Consult tax returns filed

Depending on the model you wish to consult, you can identify yourself using any of the methods enabled on the website:

- Electronic certificate or DNIe

- Cl@ve

- Income tax reference number (for models 100 and 714)

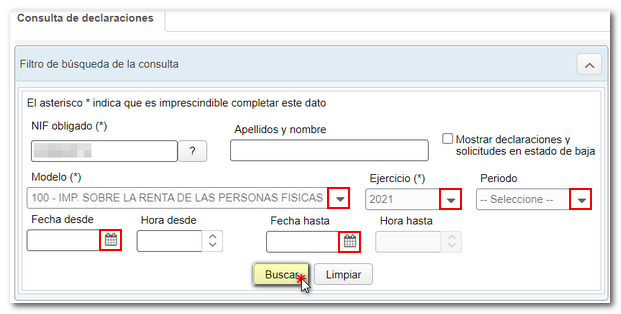

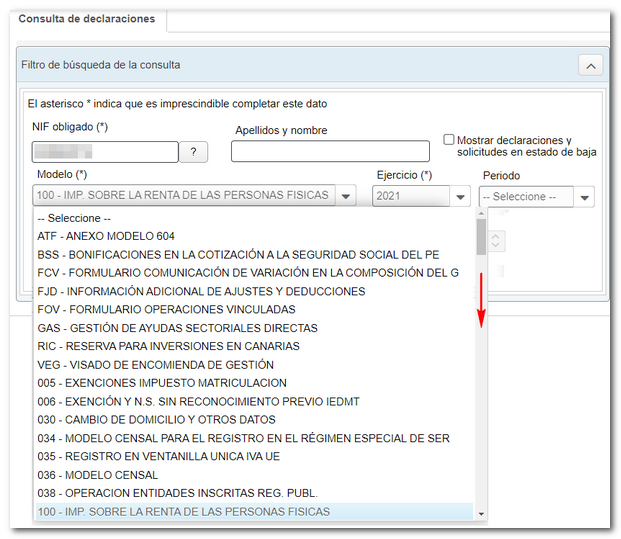

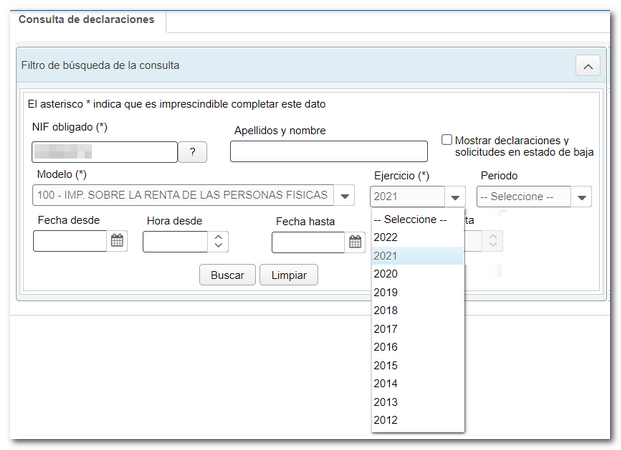

The mandatory data to carry out the query are the NIF of the declarant, the model and the fiscal year, although other additional filters can be added such as the period or range of date and time. The model, fiscal year and period fields have a tab from which you can select the available tax return models, the fiscal years for each one and the period. To set the date you can use the calendar or indicate it in the dd/mm/yyyy format, two digits for the day, two digits for the month and four digits for the year.

Click "Search" to locate files that match your search criteria.

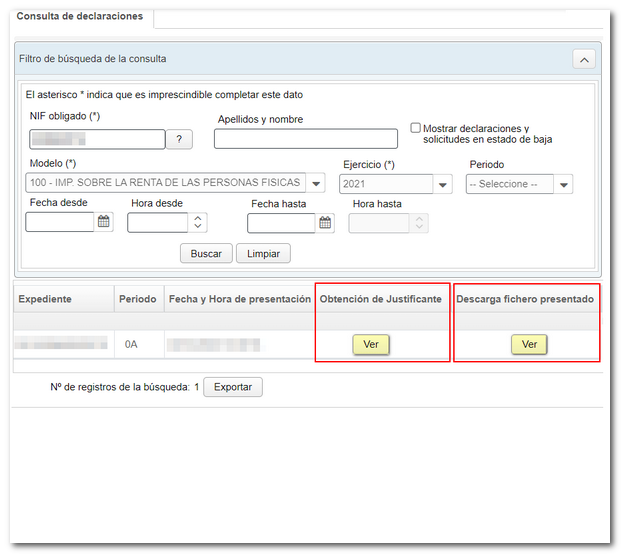

Click “See” in each column to access the file and tax return copy, or to download the file.

From the "Obtaining the Receipt" column, a new window opens to view the document in a PDF embedded in the browser.

As for downloading the submitted file, the browser will display a window for downloading the file TXT containing the declaration. It will have the file number and the date and time of download, although you can change it to another name that you consider appropriate.