Tax revenues for the year 2023

The 2023 Annual Tax Collection Report was published on Thursday, April 25.

The main data on tax collection have been known since the end of March, when the Monthly Report for December was published, but the Annual Tax Collection Report analyses the evolution of income in more detail and offers data with a higher level of disaggregation.

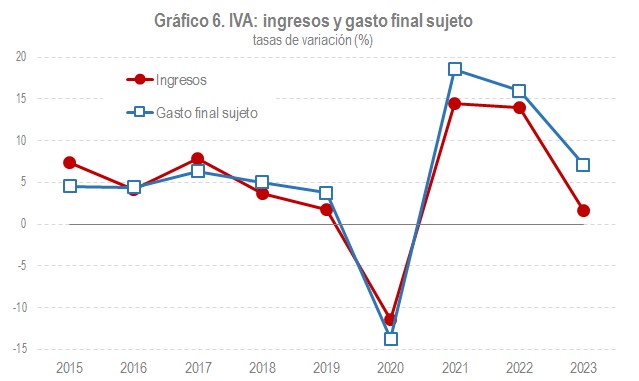

In 2023, tax revenues rose to 271.935 billion euros, which represented an increase of 6.4% compared to the previous year. It should be remembered that in previous years growth exceeded 15% in 2021 and 14% in 2022, but both years were atypical, 2021 because it was the year after the lockdown and 2022 because of the comparison with a period that had not yet fully returned to normality and because of the effect of the inflationary rebound.

As can be seen in Chart 1, income grew due to the increase in bases, although they were limited by tax reductions in personal income tax and VAT. Main tax bases went up by 7.6%. Incomes in particular increased (10.6%), with significant increases in all areas, but especially in corporate profits. Expenditure, on the other hand, grew more moderately (3.6%) due, above all, to the fall in energy prices that reduced the value of consumption subject to special taxes and despite the fact that expenditure subject to VAT rose above 7%. This development occurred in a context of progressive slowdown in activity, although with high growth in nominal variables. An analysis of the behaviour of the main fiscal indicators was carried out in the February newsletter. In Chart 1, income and bases are accompanied by the nominal domestic demand of National Accounting, which is the accounting magnitude most closely related to tax variables by including imports (among them, tourist spending). In 2023, domestic demand grew, in nominal terms, by 6%.

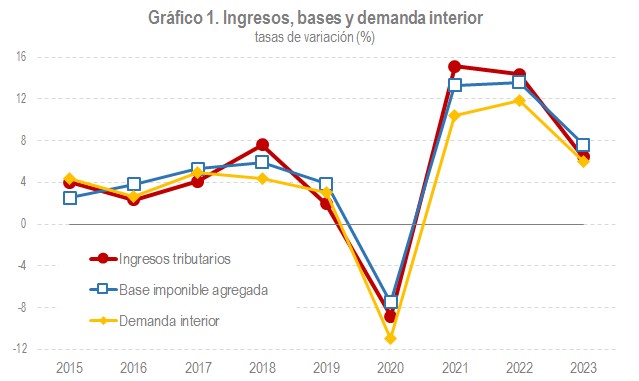

After three years of intense growth, tax revenues in 2023 were almost 30% higher than in 2019, the year before the crisis caused by Covid. And the same can be said of the bases.

When looking for explanations for this growth in bases and income, there has been speculation that the inflationary process that began in mid-2021 may explain a large part of this expansion. However, as already noted at the time (see Annual Tax Collection Report for 2021 and 2022 ), prices were not the main reason for the increase. Firstly, because, despite the strong impact on certain products, overall prices between 2019 and 2023 grew half as much as revenues and bases. And secondly, because the regulatory changes that had the greatest impact in recent years were aimed at offsetting these price increases, so it is not appropriate to simply use the usual price indicators to measure their effect on revenue. Among these measures, we should highlight the reduction in the VAT rate applicable to electricity, gas and basic foods, the total or partial elimination of taxes related to electrical consumption (Tax on the Value of Electrical Energy Production or the Special Tax on Electricity), the increase in the reduction for income from work that lowered the rate for the lowest incomes, and the modification of personal minimums, rates and deductions in the regional section of personal income tax.

