4.3. Immediate Supply of Information on VAT (SII)

The registration books referred to in article 62.1 of the Value Added Tax Regulations must be kept through the electronic headquarters of the State Tax Administration Agency, by means of the electronic supply of the billing records (SII), by the taxpayers of the aforementioned Tax, who have a settlement period that coincides with the calendar month.

VAT. VAT registration books through the AEAT electronic headquarters New window .

In accordance with the provisions of article 71.3 of said Regulation, the following have a monthly settlement period, among others:

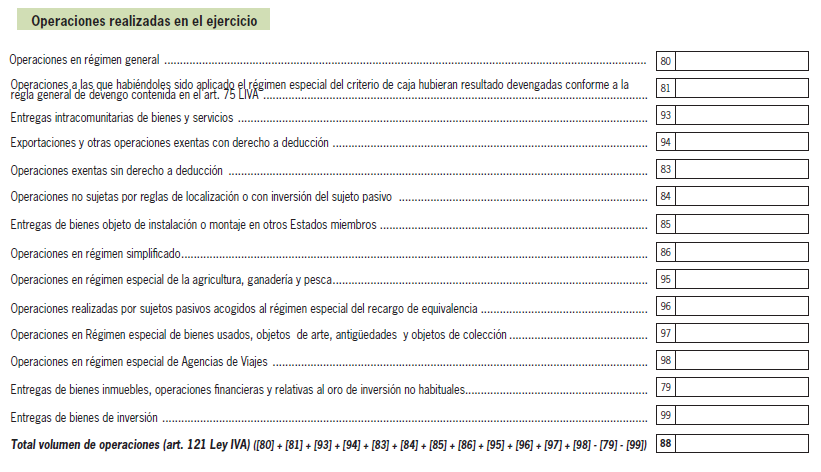

“ Those whose volume of operations, calculated in accordance with the provisions of article 121 of the Tax Law, had exceeded during the immediately preceding calendar year 6,010,121.04 euros ”.

The deadline for electronic submission of billing records is generally 4 calendar days from the date the invoice is issued or from the date on which the accounting record of the invoice is made, and in any case before the 16th of the following month.

EXAMPLES :

Example 1 : A businessman A provides a service to another businessman on February 4, 2021, issuing the corresponding invoice on the same day. The deadline for submitting the registration of this invoice through the SII ends on February 8.

Example 2 : Business A provides a service to another business on 3 January 2021, issuing the corresponding invoice on 11 February 2021 (the deadline for issuing it ends on 15 February). The deadline for submitting the registration of this invoice through the SII ends on February 15 (the deadline applies).

Taxpayers included in the SII are not required to file the Annual Declaration of Transactions with Third Parties, form 347 , and the Annual Summary Declaration of Value Added Tax, form 390 .

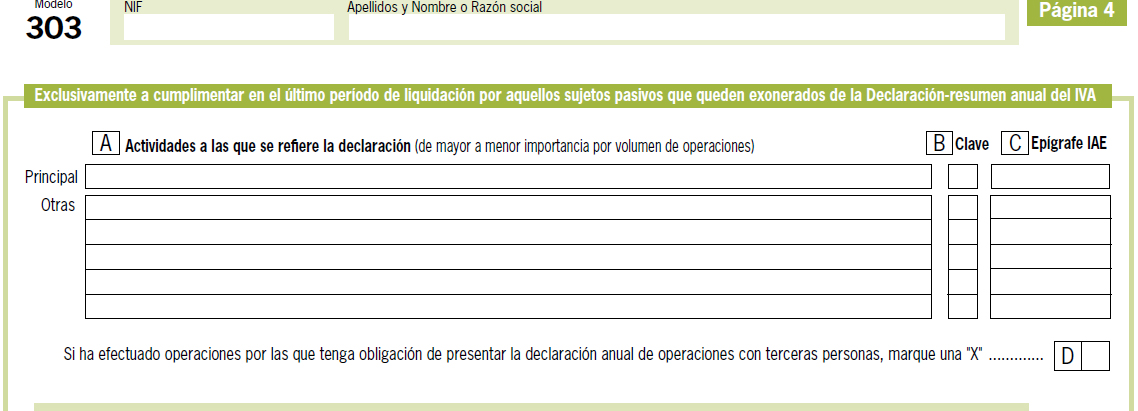

This exemption entails the necessary completion of additional boxes in the self-assessment corresponding to the last settlement period of the financial year.