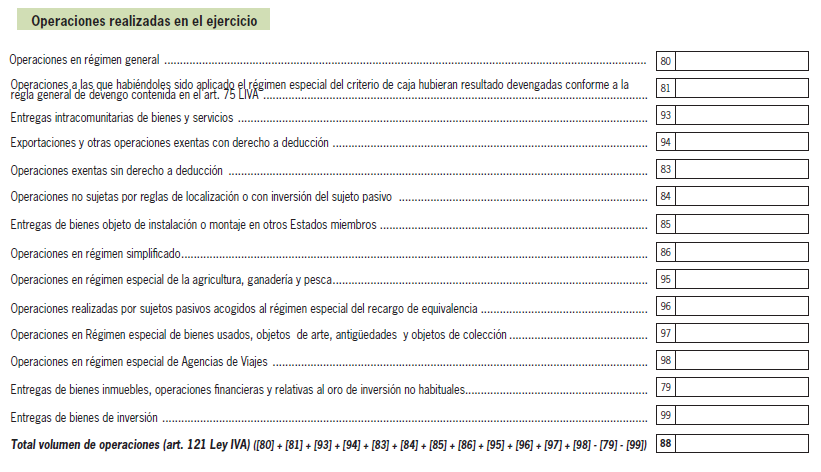

Specifically, they must declare these operations in the following section of form 303:

For more details about this section, its boxes and how they should be filled out, you can consult the Instructions for form 303 New window .

You can access the procedure at the following link:

Model 303. VAT. Self-assessment New window .