Consultation and modification of informative tax returns. Companies and Professionals. Exercises prior to 2019

Skip information indexCancellation due to replacement

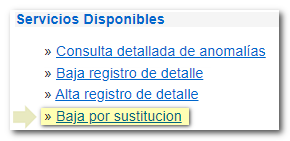

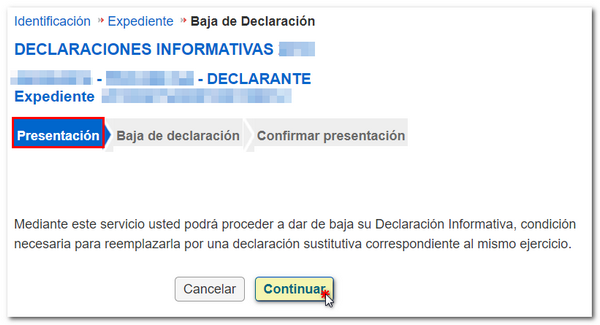

Starting with the 2018 tax returns, a new service is offered for the cancellation of tax returns by substitution, which is the necessary prior step for the presentation of substitute tax returns through TGVI online. In this way, all records of a declaration will be immediately deleted and will then be replaced by a new substitute declaration for the same fiscal year.

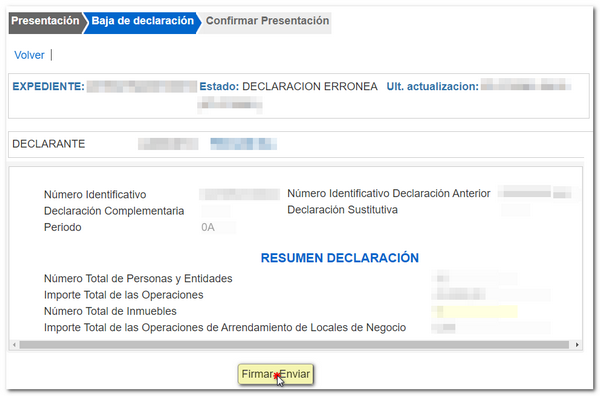

Check the data and click "Sign and Send". As with all other submissions, check the "I agree" box and click "Sign and Send" again.

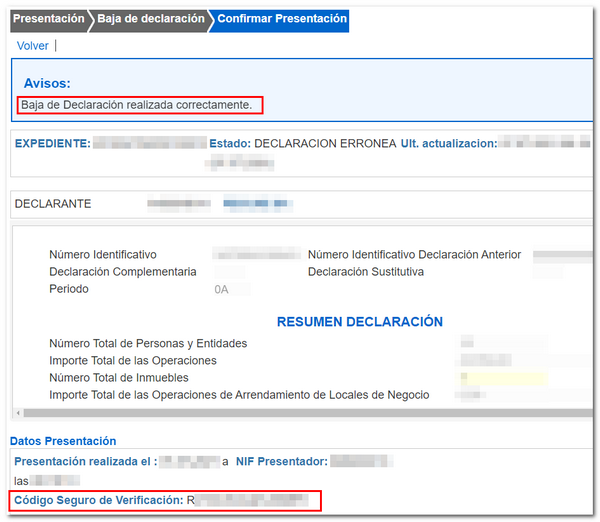

As confirmation of the cancellation, a notice and the Secure Verification Code ( CSV ) associated with the procedure are provided.