First step: modify data

Any data that was not entered in the initial declaration must be incorporated, any incorrect data must be amended, and any correct data entered in the original declaration must be maintained.

These changes will be made, as appropriate, to the individual tax return of the taxpayer, the spouse, or any children with income (even if the corrective self-assessment is being filed on a joint return).

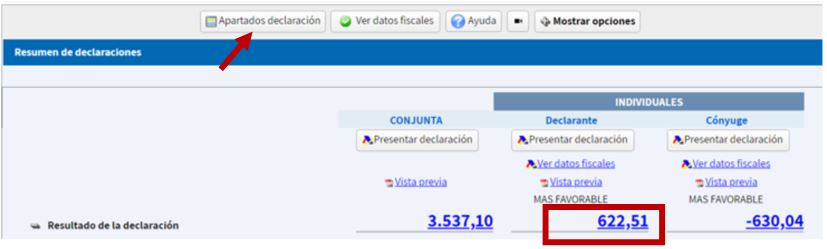

As a result of the changes introduced, a new result of €622.51 is obtained, an amount shown in the declaration summary: