How to obtain the reference number for the Income Tax return with box 505 for the 2023 tax year

The service for obtaining the reference of the Income Tax file allows you to obtain the reference immediately; With it you can manage and streamline all Income Tax services, prepare the declaration using the Renta WEB service and submit it online, regardless of the result of the declaration.

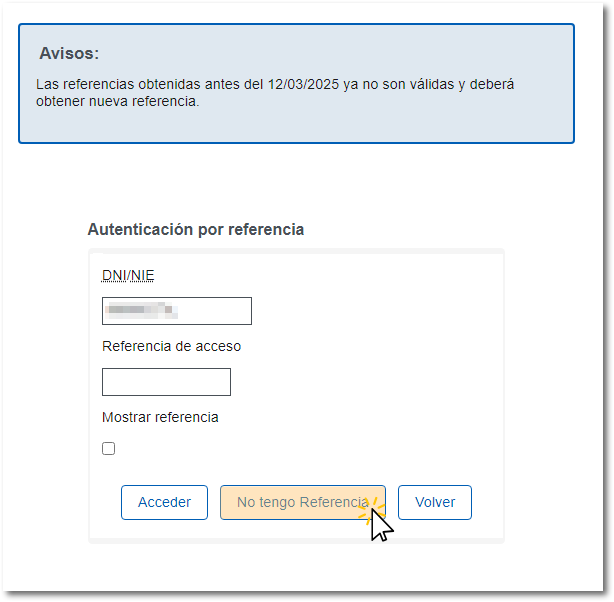

From March 2025, the references obtained during the 2023 financial year campaign will longer be effective. If you want to continue using a reference to access Income Tax services, you will need to obtain a new reference with the amount from box 505 corresponding to the 2023 Income Tax return, which will be valid for Income Tax services in 2024.

You can obtain a valid reference by accessing any Headquarters service that allows identification with reference, if you choose that mode of access. Also from the link "Get your reference number" in the "Procedures" section of this help.

Below, we show you how to obtain the reference with box 505 of Income 2023 The references obtained with the amount in box 505 for the 2022 financial year are no longer valid.

Remember that the reference is shown directly on the screen or in the APP.

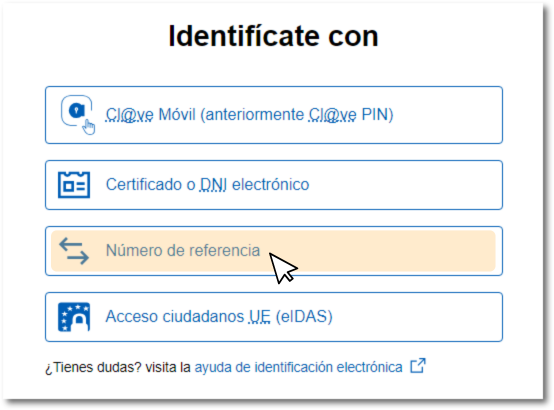

If you access from a Renta service and choose to identify yourself with Reference number , in the first window select the type of identification you wish to use, in this case click on "Reference number".

Afterwards, a window will appear asking you to enter your DNI or NIE and your access reference for the 2024 academic year. If you don't have one, click "I don't have a reference" to obtain a new one.

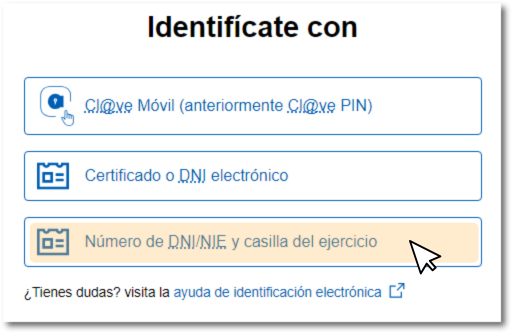

If you wish to obtain the reference from the "Get your reference number" option in the "Procedures" section, and then enter the Income services, you will find the following window, click on " DNI / NIE number and fiscal year box".

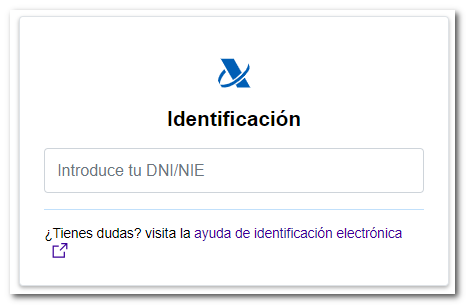

Whether you access from an Income service, by clicking the "I do not have a Reference" button or by entering the "Get your reference number" option, you will obtain the identification window so that you can enter your DNI or NIE .

-

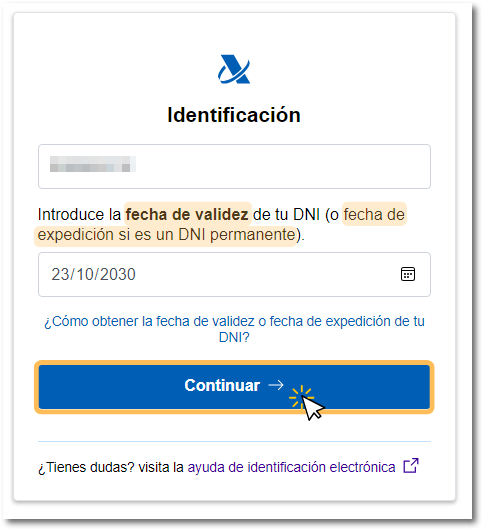

If you indicate a NIF , you will have to write the validity date of the DNI in the indicated format, dd -mm-yyyy, day, month and year separated by hyphens (if you do not enter separation, the application will add the hyphens automatically). You can also use the available calendar to select the date. If the DNI is permanent (01/01/9999), the date that will be requested is the date the document was issued. You can consult the help link "How to obtain the validity date or issue date of your DNI ?" which explains how to locate this information on the DNI .

