Examples of completion

Skip information indexIncome from leasing urban properties (renting a home)

Self-assessment to be paid by a taxpayer who obtains income from the leasing of urban properties located in Spanish territory

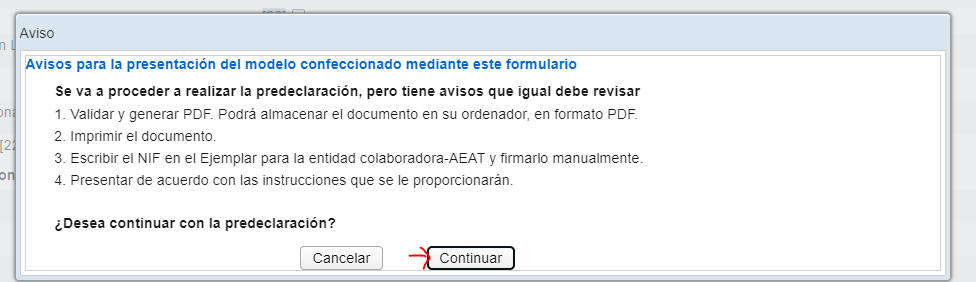

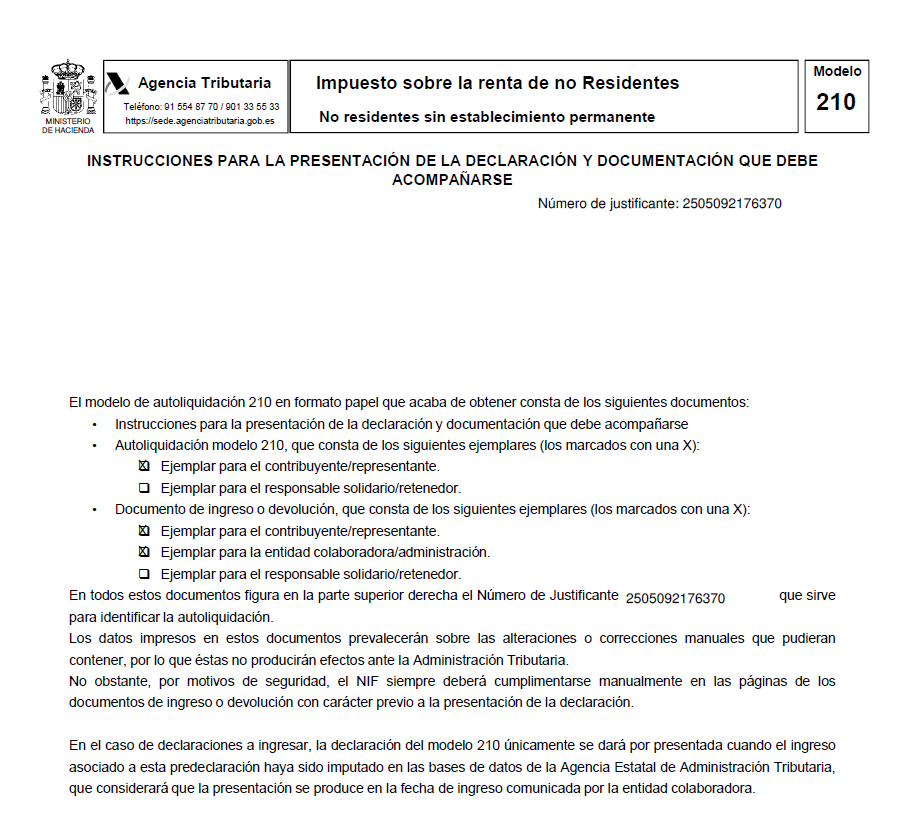

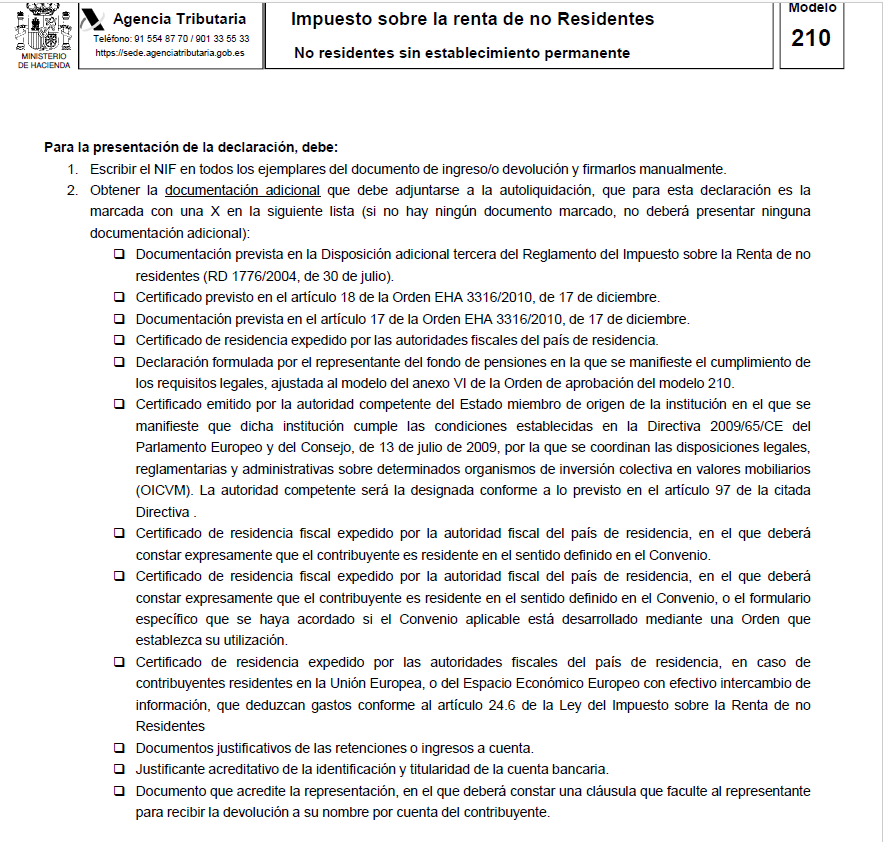

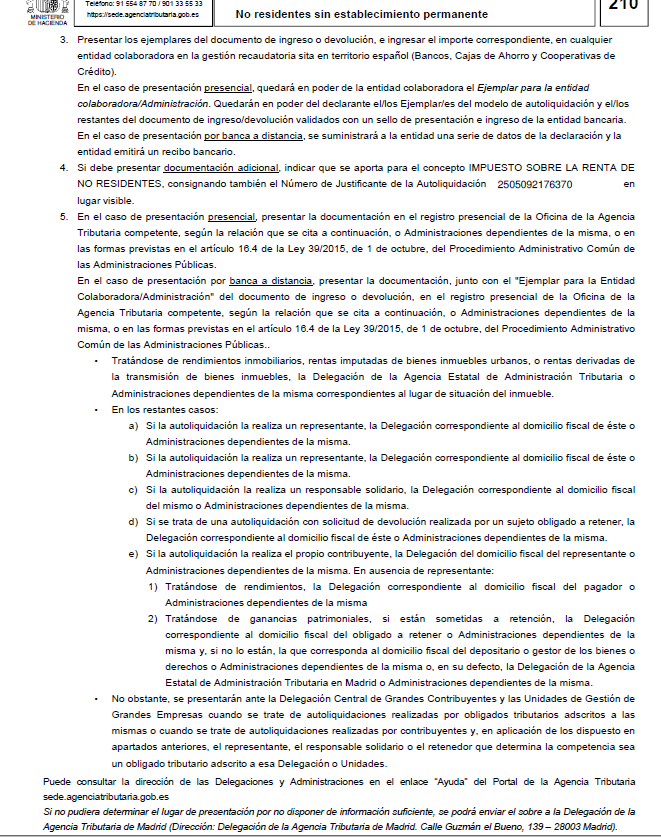

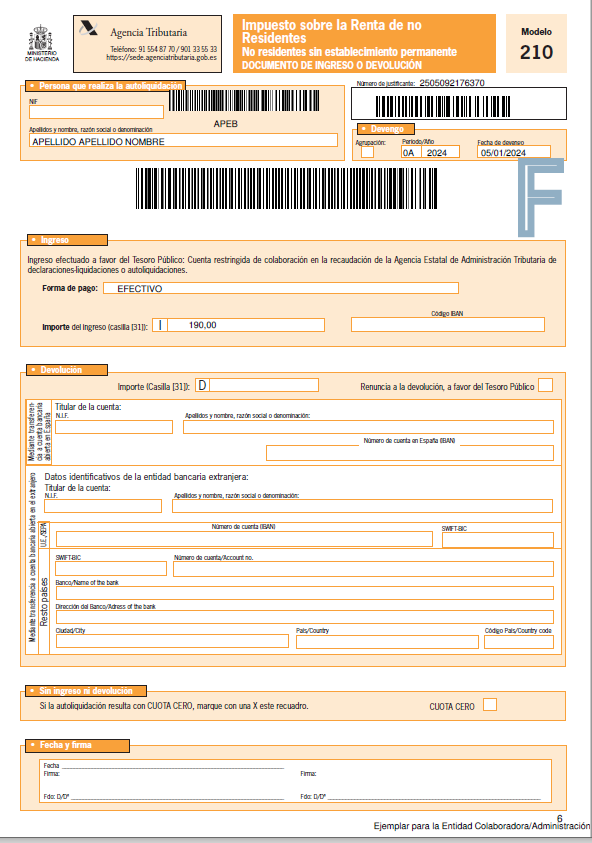

To complete the self-assessment and payment, you must submit the form 210 of the Non-Resident Income Tax (IRNR) declaration.

To do this, you must access the Electronic Office of the Tax Agency and fill out the pre-declaration form. A PDF will be generated with model 210 and some instructions.

For income accrued since 2024, you can choose to group the income annually (the quarterly grouping option disappears) (provided that certain requirements are met) in a single self-assessment or submit a self-assessment for each income accrual.

