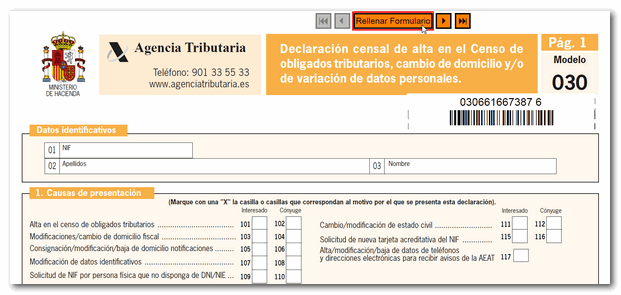

Form 030

Skip information indexPaper submission of model 030

Form 030 must be submitted in person at the Tax Agency Office or Delegation corresponding to the tax domicile of the holder or it must be sent by post to the indicated offices. Also, electronically through the option "Extraordinary procedure for filing Form 030 - not in person".

The model is available in PDF format for printing and submission in paper form via the "Download model" link in the "Information" section of the 030 model procedures.

Individuals who do not carry out business or professional activities can use Form 030 to:

- request registration in the Census of taxpayers,

- change the tax domicile,

- communicate, modify or cancel a notification address other than the tax address,

- request the NIF for a natural person who does not have a DNI / NIE ,

- communicate the modification of identifying data,

- communicate the change of marital status,

- request a new ID card NIF

- Registration, modification and cancellation of telephone and email to receive notifications from the AEAT

However, exceptionally, individuals who carry out business or professional activities or who pay income subject to withholding or payments on account may use form 030, exclusively to communicate a change in marital status, modification of identification data and to request identification labels. In this case, the change of address is made with the census declaration in form 036 or 037.

Instructions for completing Form 030 are published on the website in case there are any doubts about the data that must be included in the declaration.

To view and print the model 030 form in PDF you need to have a compatible PDF viewer installed on your computer or integrated into your internet browser.

Click the "Start Form" button at the top and then "Fill Out Form" to complete it. Once completed, print it. If you need to complete another declaration, click "Start Form" again, located at the top. A new barcode will be generated. Click "Fill Form"