Regional personal income tax in 2022

The Personal Income Tax Return Statistics for the year 2022 has recently been published. It should be noted that these statistics have been available in their current format since 2003, but the original publications from previous years (1992-2002) are also available in electronic format, which allows for a 30-year time perspective of the tax.

In fact, although it is a question of statistics on declarants, the publication contains, apart from the total number of declarants, complete statistics for each of the CC. AA. of the Common Tax Regime. This fact is of particular interest in the 2022 statistics, as detailed information is available on the changes that occurred in the declaration of that year in the regional part of the tax in several communities.

Precisely these changes were one of the highlighted elements in the evolution of the tax in 2023, the year of filing the 2022 declaration, as indicated in the various monthly collection reports , as well as in the annual report of that year. In the latter, when analyzing the impact of regulatory and management measures, it was said:

“By figures, the greatest impact was produced in the PIT at a cost of 3.841 billion. Almost everything comes down to two measures. The first is the increase in the reduction for work income, which represented a loss of 1,726 million in withholdings for the year. (…) The second is the group of various measures that the Autonomous Communities approved in the part of the IRPF over which they have jurisdiction and which were aimed, for the most part, at offsetting the effects of inflation. The character of the tax was very different in the different territories, although it basically consisted of raising the family minimums, partially deflating the rate and approving new deductions or expanding existing ones. Every year the Autonomous Communities exercise these powers, but never with such a marked impact as the one that occurred in 2023. The negative impact on net income was valued at 1,677 million.”

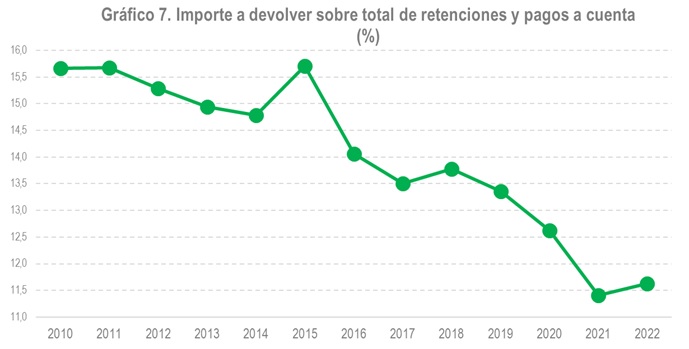

These measures meant that the part of personal income tax corresponding to the autonomous communities was substantially reduced in 2022. Chart 1 shows this decrease.

The graph reflects the changes that have occurred in this participation due to changes in the financing system (the change from 33% to 50% in 2010; In 2009, 50% was also transferred, but the tax was settled with the previous percentage), as well as measures that only affected the Central Administration (deduction of 400 euros in 2008 and 2009 and special tax from 2012 to 2014). Since 2016, there has been a slight decrease in the percentage corresponding to the Autonomous Communities, but it is in 2022 when a more pronounced drop is observed.

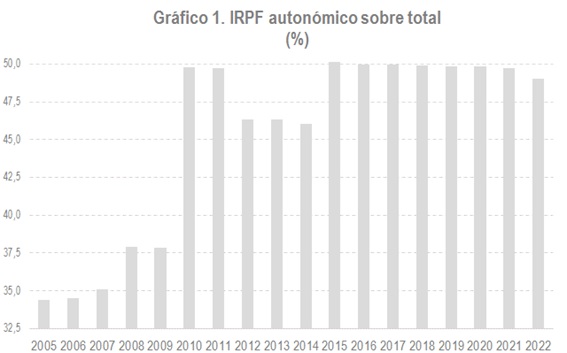

This same effect can be seen through the comparison between the average state rate and the regional rate (Chart 2).

Except for the period 2012-2014, affected by the special state tax, the evolution of both rates had not diverged since the change in the percentage of participation in 2010. In 2022, however, there was a clear divergence.