Income grouping : income obtained by the same taxpayer may be grouped together provided that it originates from the same payer, is subject to the same tax rate, and originates from the same property (declaring Income type: 01). However, in the case of income from leased properties not subject to withholding, rental income from several payers may be grouped together provided that the same tax rate is applicable and they come from the same property (in this case, recording as Income Type: 35 and leaving the data on the form relating to the payer blank).

If you choose to group the tax annually, the deadline for filing and payment will be the first twenty calendar days of January of the year following the year of accrual. For example, if you meet the grouping requirements and choose to group the income accrued annually, the deadline for filing and paying Form 210 will be the first twenty days of January of the following year. If you wish to make a direct debit, the deadline for electronic submission will be from January 1 to 15.

If you choose to declare each income accrual separately, the deadline for filing and paying form 210 will be the first twenty calendar days of the months of April, July, October and January, in relation to income whose accrual date is included in the calendar quarter. For example, if the rent is received between June and September, you will need to submit four Form 210s and pay the corresponding amount. That is, for June, you will need to submit one Form 210 between July 1 and 20, and for the remaining three months, you will need to submit three Form 210s between October 1 and 20. If you wish to pay by direct debit, the deadlines for electronic submission of self-assessments form 210 are as follows: from April 1st to 15th, July, October or January.

Regarding the forms of presentation and payment, please consult the following link: Forms of presentation and payment of model 210 .

Since December 16, 2023 (date of entry into force of Order HFP/1338/2023, of December 13), this self-assessment can only be carried out by the taxpayer.

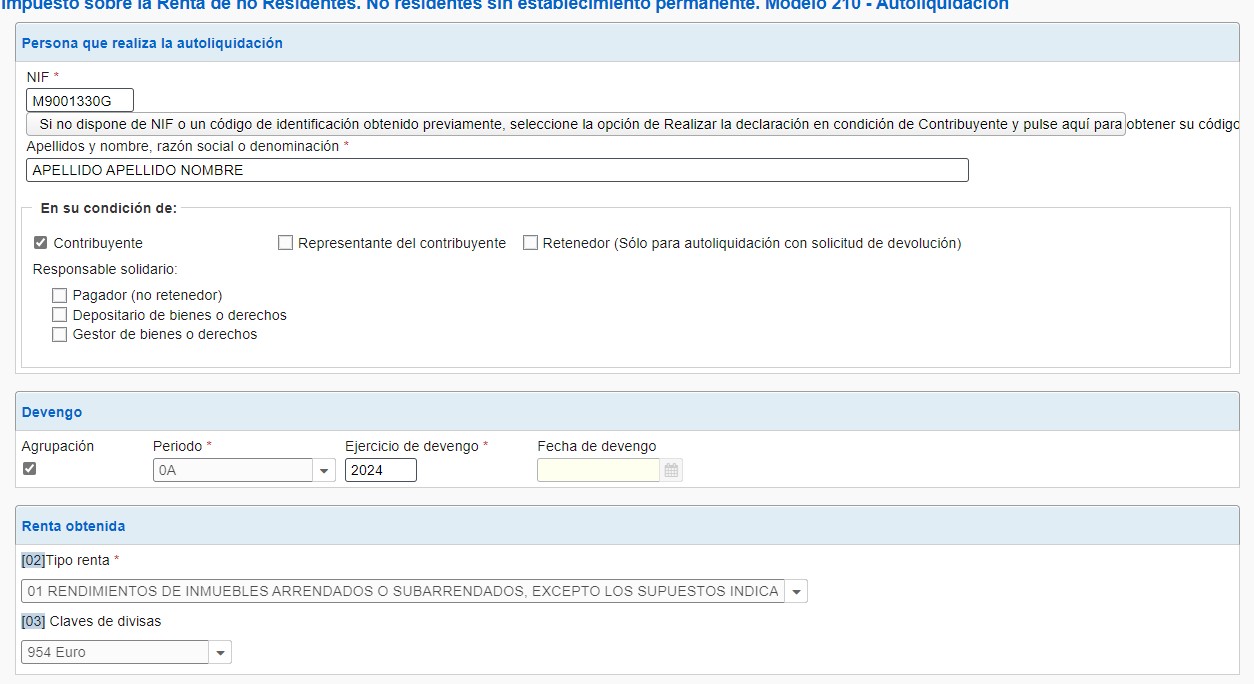

If you do not have a NIF (Tax Identification Number) assigned in Spain, at the beginning of the pre-declaration form, after checking the “S Taxpayer” box, there is the option of requesting an Identification Code at that time, which will be used both to complete this form 210 and for subsequent forms.

