Frequently asked questions (FAQ)

Compilation of questions and answers regarding Billing Information Systems and VERI*FACTU (Updated as of December 5, 2025)

General questions: compliance and delegation

Yes. The regulation establishing the requirements to be adopted by computer or electronic systems and programs that support the billing processes of entrepreneurs and professionals, and the standardization of billing record formats ( RRSIF ), approved by Royal Decree 1007/2023, of December 5, provides in its article 5 the possibility of requesting the non-application of or some aspect thereof when certain circumstances occur, which are understood to be extraordinary, related to economic activity or of a technical nature.

The application can be submitted through the Tax Agency's electronic office.

Regulations/Doctrine:

- Article 5 of the regulation establishing the requirements that must be adopted by computer or electronic systems and programs that support the billing processes of entrepreneurs and professionals, and the standardization of billing record formats ( RRSIF ), approved by Royal Decree 1007/2023, of December 5.

Yes. The material fulfillment of the obligations of the regulation that establishes the requirements for computerized billing systems may be delegated to the recipient of the operation or to a third party, provided that the conditions established in article 5 of the regulation that regulates billing obligations ( ROF ) are met, approved by Royal Decree 1619/2012, of November 30, for the purposes of the obligation to issue the invoice, with powers granted to do so.

In any case, this possibility does not exempt the party obliged to issue invoices from responsibility for such compliance.

Regulations/Doctrine:

- Article 6 of the regulation establishing the requirements that must be adopted by computer or electronic systems and programs that support the billing processes of entrepreneurs and professionals, and the standardization of billing record formats ( RRSIF ), approved by Royal Decree 1007/2023, of December 5.

- Article 5 of the regulations governing billing obligations ( ROF ), approved by Royal Decree 1619/2012, of November 30.

First of all, it must be taken into account that the object regulated in the regulation that establishes the requirements that must be adopted by the computer or electronic systems and programs that support the billing processes of entrepreneurs and professionals, and the standardization of formats of the billing records (RRSIF), approved by Royal Decree 1007/2023, of December 5, are precisely the computerized billing systems (SIF), which is different from the obligation to keep books and records of VAT (LRI). They are therefore different obligations that may affect different taxpayers.

In the case raised, and with regard to the obligations imposed by the RRSIF, if the supplier has delegated the physical issuance of the invoice to its client, it is the client who, in addition to physically issuing said invoice, must generate – and, in the "VERI*FACTU" mode, send – the initial invoicing record required by the RRSIF. However, if the client keeps billing records in accordance with the terms established in article 62.6 of the Value Added Tax Regulations, approved by Royal Decree 1624/1992, of December 29, (through the immediate provision of information, or SII), they are exempt from compliance with the obligations provided for in the RRSIF for such operations.

On the other hand, the maintenance of the LRI is independent of who actually issues the invoices and is regulated in articles 62 and 63 of the Value Added Tax Regulations, approved by Royal Decree 1624/1992, of December 29. Therefore, each company must include invoices issued for all goods sold and services rendered (regardless of who actually issued the invoice, which may be the selling company itself, a third party, or the recipient/buyer) in the LRI of invoices issued, and invoices received for goods purchased or services received (regardless of who actually issued the invoice, which may be the selling company, a third party, or the recipient/buyer) in the LRI of invoices received.

Regulations/Doctrine:

- Articles 5 and 6 of the regulation establishing the requirements to be adopted by computer or electronic systems and programs that support the invoicing processes of entrepreneurs and professionals, and the standardization of invoicing record formats (RRSIF), approved by Royal Decree 1007/2023, of December 5, amended by Royal Decree 254/2025, of April 1.

- Article 5 of the regulation governing invoicing obligations (ROF), approved by Royal Decree 1619/2012, of November 30.

- Articles 62 and 63 of the Value Added Tax (RIVA) regulations, approved by Royal Decree 1624/1992, of December 29

No.

