Form 030

Skip information indexExtraordinary procedure for filing Form 030 online

This special procedure allows you to submit Form 030 for reasons other than applying for NIF (for example, to report a change of residence/address/spouse and marital status. among others), without requiring the appearance of the interested party at the offices of the AEAT and without the need to identify himself at the Headquarters with a certificate/ electronic DNI or Cl@ve .

If the holder has a certificate/ electronic ID or Cl@ve he/she may submit it from the "Modification or submission" link on the procedures page for form 030.

Thus, the presentation of Form 030 will be accepted in the Electronic Registry of the Tax Agency in the procedure created for this purpose: " Model 030. Extraordinary submission procedure - non-face-to-face ", accessible from all the procedures of model 030 located in the blue box on the right margin.

To submit Form 030 for reasons other than the request for NIF , follow these steps:

- Obtaining the completed Form 030 in PDF

- Additional scanned documentation

- Submission of Form 030 in PDF and the additional documentation required in the electronic Registry of the Tax Agency using the procedure " Form 030. Extraordinary submission procedure - non-face-to-face" .

STEP 1.- Obtaining the completed Form 030 in PDF

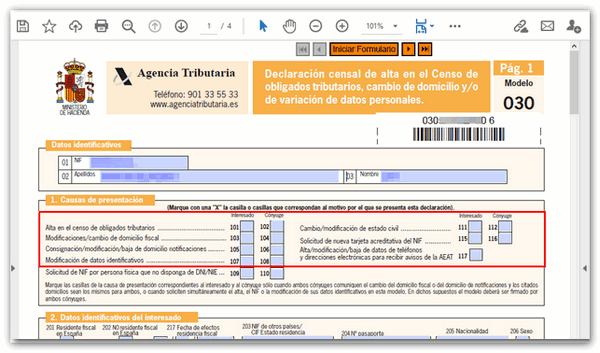

Download form 030 in PDF from the "Related content" block on the right-hand side and, before printing it, fill it in with the necessary data by the interested party or their representative by clicking on "Fill out Form" located at the top. The fields for surnames and names and the following sections of the 030 form will be filled in, which correspond to the reasons for filing:

- Causes of presentation: They will be one or more of the existing ones and the sections containing the data that you want to complete or modify with respect to the data that appear in the census will be completed:

- Identification data of the interested party;

- Identification data of the spouse, if applicable;

- Telephone and email addresses to receive notifications from the AEAT

- Assignment of tax domicile;

- Assignment of address abroad ;

- Assignment of the address for notification purposes (it would always be in Spain and is optional);

- Representative ;

- Civil status;

- Date and signature of the declaration (mandatory, by the owner(s) or their representative).

Once Form 030 has been completed, printed and signed by the owner or his representative, it will be scanned and saved in PDF format for submission via Electronic Registry, following the guidelines established in STEP 3.

For any questions that may arise, you can use the help service for completing the census forms on the Basic Tax Information telephones, (+34) 91 554 87 70 and (+34) 901 335 533.

STEP 2.- Scanned Additional Documentation

You must consult, obtain and, if applicable, scan the documentation that must accompany Form 030 for a natural person before taking the next step.

The supporting documentation will depend on the reason for submission; In the "Census Informant" you can consult the documentation that is necessary to provide in each case and it can be accessed from the "Census, NIF and tax address" section, in the "Census virtual assistance tools and IAE ".

STEP 3.- Submission of Form 030 and the necessary additional documentation in the electronic Registry of the Tax Agency

In the list of all the procedures of model 030, "Highlighted procedures", click on " Model 030. Extraordinary submission procedure - non-face-to-face ".

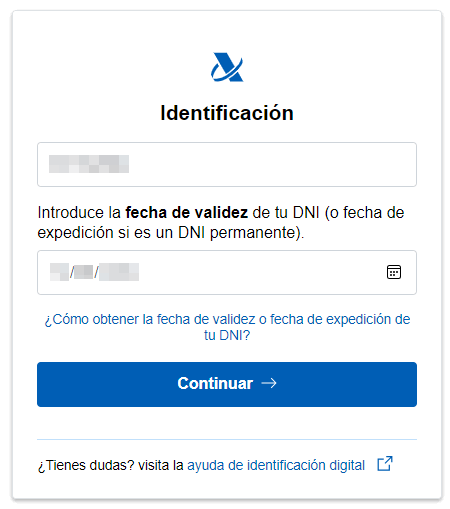

The presenter of the application, a natural person, must have a NIF registered in the Census of Taxpayers and identify himself using his NIF + a piece of information that will be:

- If a DNI is entered - The validity date of the document DNI or the issue date if it is a permanent DNI

- If a NIE is entered - The support number of the document that certifies the NIE

- If a NIF K, L or M is entered - The date of birth that appears in the AEAT database

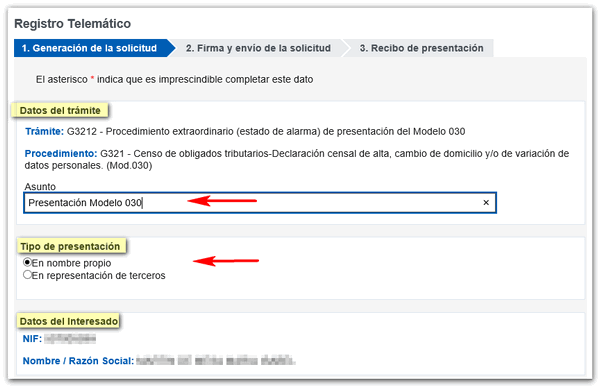

Once identified, in the online registration process, you must complete the "Subject" field with the text: Presentation Model 030. In the type of presentation, select "On your own behalf" or "On behalf of third parties" as appropriate.