Example: Leasing of urban properties. Physical person. Earnings accrued during the year 2024

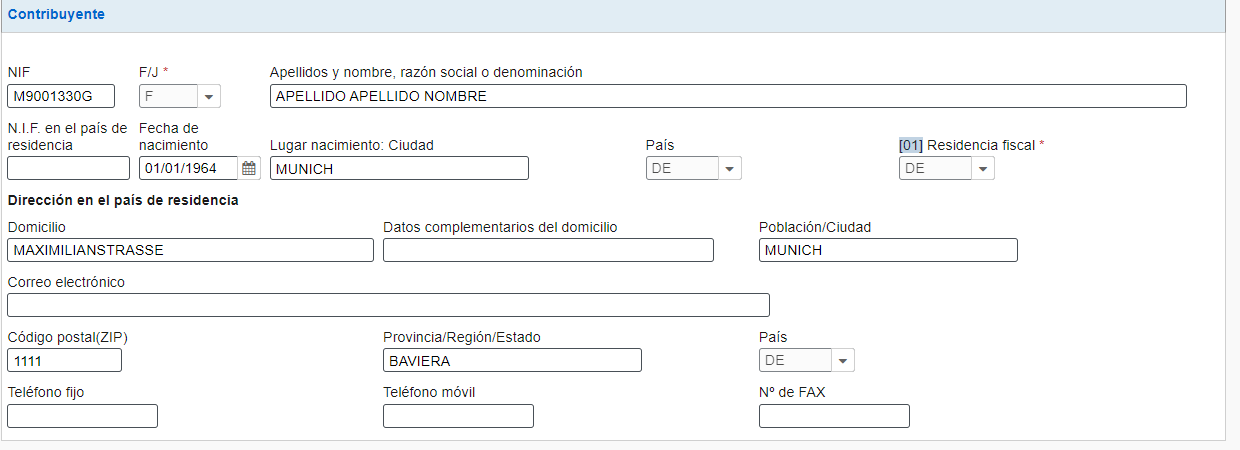

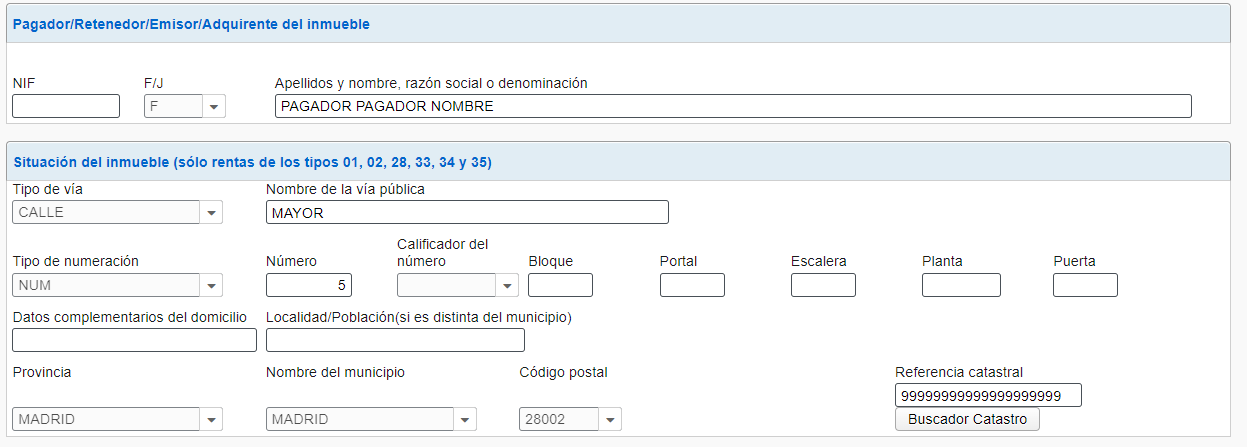

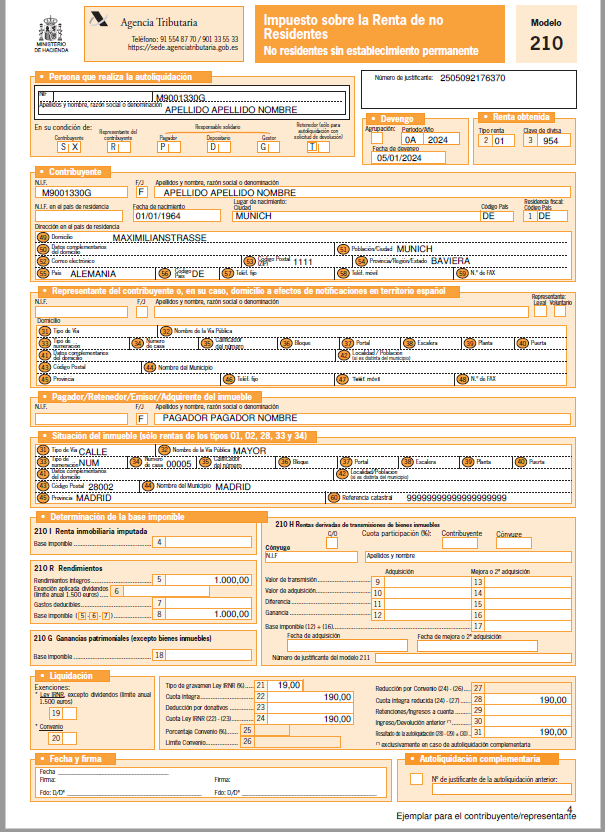

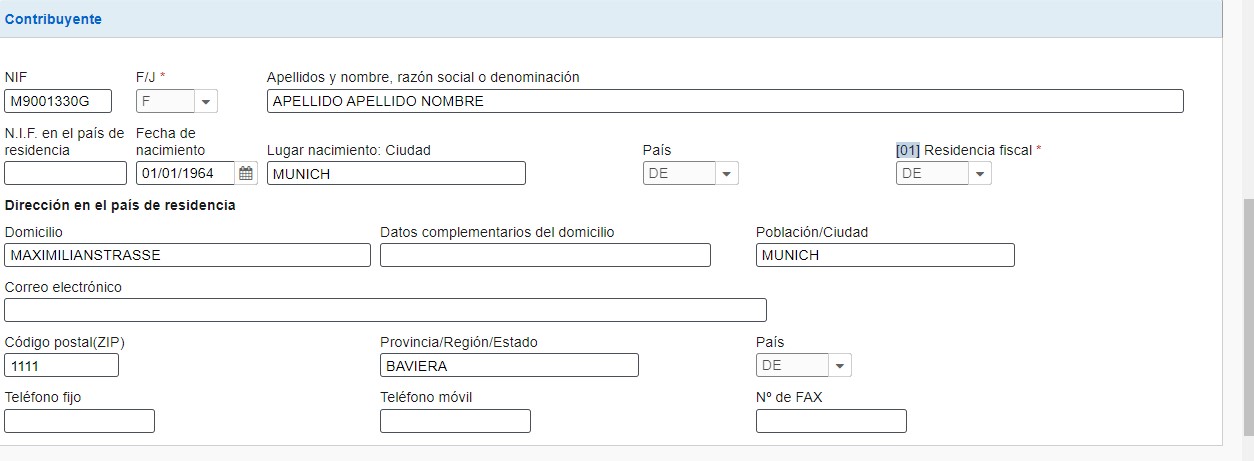

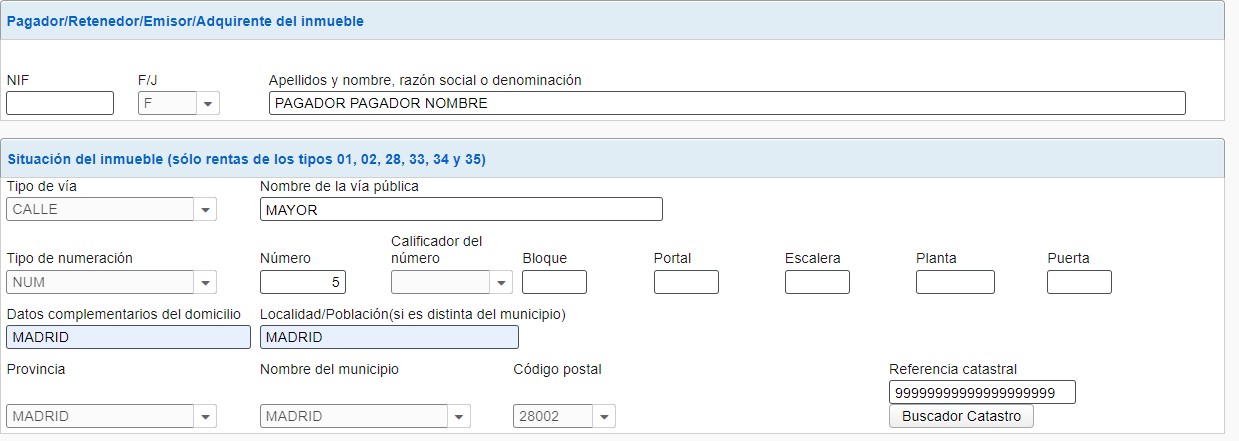

A natural person (NAME LAST NAME LAST NAME), with tax residence in Germany, has obtained monthly in Spain, during the year 2024, 1,000 euros in income derived from the rental of a home, located at Calle Mayor No. 5 in Madrid, accrued on the 5th of each month.

