Who is affected?

All players in the e-commerce supply chain are affected, from sellers and marketplaces/platforms, both within and outside the European Union, to postal operators and courier companies, customs and tax authorities in the various Member States of the European Union, and consumers.

Electronic interfaces (platforms)

The global economy and new technologies have brought with them enormous opportunities in trade, especially for electronic interfaces such as online marketplaces or platforms. To keep pace with the new trends brought about by e-commerce, VAT regulations are changing to create a simpler and fairer environment for VAT.

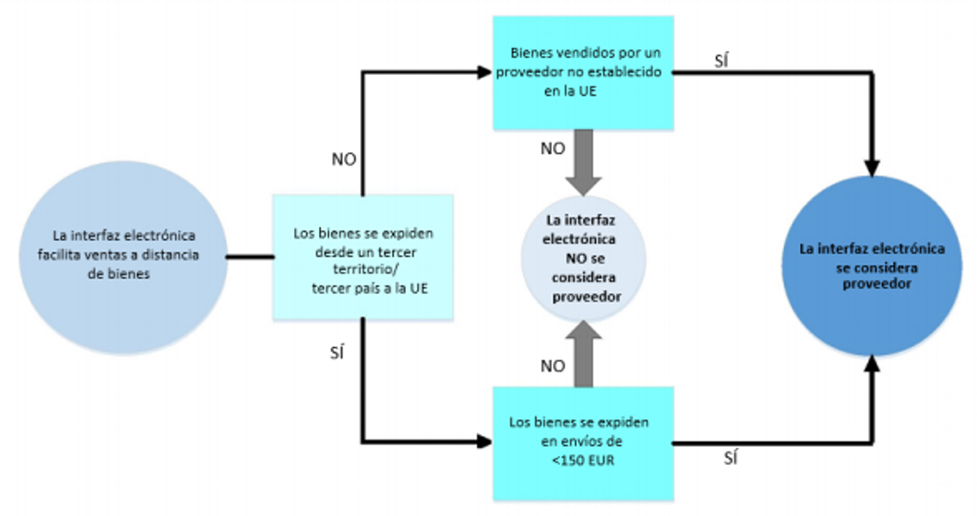

The electronic interface that facilitates the sale will not be considered a taxable person for the following transactions:

-

Goods in shipments whose value is greater than 150 euros imported into the EU , regardless of where the supplier/seller is established;

-

Goods supplied to customers in the EU , regardless of their value, in case the supplier/seller is established in the EU

We must distinguish:

-

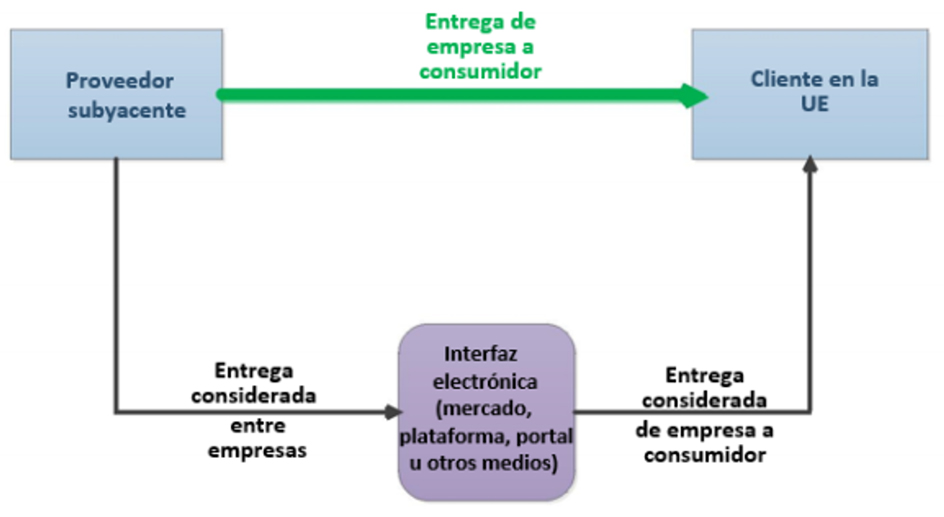

The delivery from the supplier to the electronic interface (considered a business-to-business delivery) can be:

-

A delivery of goods outside the EU (Article 14a, paragraph 1 of the Directive VAT).

Since this delivery takes place outside the EU, the Union rules on the VAT nor in terms of billing.

-

A delivery of goods within the EU (Article 14a, paragraph 2 of the Directive VAT).

This delivery, which is considered to be made between companies, is exempt from VAT, recognising the right to deduction for the supplier (Articles 136a and 169(b) of the Directive VAT). The supplier must issue an invoice to the electronic interface in accordance with the rules of the Member State where the delivery takes place.

-

-

The delivery of the electronic interface to the consumer (considered a business-to-consumer delivery) may be:

-

A distance sale of imported goods (Article 14a, paragraph 1 of the Directive) VAT). The electronic interface will have to tax the delivery of goods with the VAT applicable in the Member State of consumption and forward it to the tax authorities of that Member State.

The invoicing rules of the Member State of identification shall apply if the interface is covered by the one-stop shop (special scheme for distance sales of imported goods), and the identification number shall not be shown on the invoice. EU If the special arrangements are not used, the invoicing rules of the Member State where the distance selling of the imported goods takes place will apply (Article 219a of the Directive on the VAT).

-

A delivery of goods within the EU (Article 14a, paragraph 2 of the Directive VAT) This situation covers both national supplies and intra-Community distance sales of goods made by the electronic interface as the taxable person. Whether or not the Union regime is used, the electronic interface will have to tax the goods supplied with the VAT applicable in the Member State of consumption and forward it to the tax authorities.

