Form 030

Skip information indexVerification of a third party Tax Identity number (NIF) for census purposes

The service Checking a NIF of third parties for census purposes It facilitates the verification of taxpayer identification data included in a declaration before its submission. It is included in the procedures of model 030.

You can log in by identifying yourself with Cl@ve Mobile Cl@ve or with certificate or ID card electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

This query can be performed in our database in three ways: query a single NIF , query a list of several NIF or make a query using a CSV file (with a maximum of 10,000 records) of a list of NIF .

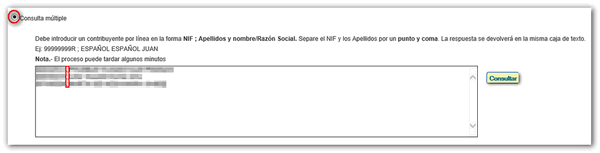

Multiple query

Selecting "Multiple query" and entering a NIF per line following the scheme NIF ;Surname and first name in the case of a natural person or NIF ;Company name in the case of a legal person. You must separate the NIF from the Surnames and Name/Company name by the sign ";" semicolon, then click "Consult".

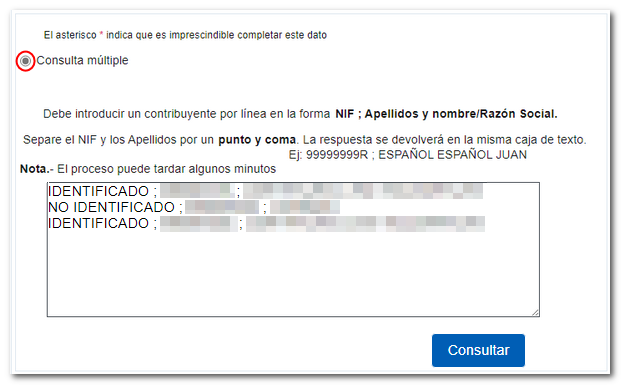

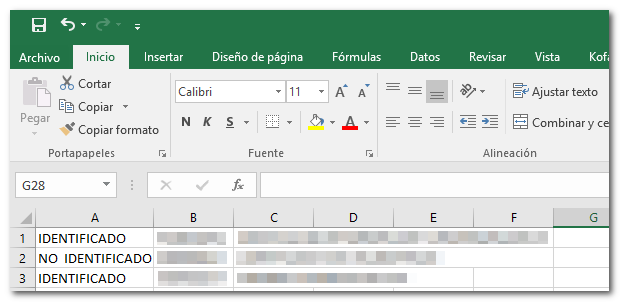

The answer to this query is the same list with these different keys in the case of natural persons:

- IDENTIFIED: If the taxpayer identifies himself with the identification data provided. The surname and first name data associated with NIF are returned.

- UNIDENTIFIED-SIMILAR: If the taxpayer does not identify himself with the identification data provided due to minor differences in the surnames and first name. The surname and first name data associated with NIF are returned.

- UNIDENTIFIED: If the taxpayer does not identify himself with the identification data provided. The data for NIF and the surnames and first names provided are returned.

The answer to this question in the case of legal entities is:

- IDENTIFIED: If the taxpayer identifies himself with the NIF provided. The current NIF and its company name are returned.

- UNIDENTIFIED: If the taxpayer does not identify himself with the NIF provided. The data provided is returned.

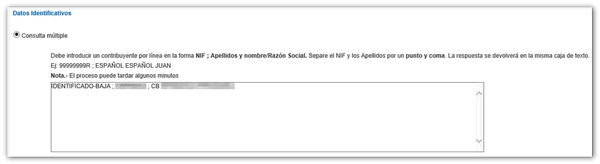

- IDENTIFIED-LOW. If the taxpayer is identified with the NIF provided, and is in low status. The current NIF and its company name are returned.

- IDENTIFIED-REVOKED. If the taxpayer identifies himself with the NIF provided and is in a low status due to revocation of the NIF the current NIF and its company name are returned.

Multiple query importing a file CSV

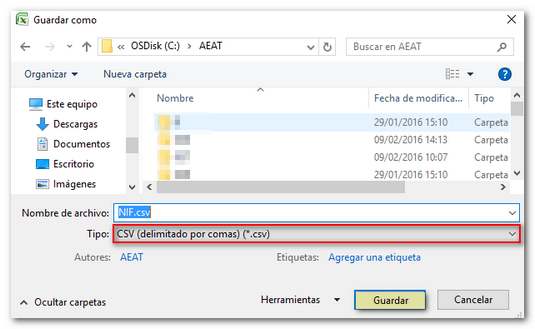

A file will have been previously prepared with the NIF to consult following the scheme NIF; Last name and first name/Company name, with one NIF per line, in .txt format. If the file is created with the Excel program, it must be saved in CSV format (comma delimited). The limit is 10,000 records.

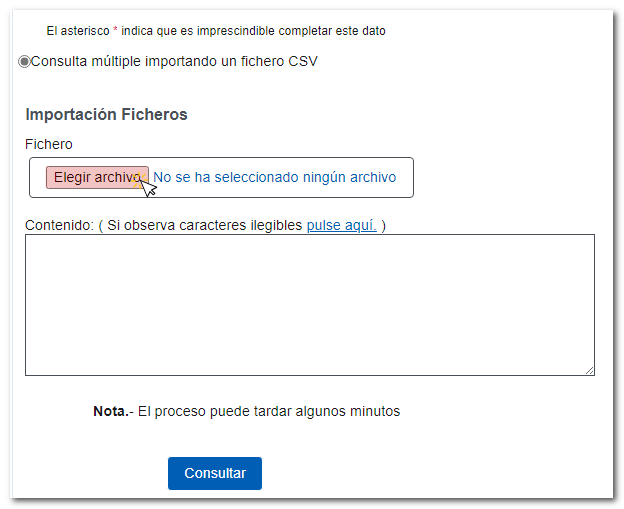

Select "Multiple query importing a file CSV " and press "Choose file".

