3.2.7. Services in Income Tax Campaign

The Tax Agency makes further efforts to facilitate the fulfilment of their duties to the more than 20 million citizens obliged to pay the Personal Income Tax corresponding to the year 2011.

Submission of the pre-populated income tax return or of tax information relevant for the declaration of the Personal Income Tax

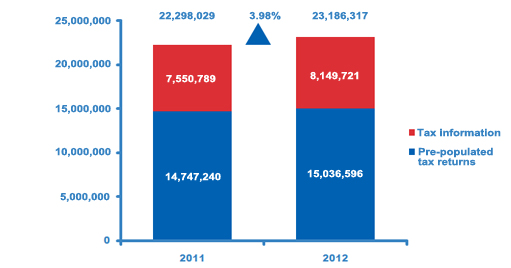

The main service that the Tax Agency provides during the tax return campaign is the possibility to submit a pre-populated income tax return or tax information relevant to produce the tax return when the Tax Agency does not have all the necessary information for that. The overall number of pre-populated tax returns and tax information calculated by the Tax Agency reached 23,186,317, which is 3.98 per cent more than the previous year.

In 2012, a total of 23,186,317 pre-populated returns and tax information were sent to taxpayers to assist them in completing their Personal Income Tax return, which means 3.98 per cent more than the previous year.

Evolution of services pertaining to the sending of tax information and pre-populated tax returns

RENØ service for obtaining the pre-populated tax return and tax information on line

This year has been the second in which the RENØ service for obtaining the pre-populated tax return and tax information on line has been available, and it has reached 12,634,816, which means a 92.42 per cent increase compared to last year. By entering the NIF (Personal Tax ID), name and surnames, a mobile telephone number and box 620 of the previous year's tax return, or the number of a bank account in the electronic office if the tax return has not been submitted, the system automatically sends a text message (SMS) with the reference number of the pre-populated tax return that allows to consult, modify and confirm it.

As a novelty of the tax return campaign 2011, in order to access the RENØ service it was not necessary to have previously requested the pre-populated tax return, since it is available on line, along with tax information for the taxpayers, both for those who have submitted their tax return in the previous year as well as for the new returns in this financial year.

Confirmation or modification of the pre-populated income tax return

The pre-populated tax return can be confirmed or modified by the taxpayer using several means: telephone, Internet, text messages, automated teller machines, banking or telephone electronic (in the entities which provide this service), and face to face, in Banks, Savings Banks or Credit Co-operatives, in the offices of the Tax Agency and in specific offices authorised by the Autonomous Communities, Autonomous Cities and Local Authorities.

Aid services for completing tax returns

Taxpayers who, due to the type of incomes obtained, do not have the pre-populated tax return, will be able to prepare its tax return with the PADRE program, available on line, and to also submit it on line, or on-site at the offices of the Tax Agency and other collaborating organisations, or go to the aid service for the completing tax returns in the offices of the Tax Agency or of any collaborating organisation, like Autonomous Communities, Town Councils, Regional Governments, etc., by requesting an appointment on line or by telephone.

In 2012, 95.45 per cent of the tax returns were elaborated with the PADRE help program

Consult the status of the refund procedure.

The Administration has a six months deadline starting from the end of the tax returns' submission deadline, or from the tax returns' submission date if it was submitted outside of the deadline, to carry out the provisional settlement that confirms or modifies the amount of the refund requested by the taxpayer.

The issuing of refunds starts off 48 hours after the beginning of the tax return campaign. The consultation of the status of the return's procedure is available in the Tax Agency's website and in the automatic telephone helpline.

In 2012, the average time of each refund procedure in the Tax Return Campaign has been 24 days.

Taxpayers' evaluation of the services in tax return campaign

In the "Survey of the Personal Income Tax 2011", carried out during the year 2012, in which the Tax Agency asks the opinion of those that have used the electronic filing service for their Personal Income Tax returns, 64.06 per cent of the taxpayers who have used this service seem satisfied or very satisfied with the service.

Once again, the five services that users consider most useful are the filing of tax returns, the requests, the modification and confirmation of the pre-populated Income tax returns, the consultation of the status of the returns, the available data communication related to the Personal Income Tax return, and the download of the Help Program.