- The taxpayer chooses to declare the income in a grouped manner (annually). The returns correspond to the same payer (Type of income: 01).

In preparing the example, the possible expenses necessary to obtain returns have not been taken into account.(1).

Accrual

Group: X

Period/year: 0A

Accrual exercise: 2024

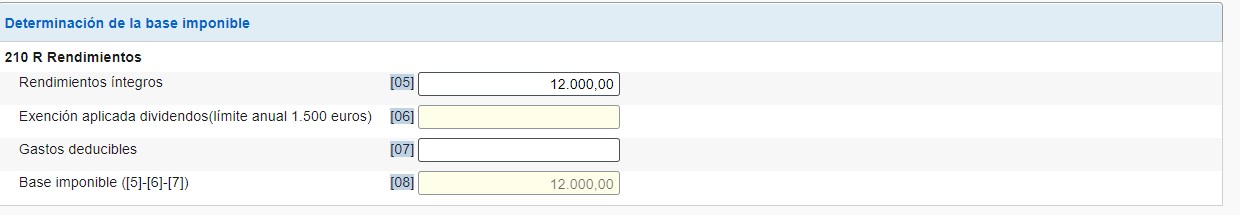

Calculation of the taxable base

210 R Performance

Total returns: 12,000.00 euros (1,000 x 12 months)

