The observatory of business margins

The Business Margins Observatory has recently been published. This is a joint project promoted by the Ministry of Economic Affairs and Digital Transformation, the Bank of Spain and the State Tax Administration Agency.

The information of this Observatory can be consulted both on the portal created by the Bank of Spain ( https://www.bde.es/wbe/es/inicio/observatorio-margenes-empresariales/ ) and on the Tax Agency's own website ( Tax Agency: Business Margins Observatory ).

The objective of the Observatory is twofold. On the one hand, it is about clarifying the concepts relating to business margins. To this end, two methodological sheets have been prepared with the definitions and the main sources of information. On the other hand, the Observatory aims to facilitate access to analysts, researchers and any interested citizen to the information already available on these margins and to the possible extensions that may be developed in the future.

There is indeed some confusion when talking about business margins, confusing these with the final profit of companies. The information provided by the Observatory is used for the analysis of the gross operating result, which in terms of National Accounting is called Gross Operating Surplus. This surplus measures the balance generated in the company's production activities, once the labor factor has been remunerated. Seen from another perspective, they are the resources available to the company after the production process that will allow it, among other things, to remunerate its owners, satisfy any debts it may have, pay taxes or, where appropriate, finance its investments. In typical business analysis, this surplus is the best approximation to the concept of EBITDA (earnings before interest, taxes, depreciation and amortization).

The second objective of the Observatory is to make information on margins more accessible. Some of this information is not new, as it was available in different places. For example, the profit and loss accounts of companies (and their balance sheets) can be consulted in the Corporate Tax statistics since 2002 ( Tax Agency: Unconsolidated annual accounts for corporate tax ), and the sales, purchases and wage data from the report Sales, Employment and Wages in Large Companies and Corporate SMEs ( Tax Agency: Sales, Employment and Salaries in Large Companies and SMEs ) already allowed a quarterly approximation to be made to the evolution of margins. With less coverage, the Bank of Spain's Balance Sheet Centre also traditionally carries out analyses of gross operating profit. What does the Observatory contribute then? First, it groups and centralizes relevant information on the subject; Secondly, it has allowed us to systematize the information and offer more detail about it; And thirdly, it provides a framework from which to address future extensions, some of which are already planned and others which will emerge as users raise new needs.

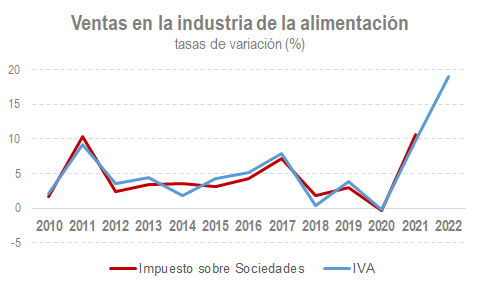

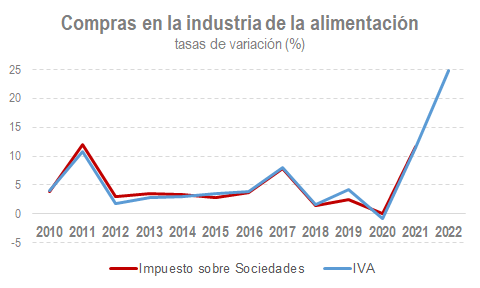

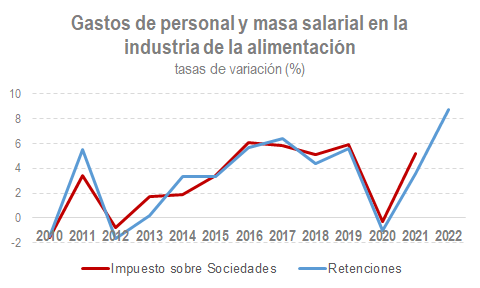

From the Agency's point of view, the Observatory's publication has served to visualise, once again, the wealth of information available. Although the Corporate Tax statistics are consolidated statistics in the analysis of corporate profits, the Observatory has made it possible to publish more detail by activity and to bring forward the publication of the results for the 2021 financial year by a few months (in August the first data for the 2022 financial year will be published, the declaration of which most companies will present in the next few days). Furthermore, the combination made in the Observatory of the information from the Corporate Tax and that obtained from the monthly and quarterly declarations of theVAT and labor withholdings, allows us to see the consistency between sources and the usefulness of having quarterly indicators for monitoring sales, purchases, payroll, and margins. The graphs below, referring to the food industry (one of the 74 activities published), are a good example of this aspect.