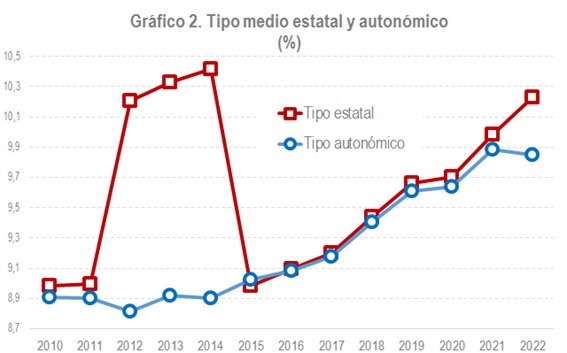

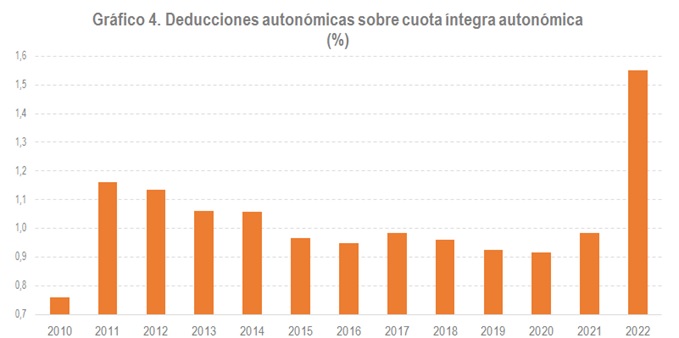

In view of the decisions taken by the Autonomous Communities, the brake on the increase in the average rate originated both through the stabilisation of the full rate thanks to the deflation of the tariff and the increase in the minimums (Chart 3), and through the increase in the weight of the deductions on the full rate (Chart 4).

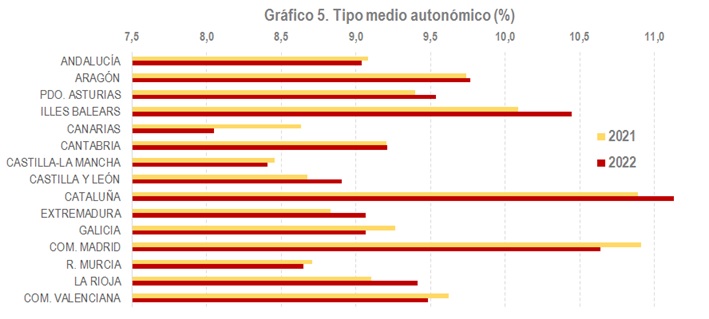

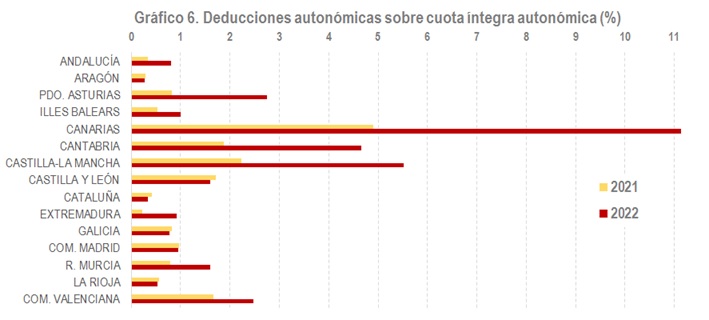

Logically, the situation was not the same in all the autonomous communities, neither in terms of the variation in their average rate (Chart 5) nor in the increases that occurred in their own deductions (Chart 6).

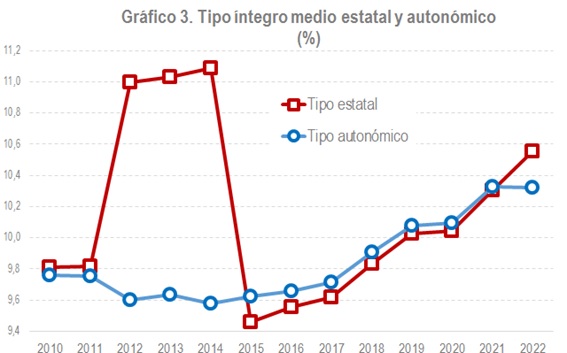

An additional consequence of these measures was the change they brought about in the evolution of the ratio between the amount to be refunded from the result of the declaration and the withholdings and payments on account made by taxpayers. It should be noted that withholdings from work are made using a general rate table for the entire territory of the Common Tax Regime, so that any separation of the autonomous rates from these general rates implies, without considering the effect of the other income, a result in the declaration to be paid or returned. As seen in Chart 7, this ratio followed a downward trend until 2021, only broken in 2015 (due to the early entry into force of the reform) and in 2018. In 2022, largely as a result of the downward reforms of the Autonomous Communities, the ratio rebounded, an indicator of the existence of lower rates in the declaration than those applied to withholdings.