Mutualists: Application of DT 2ª in Income 2023

Learn how the second transitional provision (DT 2ª) is applied in Income Tax 2023.

The Tax Agency has all the information to calculate the reduction

If the Tax Agency has all the information, the reduction will already appear in the tax data with the concept (“Adjustment for Mutual Societies - DT2 LIRPF”) and will be automatically applied in the declaration.

Accessing the tax data query from Tax Agency: 2023 Income Tax Campaign

Or once you have accessed the draft/declaration processing service (Renta WEB), within the available services:

It will be shown in relation to work income:

NOTICE TO PENSIONERS REGARDING CONTRIBUTIONS TO MUTUAL SOCIETIES

You are informed of the " Adjustment for Mutual Societies - DT2 LIRPF " which corresponds to the amount of the pension not subject to taxation by application of the provisions of the Second Transitional Provision of the Law of IRPF .

This adjustment is automatically transferred to your 2023 Income Tax Return, reducing the amount of the pension subject to tax in box 003. In this way, when you file your return, the reduction that corresponds to you is already applied.

For more information, click on Mutualists: return requests .

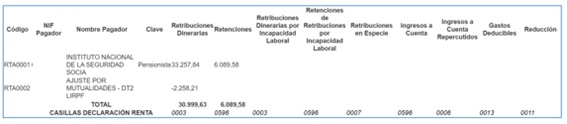

- The amount of the retirement or disability pension

- The adjustment for Mutualities-DT 2 LIRPF that corresponds to the amount of the reduction to be applied (amount with negative sign).

And in the declaration only the difference between both amounts will have been included as work income (in box 0003) because the reduction to be applied will have been taken into account.

In the event that there is more than pension with the right to apply DT 2 , a line will appear with each of the pensions received and an adjustment line for each of the pensions with the right to apply DT 2. This will be the exceptional case, for example, of those taxpayers who made contributions to a complementary mutual fund that was later transformed into a pension plan.

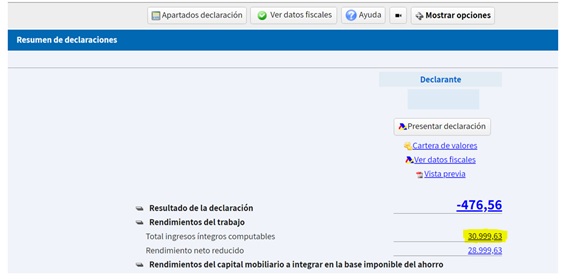

You can check this by clicking on the amount corresponding to the “Total total computable income” of the work income in the declaration summary:

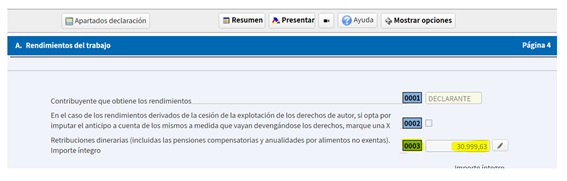

This will lead to box 0003, where only the difference between the retirement or disability pension received and the adjustment applied will appear:

If there are other gross earnings from work, the amount that will appear in box 0003 will be the amount previously calculated (retirement or disability pension reduced by adjustment) plus the amount of the rest of the gross earnings from work obtained.