Consult tax data online

To view your tax information, click the link "Tax information" in the "Highlighted procedures" section.

Currently, to consult your tax data you can identify yourself in these 4 ways:

- With certificate or electronic DNI ;

- With Cl@ve Mobile (if you are registered in the Cl@ve system);

- With the reference number of the 2024 Income Tax draft or declaration;

- Using another country's ID such as a EU citizen (eIDAS).

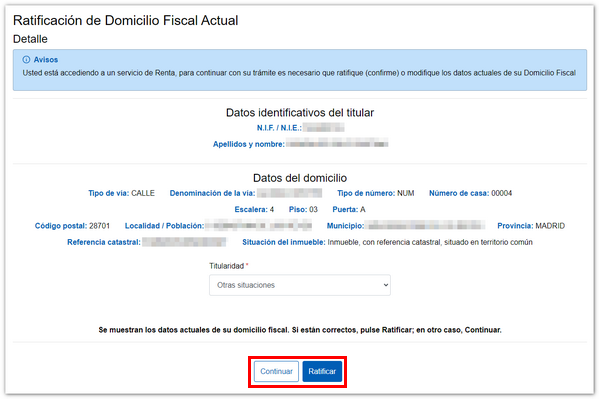

After logging in to any of the enabled systems, if this is your first time accessing the 2024 Income Tax services, a window will appear for you to confirm or modify, if necessary, your tax address information.

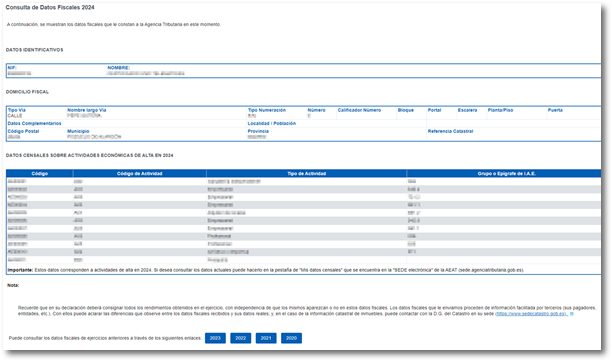

Once the address has been confirmed, the tax data that the Tax Agency has at that time will be displayed.

You can also consult your tax data through the APP- AEAT for mobile devices, identifying yourself in the application with the Income reference number, Cl@ve , electronic certificate or DNIe .

Consultation of tax data from previous years

If you need to consult tax data from a previous year, you can access it from the query itself or from the "Previous years" section and select the corresponding year.