Form 030

Skip information indexConsultation and modification of the tax address and the notification address

To access "Consult and modify the tax address and the address for notifications (My census data)" , from where you can consult and modify your tax and notification address, you must identify yourself with a certificate, DNIe or Cl@ve

You can access by identifying yourself with Cl@ve , certificate or DNI electronic. If you have questions about how to obtain an electronic certificate or how to register in the Cl@ve system, consult the information available in the related content.

Access may be on your own behalf or on behalf of third parties (social collaboration, power of attorney or succession).

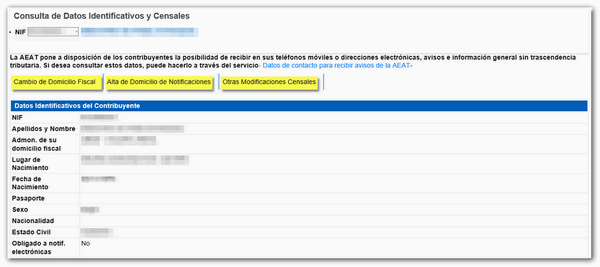

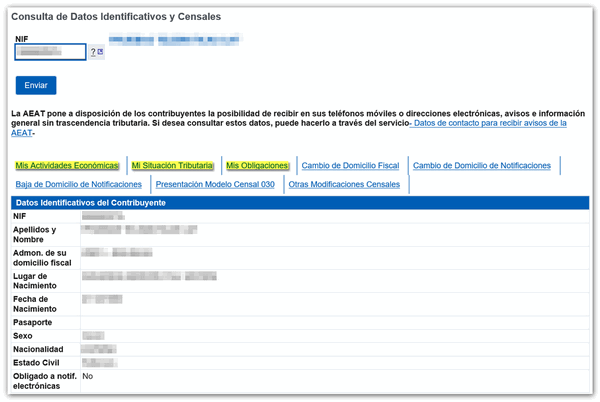

At the top left, the NIF of the query holder is shown.

The taxpayer's identification data and the tax and notification addresses that are available at that time will then be displayed. Depending on the census status of the owner, the system will display a series of query options or others.

In the case of accessing the query of a taxpayer without economic activities, the query and modification options will be the following:

- Change of Tax Address : allows you to modify the tax domicile data that appears in the census.

- Registration of Notification Address : Through this option, you can add an address for notifications. Allows you to add a postal address or a PO Box.

- Other Census Modifications : This option links directly to the procedures of model 036-037.

In the event that the data of a person obliged to the Census of Businessmen, Professionals and Withholders is accessed, the following options, among others, may also be consulted:

- My Economic Activities : the list of activities of the taxpayer is shown.

- My Tax Situation : provides a summary of the tax situation in the regimes of VAT, of the Corporate Tax, of the PIT and the Non-Resident Income Tax.

- My Obligations : shows the list of periodic tax obligations and their status.

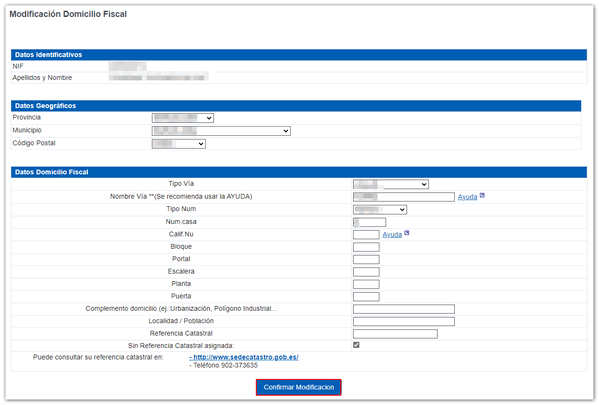

From option "Change of tax address" you can modify the tax address details listed in the census. With this option, the change in the database is immediate, unlike what happens with other procedures.

Once you have checked and modified the necessary data, click "Confirm Modification".

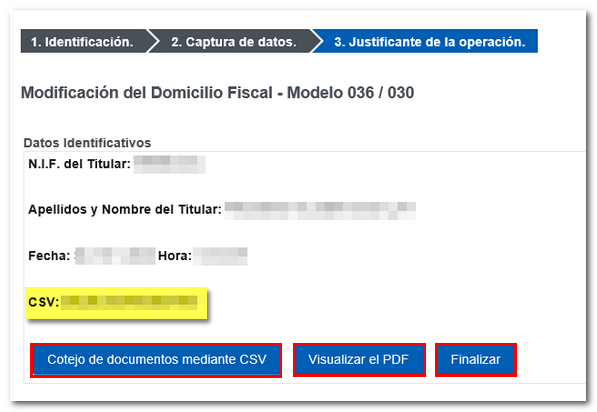

As confirmation of the change, the receipt of the procedure will be displayed with the date and time of submission, the CSV of the submission that will allow the receipt to be retrieved from the Electronic Office and a direct link to view the receipt.

To change the address for notification purposes, the same procedure is followed.

Depending on the taxpayer's status in the census, it will also be possible to modify other census data in addition to the address, by clicking on the "Other census modifications" option, which links directly to the procedures of form 036-037.

If you do not have an electronic certificate, DNIe or Cl@ve you can submit Form 030 using the option "Extraordinary procedure for submitting Form 030 - not in person". In addition, the form can be submitted in person at the Tax Agency office corresponding to the tax domicile at the time of submission or sent by certified mail to the same address.