3.2.7. Personal Income Tax Campaign

The Tax Agency makes further efforts to facilitate the fulfilment of their duties to the more than 20 million citizens obliged to pay the Personal Income Tax corresponding to the year 2012. This is why the Tax Return Campaign 2013 was reinforced with human means to cover the demand of on-site attention with a total of 1,332 additional posts, as well as with a series of services that are indicated next.

Submission of the pre-populated income tax return or of tax information relevant for the declaration of the Personal Income Tax

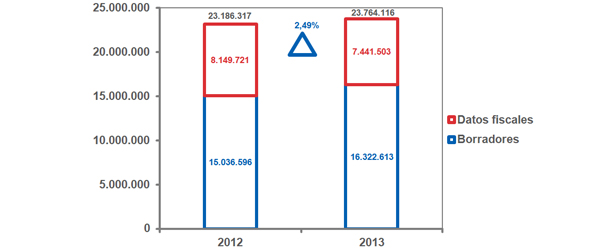

The main service that the Tax Agency provides during the tax return campaign is the possibility to submit a pre-populated income tax return or tax information relevant to produce the tax return when the Tax Agency does not have all the necessary information for that. The overall number of pre-populated tax returns and tax information calculated by the Tax Agency reached 23,764,116, which is 2.49 per cent more than the previous year.

RENØ service for obtaining the pre-populated tax return and tax information on line

This year has been the third in which the RENØ service for obtaining the pre-populated tax return and tax information on line has been available, and it has reached 14,452,813 taxpayers using it in 2013, which means a 14.39 per cent increase compared to last year. By entering the NIF (Personal Tax ID), name and surnames, a mobile telephone number and box 620 of the previous year's tax return, or the number of a bank account in the electronic office if the tax return has not been submitted, the system automatically sends a text message (SMS) with the reference number of the pre-populated tax return that allows to consult, modify and confirm it.

Confirmation or modification of the pre-populated income tax return

The pre-populated tax return can be confirmed or modified by the taxpayer using several means: telephone, Internet, text messages, automated teller machines, banking or telephone electronic (in the entities which provide this service), and face to face, in Banks, Savings Banks or Credit Co-operatives, in the offices of the Tax Agency and in specific offices authorised by the Autonomous Communities, Autonomous Cities and Local Authorities.

Aid services for completing tax returns

Taxpayers who, due to the type of incomes obtained, do not have the pre-populated tax return, will be able to prepare its tax return with the PADRE program, available on line, and to also submit it on line, or on-site at the offices of the Tax Agency and other collaborating organisations, or go to the aid service for the completing tax returns in the offices of the Tax Agency or of any collaborating organisation, like Autonomous Communities, Town Councils, Regional Governments, etc., by requesting an appointment on line or by telephone.

As it has been previously stated, in 2013 99.6 per cent of the tax returns were elaborated with the PADRE help program.

Consult the status of the refund procedure.

The Administration has a six months deadline starting from the end of the tax returns' submission deadline, or from the tax returns' submission date if it was submitted outside of the deadline, to carry out the provisional settlement that confirms or modifies the amount of the refund requested by the taxpayer.

The issuing of refunds starts off 48 hours after the beginning of the tax return campaign. The consultation of the status of the return's procedure is available in the Tax Agency's website and in the automatic telephone helpline.

In 2013, the average time of each refund procedure in the Tax Return Campaign was 26 days.