The invoicing rules of the Member State of identification will apply if the interface is covered by the one-stop shop (special arrangements for intra-Community distance sales of goods and certain national supplies). If the special arrangements are not used, the invoicing rules of the Member State where the supply takes place will apply (Article 219a of the Directive on the VAT).

-

You are considered a taxpayer if you provide:

-

Distance sales of goods imported into the EU for a value not exceeding 150 euros; I

-

Supplies of goods to customers in the EU , regardless of their value, when the supplier/seller is not established in the EU (both domestic supplies such as distance sales within the EU ).

To declare and pay the VAT owed in other Member States, online marketplaces/platforms will be able to easily register for the new special One Stop Shop schemes.

The new rules will make it possible to:

-

Ensure that the VAT payment is made where goods and services are consumed;

-

Create a system of VAT uniform and transparent for cross-border deliveries of goods and services;

-

Establish fair competition between European and foreign players in the e-commerce market, as well as between e-commerce and brick-and-mortar stores;

-

Provide businesses with a simple and uniform system to declare and pay their VAT in the EU through the One-Stop Shop of the VAT (OSS) / Single Import Window (IOSS).

The electronic interface is treated for the purposes of VAT as if it were the supplier of the goods and will be responsible for the VAT on these sales. In other words, the electronic interface facilitating the sale is deemed to have received and delivered the goods on its own behalf and the transport of said goods is linked to the delivery made by the platform. This means that the sale of goods made by the supplier through an electronic interface to the final consumer is divided into two deliveries:

-

A delivery from the supplier to the interface (B2B transaction)

-

A delivery of the interface to the end consumer (B2C transaction between business and end consumer)

"Facilitating" the use of an electronic interface to enable a customer and a supplier offering goods for sale via the electronic interface to enter into contact resulting in a delivery of goods via that electronic interface to that customer.

This is reflected in the fact that the order and payment process is carried out by or through the electronic interface, but is not determined by the physical delivery of the goods, which the taxable person managing the operational interface may or may not have organised/carried out.

An electronic interface is considered not to facilitate delivery if:

-

does not establish, directly or indirectly, any of the terms and conditions under which the delivery of goods is made, and

-

does not intervene, directly or indirectly, in the authorization of the collection of payments from the client, and

-

does not intervene, directly or indirectly, in the order or delivery of goods.

For an electronic interface to be considered not to facilitate delivery, it must satisfy all of these conditions. Therefore, even where the platform carries out only one of these activities, it could be considered to facilitate the delivery of goods.

The electronic interface will also not be considered to facilitate delivery when it performs the following activities:

-

the processing of payments in relation to the delivery of goods;

-

the listing or advertising of goods;

-

the redirection or transfer of customers to other electronic interfaces where the goods are offered for sale, without any further intervention in the delivery.

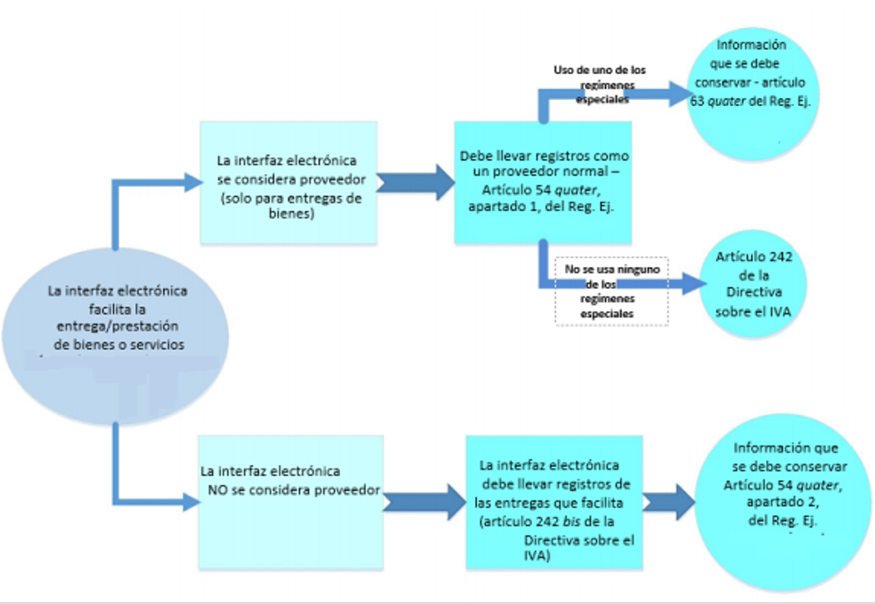

Online marketplaces/platforms must maintain records of the transactions they facilitate, regardless of whether they are considered taxable persons or not. These records must be kept for 10 years and be available in electronic format upon request by Member States.

The following figure schematically presents the information obligations of the different electronic interfaces.

For further information, and in particular on the information to be retained, please refer to the Commission's explanatory notes (section 2.2).

From 1 July 2021, electronic interfaces such as online marketplaces/platforms will have new features for the purposes of VAT in the EU:

-

They may become taxpayers;

-

They will have certain record keeping obligations.

If so, see the sections on the new special one-stop-shop schemes (OSS and IOSS) to find out what they are for, how they work, who they affect, how to register for them and what you need to do when you start using them.

An electronic interface (EI) should be understood as a broad concept. An IE can be a website, portal, gateway, marketplace, platform, application program interface (API), etc.