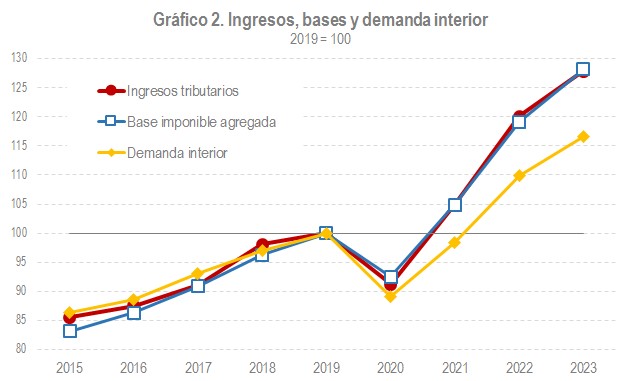

As a result of the uneven evolution of income and expenditure and the negative impact of regulatory changes, the growth in revenue from direct taxes was higher than that of revenue from indirect taxes. The former grew by 10.1%, while income linked to spending (mainly VAT and Special Taxes) increased by only 1.7%.

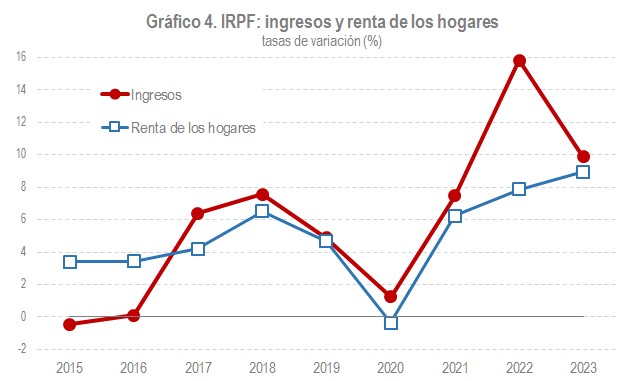

Analyzing the three main figures in more detail (personal income tax, corporate tax and VAT), personal income tax income grew by 9.9%, with an increase in household income of 9%. The main causes of the growth were the increase in employment, wage and pension increases, and the increase in the effective rate associated with these increases, which led to a considerable increase in withholdings on employment income. Although its weight in the tax is lower than that of the previous withholdings, there were also significant increases in withholdings on income from movable capital and in the fractional payments of personal companies.

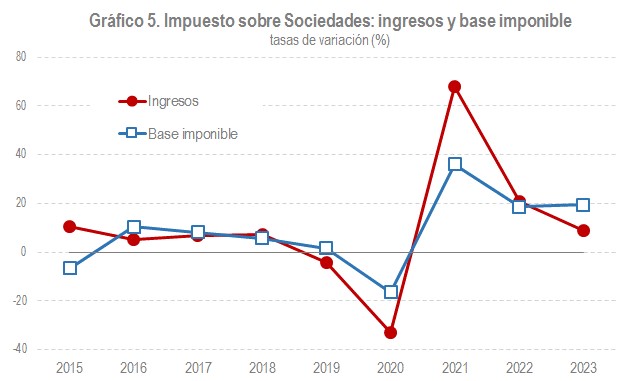

In the case of corporate tax, revenue grew by 9%, while corporate profits increased by over 15%, which was reflected in an increase in the fractional payments, the main component of this income, of the same order. The positive share of the annual declaration, corresponding to the 2022 settlement, also experienced a notable growth, exceeding 12%. Despite these two elements, total revenue grew by only 9% as a result of the high amount of refunds in 2023, which is explained, in turn, by two reasons: the existence of a large volume of refund requests from the 2021 tax year (which were paid at the beginning of 2023) and the advance in the schedule for making refunds for the 2022 campaign (returns submitted from the end of July 2023).

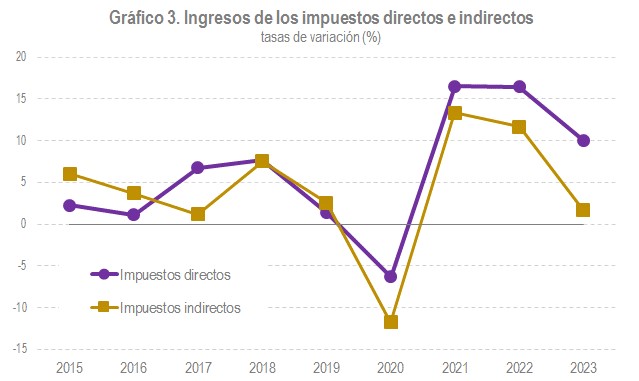

Finally, VAT revenue grew by 1.6%. The subject expenditure was 7.1%. The difference is understandable if we consider the impact of the various regulatory and management changes (lower rates on energy and basic foodstuffs, but also the new regulation on deferrals and the existence of extraordinary refunds). The net effect of these changes was an estimated loss of revenue of more than €3 billion.