3.2.8. Support for paying tax liabilities

Payment in financial institutions

In order to facilitate the payment of the taxes, the tax regulation enables the Tax Agency to authorise credit institutions that request to collaborate in the collection. As of 31 of December 2012, 155 entities had the authorisation to act as collaborators in the tax collection management.

The total amount raised through the collaborating organisations has reached 209,562 million euros in 2012, which makes it the most usual payment system.

During the 2012 financial year, certain verification actions have been carried out on roughly 72 entities, seven of which were controlled from an integral point of view. In addition, there have been verifications in relation to 1757 attachment of bank accounts corresponding to 11 entities, with the aim of verifying the results of the obstacles reported to the Tax Agency by the entities.

Deferment and payment by instalments

The taxpayers can request the deferral and fractioning of their debts when temporary treasury problems obstruct the payment.

In 2012 there has been a continuation of the rising trend of the previous years in the number of deferment and fractioning requests as well as in the required amount. Thus, 1,942,219 applications have been filed for a total amount of 17,595.27 million euros, that is, respectively 18 and 10 per cent more that in 2011.

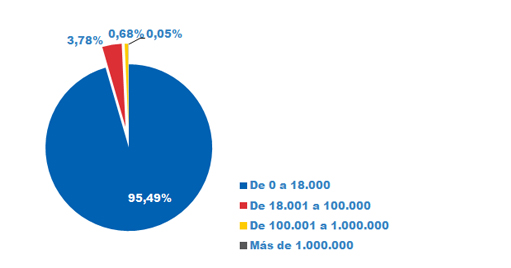

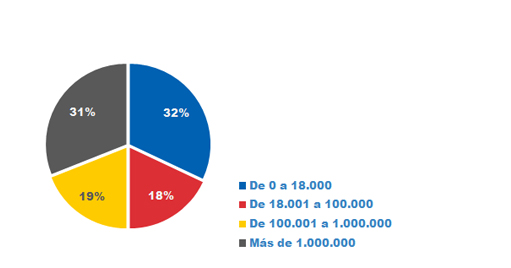

The following tables show the distribution of the deferment and fractioning requests distributed by the amount of the debts:

Applications for deferrals in number

Percentage distribution by income brackets

Applications for deferrals by amount

Percentage distribution by income brackets

95.49 per cent of the received requests correspond to debts of less than €18,000, although they are only 32 per cent of the total amount requested. In these deferments, the regulations exempts the debtor of the general obligation of providing proof of the payment.

As for the deferments and fractioning solved, 1,868,093 deferment and fractioning agreements for a total amount of 14,177.6 million euros have been carried out in 2012.

96 per cent of these agreements correspond to debts of amounts below €18,000, which are subject to computerised management in order to speed up their procedure (RAM). The average period of discharge for these deferments in 2012 was 12 days.

| PAYMENT DEFERMENT AND FRACTIONING AGREEMENTS | ||||||

|---|---|---|---|---|---|---|

| TOTAL AGREEMENTS 2012 | RAM AGREEMENTS | NOT RAM AGREEMENTS | ||||

| GRANTED | DENIED | GRANTED | DENIED | |||

| Number | 1,868,093 | 1,151,546 | 505,710 | 104,065 | 106,772 | |

| Cost | 14,177.6 | 3,347.4 | 697.4 | 5,189.1 | 4,943.6 | |

*Quantities and amounts in millions of euros

| GUARANTEES IN THE GRANTED DEFERMENTS | |||||

|---|---|---|---|---|---|

| TOTAL | EXEMPTION | GUARANTEES | WAIVING | ||

| PARTIAL | TOTAL | ||||

| Number | 1,255,611 | 1,205,552 | 20,924 | 1,591 | 27,544 |

|

Cost |

8,536.50 | 4,521 | 2,823 | 380.6 | 811.8 |

*Quantities and amounts in millions of euros

Annexes:

Evolution of the number of deferrals requested Evolution of the amount of deferrals requested