Deductible expenses: 0 euros

Taxable base: 12,000.00 = 12,000.00 euros

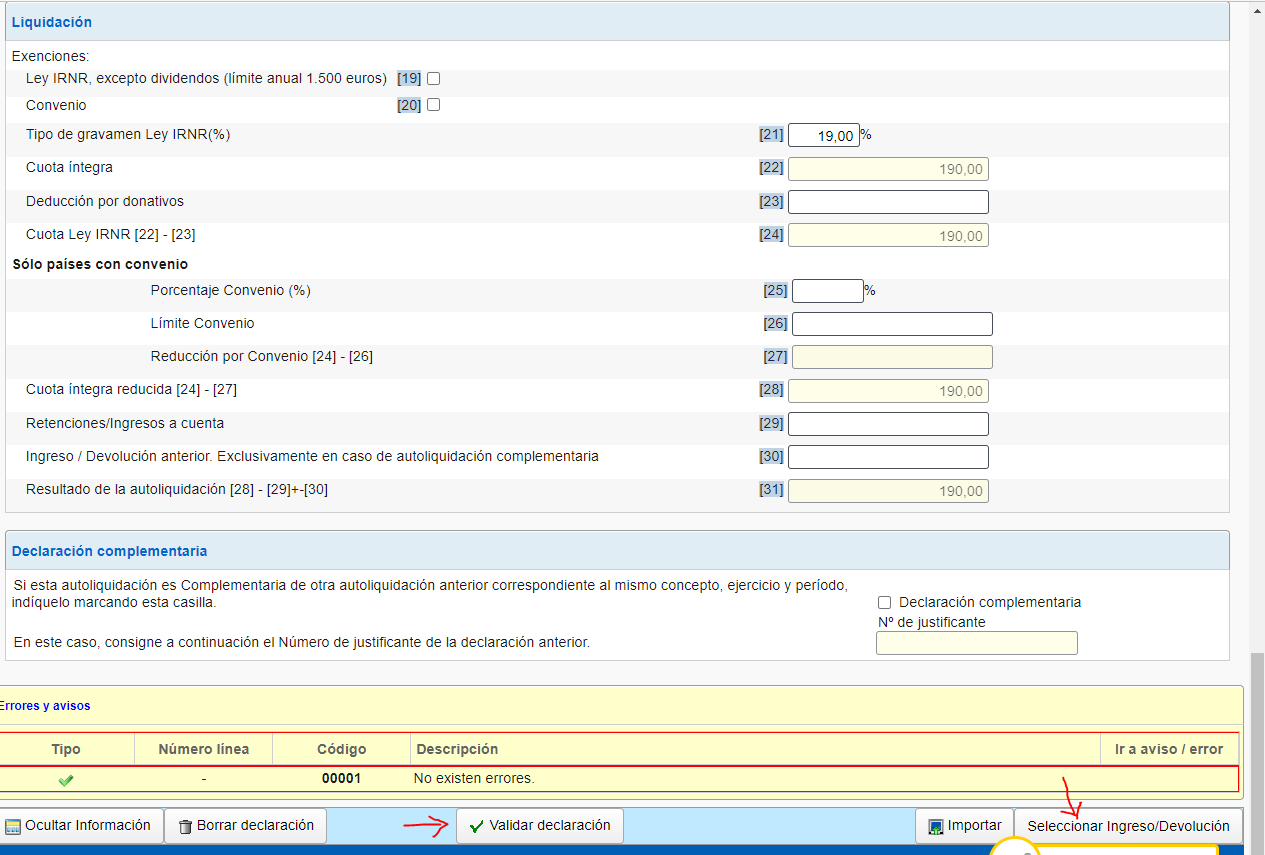

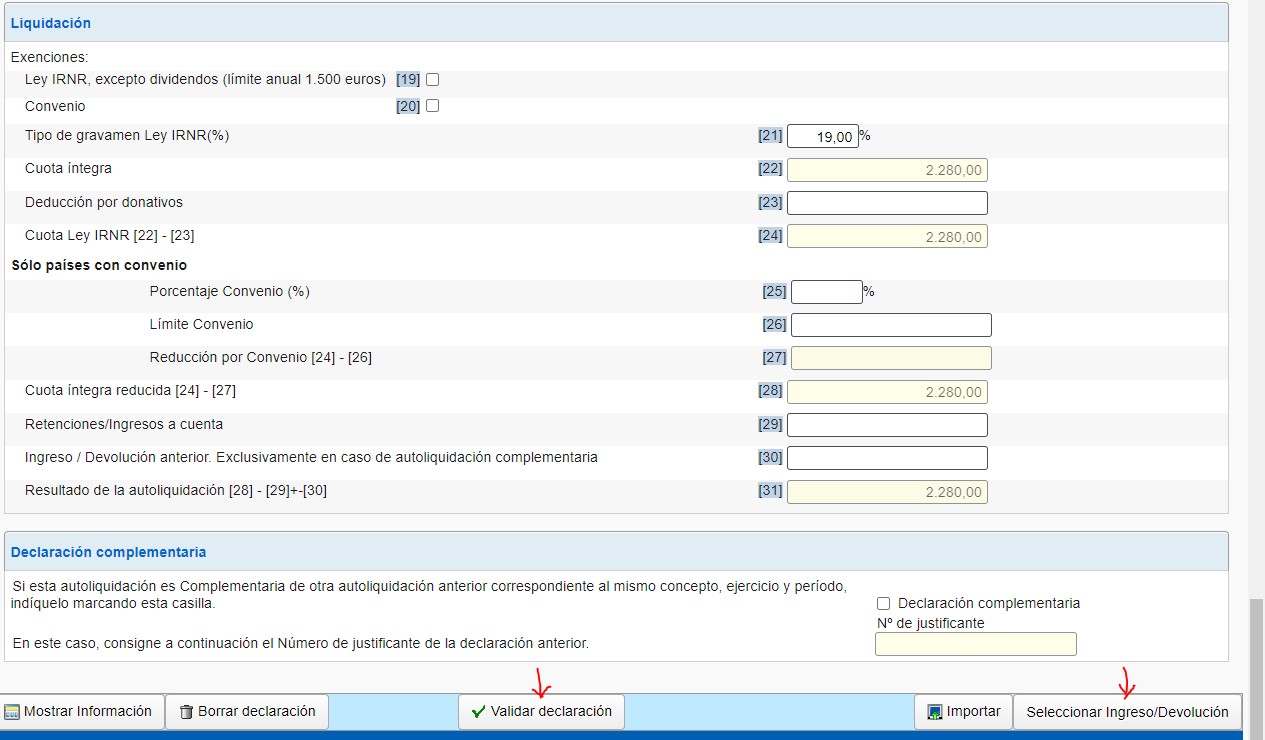

Settlement

Type of tax under the IRNR Law in 2019: 19%(2)

Full share (19.00% of 12,000.00): 2.280,00 euros

IRNR Law Fee: 2.280,00 euros

Reduced full rate: 2.280,00 euros

Result of the self-assessment to be entered: 2.280,00 euros

(1) As a general rule, the taxable base will consist of the full amount, that is, without deducting any expenses.

However, in the case of taxpayers resident in another Member State of the European Union and in a State of the European Economic Area in which there is an effective exchange of information (which means adding Iceland, Norway and Liechtenstein), in order to determine the tax base, in the case of taxpayers who are natural persons, the expenses provided for in the Personal Income Tax Law may be deducted, provided that the taxpayer proves that they are directly related to the income obtained in Spain and that they have a direct and inseparable economic link with the activity carried out in Spain.(Back)

When deducting expenses, a certificate of tax residence in the relevant State issued by the tax authorities of that State must be attached to the tax return.

(2) Tax rate applicable to 2024 accruals for taxpayers from the EU, Iceland, Norway and Liechtenstein: 19%.

Rest of taxpayers: 24%.(Back)