-

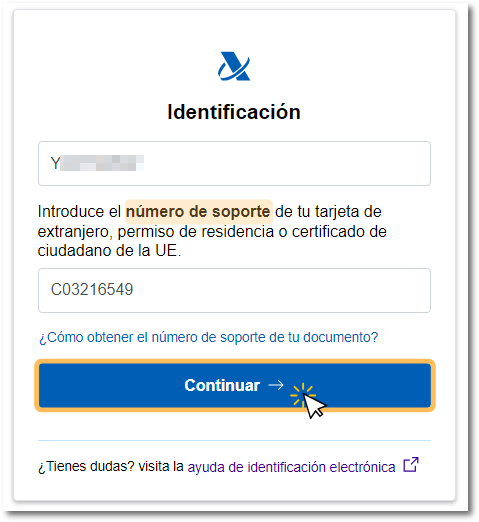

If you indicate a NIE , the information that will be requested will be the support number that appears on the document. You can consult the help link "How to obtain the support number of your document", which explains how to locate this information on the foreigner's card, residence permit or certificate of citizen of the EU and how to enter it correctly on the form.

-

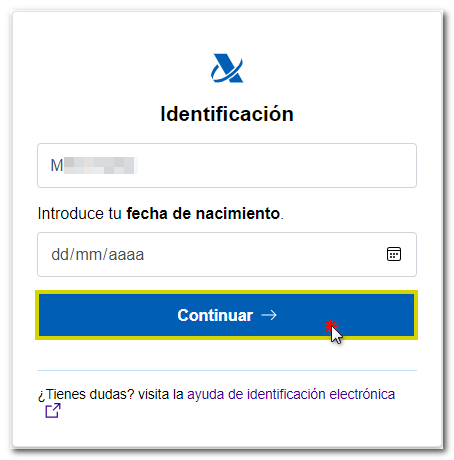

If it is a NIF without a validity date, type K, L, M , the information you will have to provide will be the date of birth that appears on your document.

Click "Continue".

NOTE . If you are disabled from obtaining the reference via checkbox, these options will not appear.

After clicking "Continue", the system detects whether or not you filed Income Tax in the previous year.

-

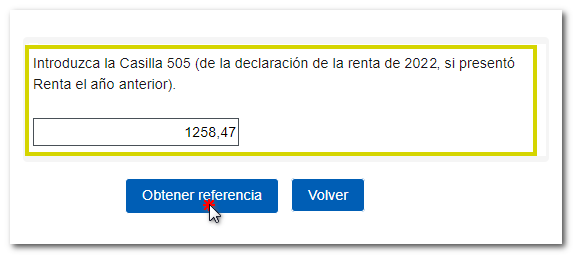

If you filed an income tax return for the 2023 tax year, whether as an individual or joint return, the field is enabled to provide the information from box 505 of the 2023 income tax return. Remember that this corresponds to the "General taxable base subject to tax" and not to another amount or to the result of the declaration. Check that box on the copy of last year's declaration or draft, in the "Income or refund document." To enter the amount correctly, do not enter any sign in the whole number and separate the decimals with a comma.

-

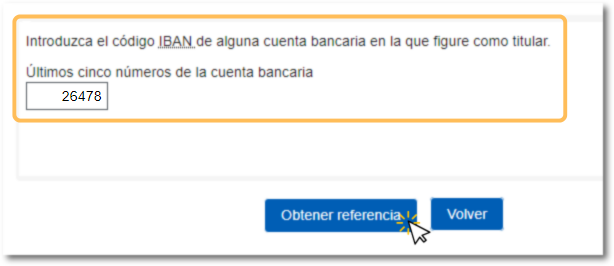

If you were not a 2023 Income Tax return taxpayer, the last five positions of the IBAN of a bank account that we know you held in 2024 will be requested. This information will also be requested if the amount in box 505 of the 2023 Income Tax Return is 0.00.

Once you have entered all the requested data, click on "Get reference".

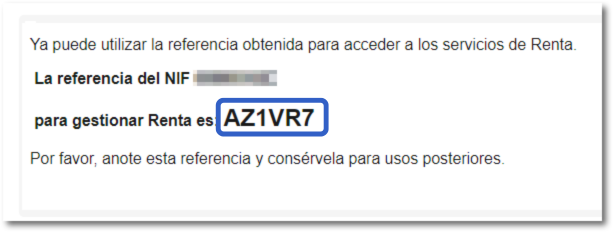

The 6-character reference to manage Income will be displayed. Please write down or copy this reference for later use. However, you are allowed to obtain up to 10 Renta references per day and each of the references received will be different and will automatically revoke the one previously generated.

Please note that if you have obtained a reference from the APP, obtaining a new one through the browser will revoke the previous one, so you will have to identify yourself again on the mobile device. Remember that only the last reference generated will be valid, either through the APP or from the website.

Once you have obtained the reference, you will be able to manage any of the available Income services or those that allow identification in this way, such as requesting a tax certification. PIT.

By means of a reference, you will access your Income Tax file, where in the "Available Services" section you will be able to check the procedures enabled for you at that time.

If you want more information about managing the reference from the Tax Agency APP, you can consult the help "User management in the APP- AEAT ".