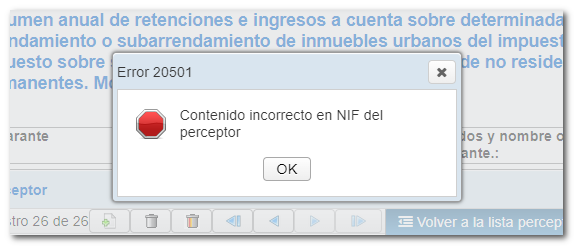

Error: Non-identified recipient

If when entering the data of a recipient or declared person the message "Error: "Unidentified recipient" means that it is not possible to send the registration data in this way, since it does not match the data in the Tax Agency's census.

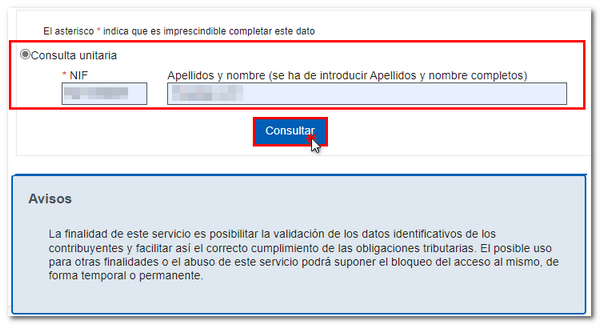

To check if a NIF appears in the AEAT census, use the online service "Checking a NIF of third parties for census purposes" . You have direct access to this help from the related links.

You can also find this service from the Electronic Office in the "Census, NIF and tax address" block of the "Information and procedures" section. In the "Highlighted procedures" box, click on "All procedures" to access the rest of the options, and click on "Verification of a NIF of third parties for census purposes" .

Access is available by identifying yourself with a certificate/ electronic ID or with Cl@ve .

Once in the form, go to the "Unit consultation" section and indicate the NIF and the full surname and name in that order. Click on "Check".

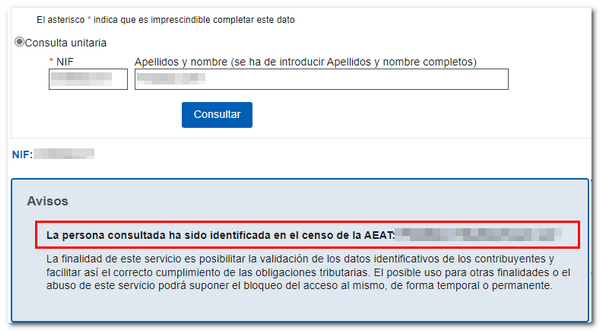

In the event that the data entered in the surname field is not entirely correct but the minimum percentage of matches is exceeded, the system will return the following message: "The person consulted has not been identified with the name provided, but there is similarity with the name registered in the census of the AEAT " . The complete data that appears in the census will also be displayed.

For the declaration to be accepted, the recipient's data must be indicated in the information declaration as they appear in the census.

If the error message persists, you can change the order of the name, or just part of it. Check if there is a match this way.