The income of individuals and households in the Tax Agency's statistics

In recent weeks, some of the statistics that awaken the most interest among the media and, in general, the users of the Tax Agency's statistics have been published. These are the Statistics of payers of Personal Income Tax by municipality and the Statistics of payers of Personal Income Tax by main municipalities by postcode. Both are part of the universe of statistical products obtained from the information provided by the Personal Income Tax returns (hereinafter, "IRPF").

The importance of this group of statistics is due to the central role of personal income tax in our tax system. Therefore, since the first few years following the creation of the Personal Income Tax at the end of the seventies, the results have been published in a very similar way as the current Statistics of Personal Income Tax declarers. Initially, the scope of dissemination of statistics was very limited, and it was mostly internal, within the Ministry of Finance. The external dissemination began in 2005 with the publication of the data of fiscal year 2003 on the Tax Agency's website (although statistics from the 1992-2002 period can also be downloaded since a couple of years ago).

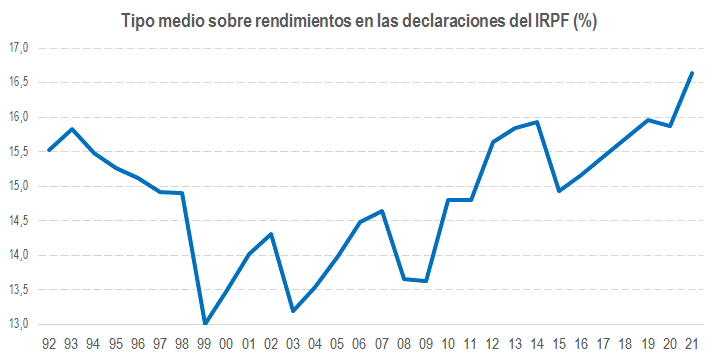

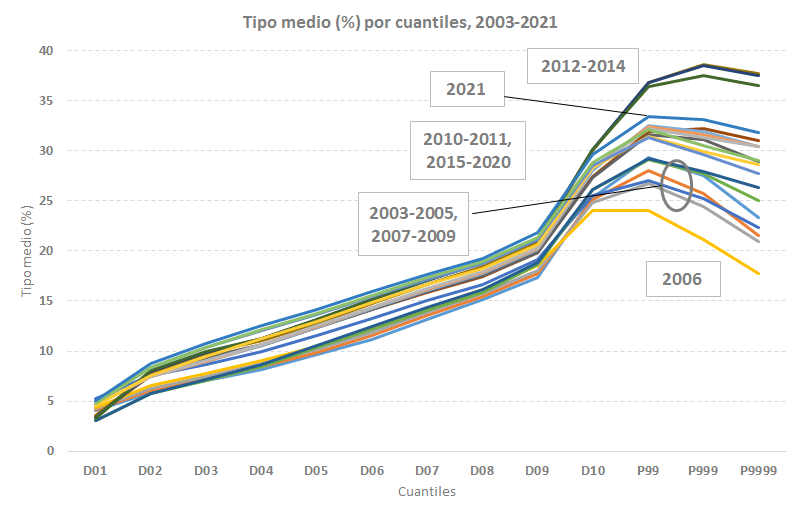

The wealth of information on the Personal Income Tax return, together with the improvement of the technical resources in its management (draft, Renta Web, etc.), have allowed developing other products associated with this information, on some occasions resulting from the details of the settlement itself and on others enriching that information with other sources. The two statistics mentioned above are two good examples, as so are the Disability statistics in Personal Income Tax and the Statistics on Earnings from economic activities. Furthermore, with a broader time horizon, there are new applications such as the Distribution of Personal Income Tax returns, a file that is attached to the Tax Revenue Annual Report and that contains a selection of data used to analyse aspects like the evolution of average rates by income level.

Since the mid-eighties, another way of using data was also explored: samples of declarers. In collaboration with the Institute of Tax Studies (IEF), income panels and samples were made available to researchers (the oldest available is a panel with tax returns from 1982) and a model for simulating Personal Income Tax was also developed (the MOSIR model).

However, all this information from Personal Income Tax returns has, by definition, a personal perspective (the income declared is mainly personal income) and an incomplete scope (it only considers declarers). Although in some products an attempt has been made to build a household income (identifying the spouses, adding information from the work withholdings form for non-declarers), due to the nature of the tax, this approach, with tax return data, is limited.