The census communication of the obligated issuer (supplier) through boxes 739 and 740 of Model 036 only applies to the scope of subjects assigned to the SII (Immediate Supply of Information).

Article 5 of the ROF (Regulations establishing invoicing obligations) and Article 6 of the RRSIF (Regulations establishing the requirements for computerized invoicing systems)

In order for a third party/recipient authorized in accordance with Article 5 of the Regulation establishing the invoicing obligations (ROF) to issue invoices, to be able to send the invoicing records in accordance with the Regulation establishing the requirements of computerized invoicing systems (RRSIF) on behalf of and for the account of the party obliged to issue them, they must be authorized, and said authorization must be registered in the register of powers of attorney: either with a general power of attorney or a specific power of attorney to send VERI*FACTU records.

There are 3 ways to register the power of attorney:

-

Power granted by personal appearance at the Delegations and Administrations of the Agency and in the case of legal persons or entities lacking legal personality referred to in article 35.4 LGT, by appearance of the legal representative of the entity or of the person who holds sufficient power to grant the powers.

-

Power granted by public document or private document with notarized signature presented to the Tax Agency.

-

Power granted over the Internet through the use of one of the identification and authentication systems provided for in Law 39/2015, of October 1, on the Common Administrative Procedure of Public Administrations.

This last option is the easiest and preferable way to grant the aforementioned power of attorney. To do so, the principal can follow the procedure below: Tax Agency: Register of powers of attorney.

And subsequently, enter into management Registration of power of attorney for specific tax procedures (agenciatributaria.gob.es)

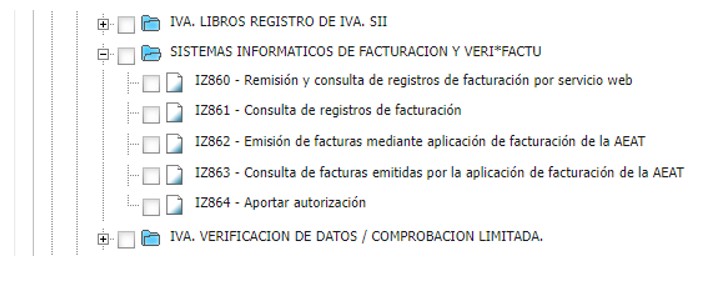

This link provides access to the specific procedures related to "Invoicing and VERI*FACTU Computer Systems".

Unlike powers of attorney, in social collaboration the taxpayer authorizes his representative through a representation model (not to be confused with a power of attorney document) to carry out certain procedures online before the AEAT. This authorization must remain in the possession of the social collaborator and must not be provided to the AEAT, unless required.

To grant representation to the social collaborator, the models approved by the Resolution of December 18, 2024, of the General Directorate of the State Tax Administration Agency, which approves the standardized documents to accredit the representation of third parties in the procedure for sending the files containing billing records generated by invoice issuance systems, through the Electronic Office of the Tax Agency, and which are those listed as annexes in said resolution:

-

Annex II, for the granting of representation of taxpayers to tax professionals.

Unlike powers of attorney, in social collaboration the taxpayer authorizes his representative through a representation model (not to be confused with a power of attorney document) to carry out certain procedures online before the AEAT. This authorization must remain in the possession of the social collaborator and must not be provided to the AEAT, unless required.

To grant representation to the social collaborator, the models approved by the Resolution of December 18, 2024, of the General Directorate of the State Tax Administration Agency, which approves the standardized documents to accredit the representation of third parties in the procedure for sending the files containing billing records generated by invoice issuance systems, through the Electronic Office of the Tax Agency, and which are those listed as annexes in said resolution:

-

Annex I, for the granting of direct representation of taxpayers to software supply companies, which will provide services from their platforms.

-

Annex III, for the granting of representation of tax professionals to software supply companies, for tax professionals who provide their services to taxpayers under license of the applications and programs supplied by software supply companies.