Consultation, revocation, rectification of direct debit account for collaborators

Skip information indexDirect debit consultation for collaborators

Social collaborators can consult and manage those direct debits that they have submitted on behalf of third parties by accessing with a certificate or DNI electronic to the procedure"Direct Debits. Query, revocation, reinstatement, or correction of the direct debit account for employees.

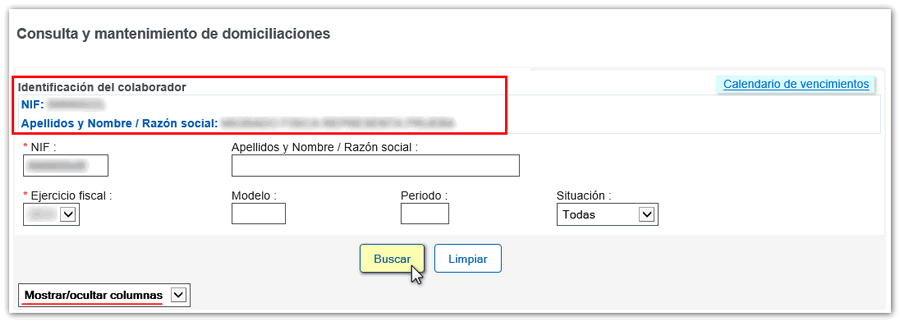

After identifying yourself, the following window will display the collaborator's identification data and, in the upper right-hand corner, the link to " Due date calendar" , which links to the "Taxpayer calendar" so that you can check the direct debit deadlines for the different models.

To locate a direct debit and access the details and available services, you must complete at least the mandatory search filters " NIF " (of the direct debit holder) and " Fiscal year" (optionally fill in the "Model" or the "Period") and press " Search" .

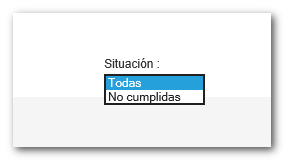

Using the "Status" drop-down menu, you can check all the due dates for direct debits by selecting "All" or filtering by "Unfulfilled".

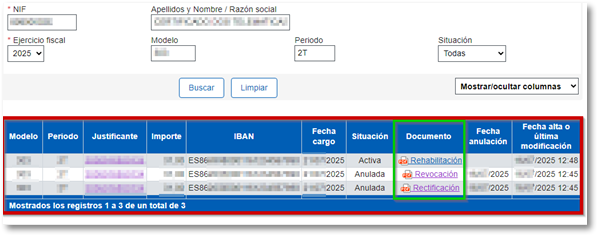

The list of existing direct debits that match the established filters will be displayed and the information for each record will be sorted into columns (Model, Period, Proof, Amount, IBAN , etc.).

The " Show/Hide Columns" drop-down displays only the information you want.

In the " Status" column you can see the status of the direct debit processing, which determines the possible actions (rectification, revocation or rehabilitation).

By clicking on the receipt number you can access the details of the file and the available actions.