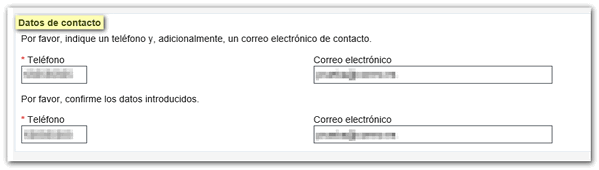

The presenter must then provide, as required, a and, additionally, an email address.

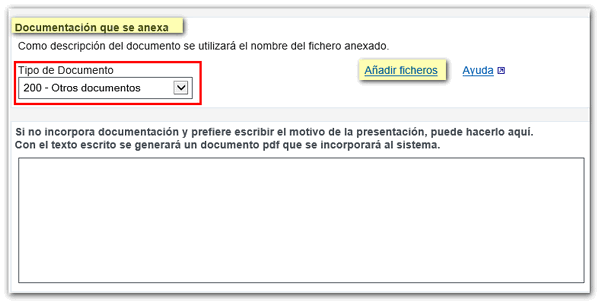

In the "Attached documentation" section, select "200 - Other documents" as the document type and click on the "Add files" link to select the file with the documentation you must submit. In the "Help" link you can check the list of formats accepted for submitting files for this procedure, the maximum size allowed for each file being 64 MB .

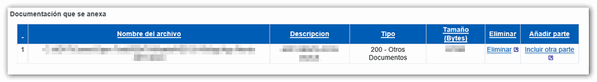

You must incorporate the Model 030 in PDF and the additional documentation identifying the content of each file (for example: Model 030; Tax residence certificate: representation document, among others).

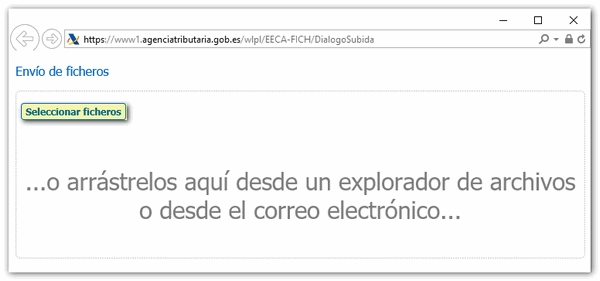

You can select or drag the file. It is preferable that the file name does not have punctuation marks and is saved on the local disk, within the folder " AEAT ".

The added file will appear in the "Attached documentation" section.

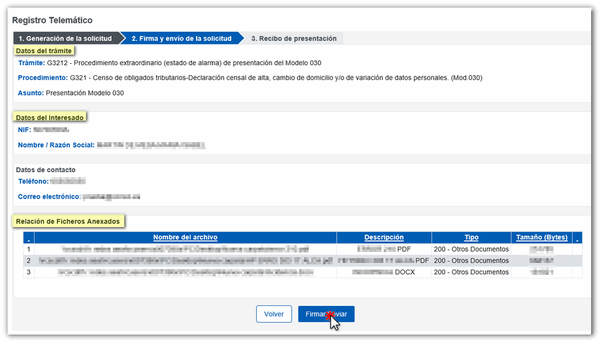

When you finish attaching the files, click "Submit" at the bottom. The data to be sent is then displayed; If you wish to make a change, click "Return" and if you agree, click "Sign Send".

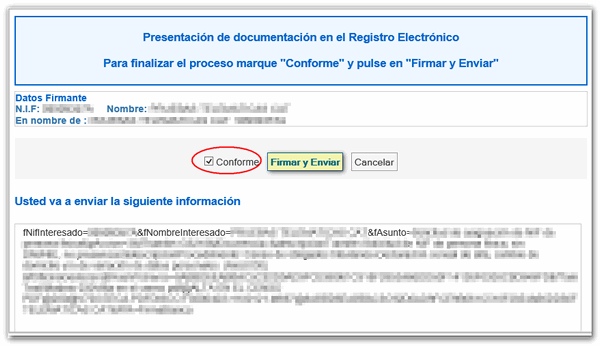

In the pop-up window, check the "I agree" box and click "Sign and Send" to complete the submission process.

Once this procedure has been carried out, an electronic Registration file is generated.

If you have provided your telephone number or email address in the corresponding section of Form 030, you may be sent a notice informing you of the Secure Verification Code of the letter in which you are informed about the result of the processing or the incidents that have arisen.

It should be noted that failure to submit the necessary supporting documentation or submitting it incompletely or inaccurately may result in the application being filed (articles 88 and 89 of the Regulations for the Application of Taxes, approved by Royal Decree 1065/2007, of July 27).

Before proceeding to communicate any new census data, it is recommended that you access the Electronic Office with one of the indicated identification methods ( NIF + data, certificate/ DNI electronic or Cl@ve ) to consult the information previously included in the census in the banner "PERSONAL AREA", "My census data". Once you have consulted the identification, address or representation data that appear in your census data in the Tax Agency database, you can communicate new data or modify previous data, either in the “Consult and Modify My Census Data” options that exist on that same site or by submitting Form 030 through the channels indicated above.