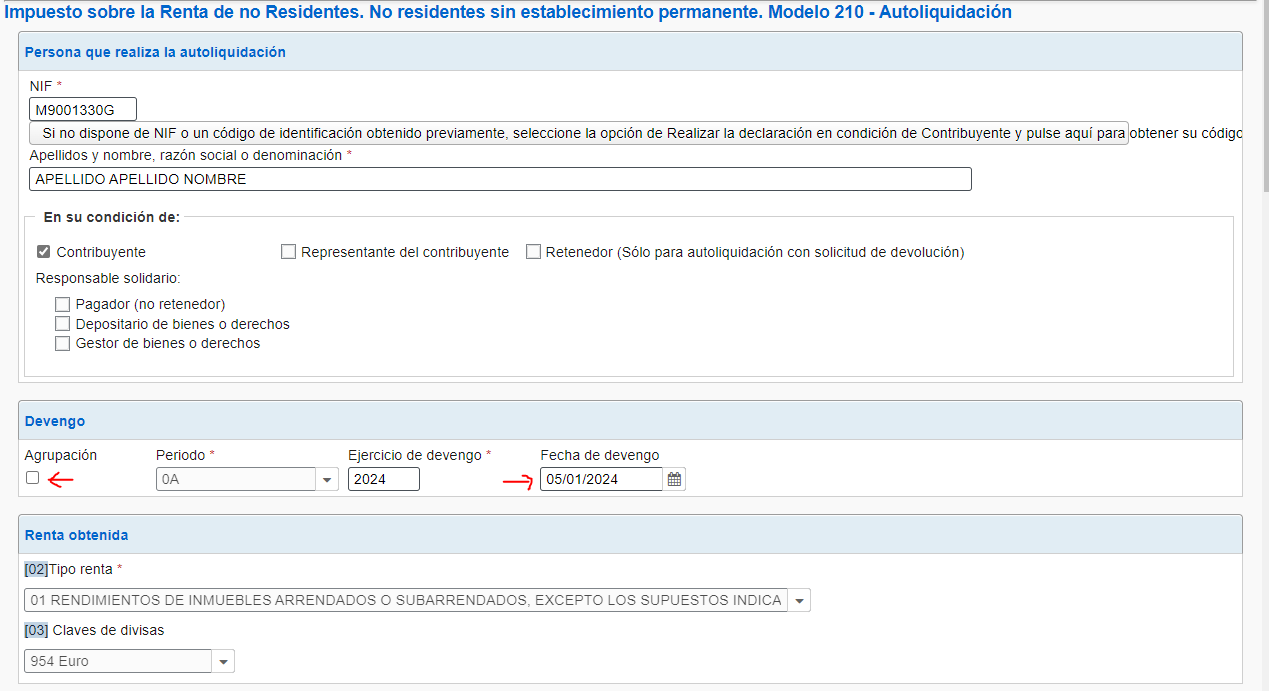

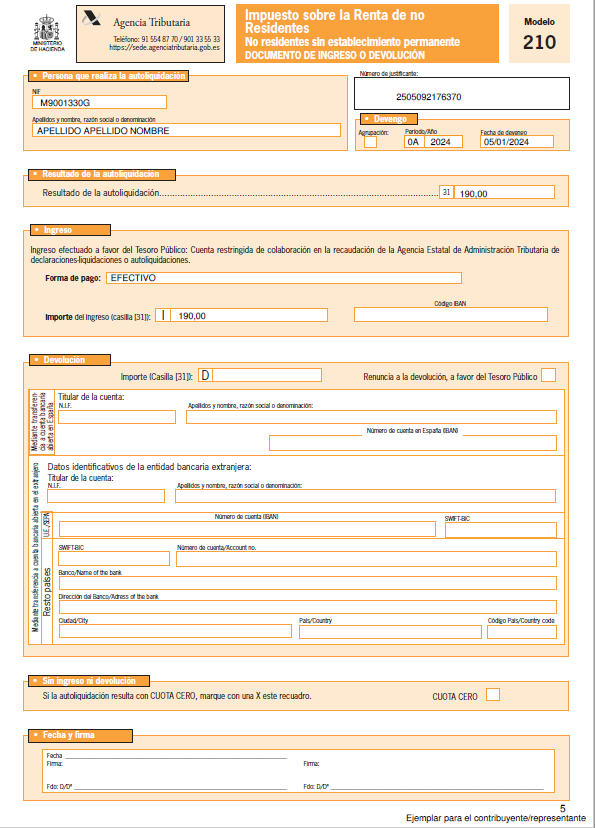

- The taxpayer chooses to file a separate declaration for each income accrual. In this case, you must submit 12 self-assessments (one self-assessment for each income accrual).

Self-assessment for the month of January:

Accrual

Group: unfilled

Accrual date: 05/01/2024

Period/year: 0A

Accrual exercise: 2024

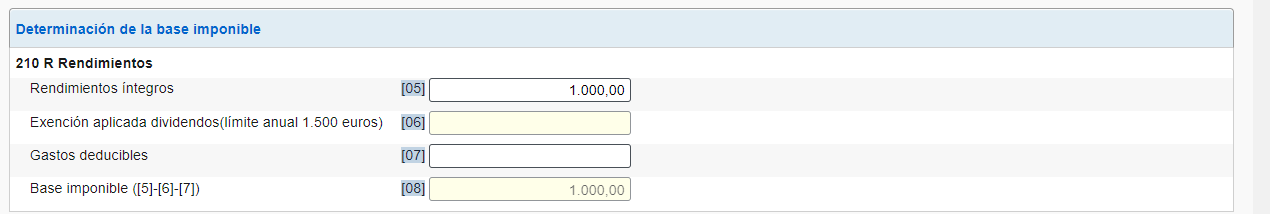

Calculation of the taxable base

210 R Performance

Total returns: 1,000.00 euros

Deductible expenses: 0 euros

Taxable base: 1,000.00 = 1,000.00 euros

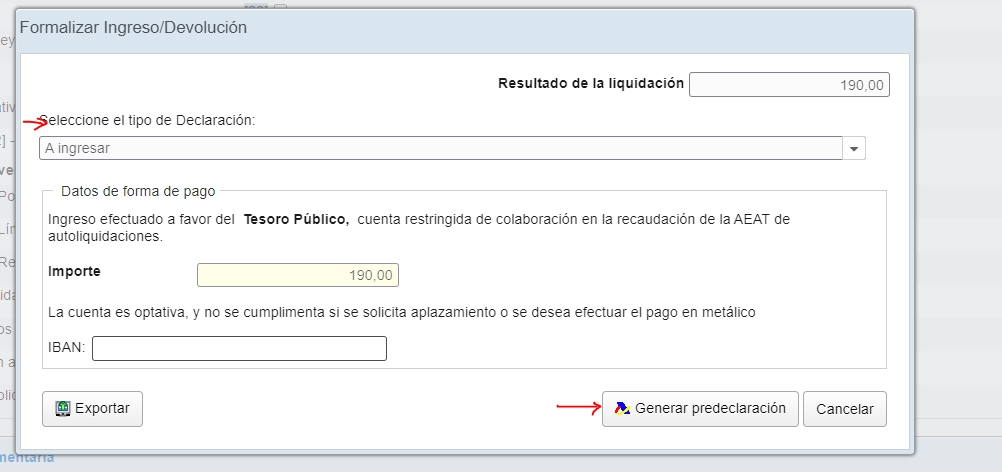

Settlement

Type of tax under the IRNR Law: 19%

Full share (19.00% of 1,000.00): 190,00 euros

IRNR Law Fee: 190,00 euros

Reduced full rate: 190,00 euros

Result of the self-assessment to be entered: 190,00 euros