FAQs

Skip information indexAccounts subject to reporting obligation

In the above-mentioned case, Form 290 must include information relating to the specific US person who exercises control over the reporting entity of the US account, in addition to information relating to the reporting entity of the account. However, the declared balance or value of the financial account held by the non-US entity will be the total corresponding to it, without being subject to any type of distribution or prorating.

In the indicated case, the US entity must be identified as the account holder, since it is this specific US person who holds the ownership of the account in accordance with letter ee) of Article 1 of the Agreement.

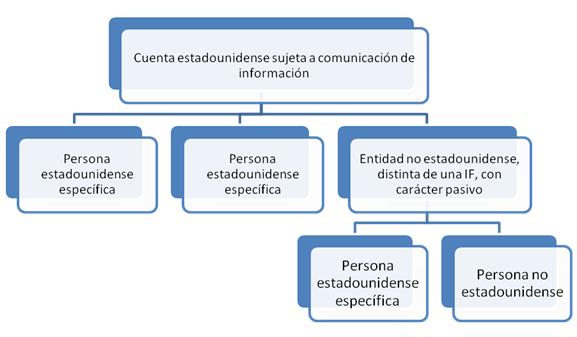

The scheme presented in the question is as follows:

Form 290 shall include information relating to each US account subject to reporting and, based on this element, shall include information relating to the account holders and, where applicable, the persons exercising control over said account holders and who determine that said account must be subject to reporting.

Therefore, in the indicated case, together with the information relating to the account, which will appear with its balance or total value, the two specific US persons and the non-US entity that is not an FI and has a passive character will be identified as the account holders. In addition, with respect to the non-US entity, its nature must be indicated as indicated in item 17 of Annex I of the Order, identifying the specific US person as the person exercising control over said holder.

In relation to this type of group life insurance, the Spanish financial institution required to report information may treat it as a non-reportable account until the date on which the corresponding benefit must be paid to the employee or beneficiary, provided that it receives a certificate from the company that none of the employees covered by the insurance is a US person (not being required to review all the documentation held by the company in order to determine whether the account holder's status is incorrect or unreliable) and the following requirements are met:

-

The policyholder is the company and said insurance covers at least 25 employees.

-

Covered employees have the right to receive the corresponding benefit and to designate beneficiaries in the event of death.

-

The total amount to be paid to the employee or beneficiary does not exceed one million dollars.