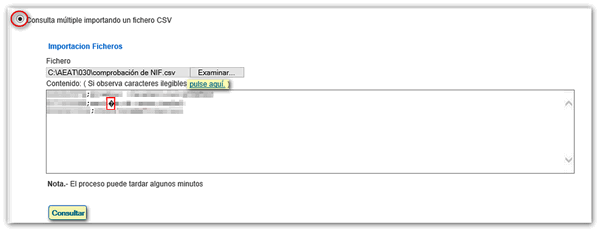

Locate the .csv or .txt file and click "Open".

Once the file has been read, the information contained in the system will appear in the lower window. If illegible characters are found, click on "click here" to correct them. Then press "Continue".

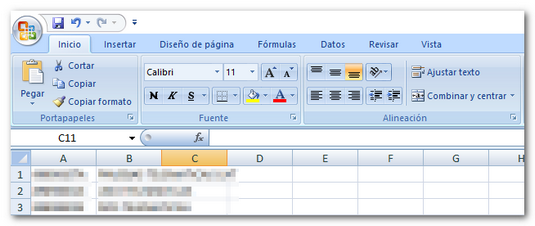

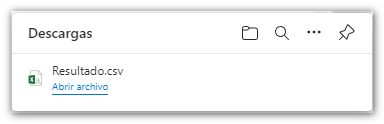

The response is a file with the name "Result" and the extension .csv. The file is saved by default in the "Downloads" folder, although you can save it in another location or open it directly.

The answer to this query is the Excel file with this information in the different columns of the file:

- IDENTIFIED: If the taxpayer identifies himself with the identification data provided. The surname and first name data associated with NIF are returned.

- UNIDENTIFIED- NIF : If the taxpayer does not identify himself with the identification data provided due to minor differences in the surnames and first name. The surname and first name data associated with NIF are returned.

- NO NIF : If the taxpayer does not identify himself with the identification data provided. The data for NIF and the surnames and first names provided are returned.

The answer to this question in the case of legal entities is:

- Tax ID: If the taxpayer identifies himself with the NIF provided. The current NIF and its company name are returned.

- NO NIF : If the taxpayer does not identify himself with the NIF provided. The data provided is returned.

- IDENTIFIED- NIF If the taxpayer is identified with the NIF provided, and is in low status. The current NIF and its company name are returned.

- IDENTIFIED- NIF If the taxpayer identifies himself with the NIF provided and is in a low status due to revocation of the NIF The current NIF and its company name are returned.

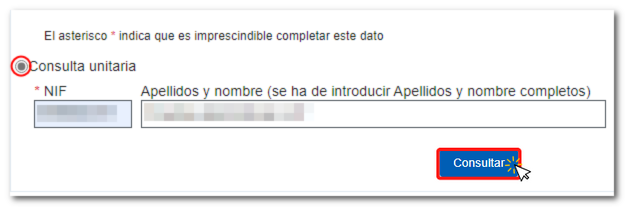

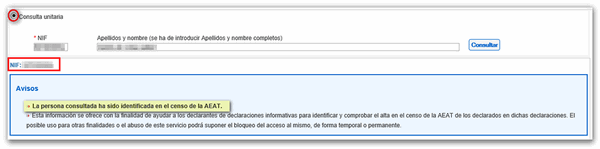

Unitary consultation

Select "Unit query" and enter the NIF that you want to check, the surnames and first name, in that order, if it is a natural person. In the case of legal entities, it is not necessary to enter the company name. Click on "Check".

The NIF and the message confirming the existence of the AEAT in the census will then be displayed.

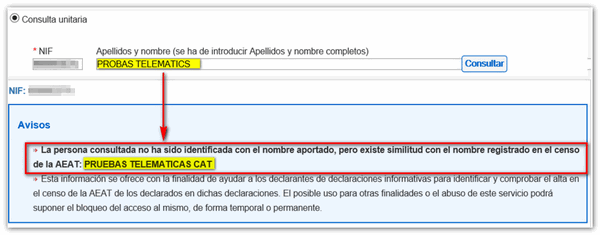

If the data entered in the surname field is not completely correct but the minimum percentage of matches is exceeded, the system will return the message: "The person consulted has not been identified with the name provided, but there is similarity with the name registered in the census of the AEAT " and the complete data of the census .

Please note that in order to carry out procedures through the AEAT website, you must be registered as a taxpayer and, when necessary, provide identification, the data as it appears in the census. If you are not registered and your information is not in the databases, ID cardYou must submit a form 030, "Census declaration of registration in the Census of taxpayers, change of address and/or variation of personal data", in the case of a natural person. Print the form to submit it to your Administration or Delegation, also using the link "Form 030. Extraordinary submission procedure - non-face-to-face" located in the procedures of model 030.

However, if you have an electronic certificate or DNIeIt is possible to register online in the Taxpayer Registry when accessing a procedure that requires an electronic certificate and it is detected that you are not registered.