Consultation, revocation, rectification of direct debit account for collaborators

Skip information indexRehabilitate direct debit for collaborators

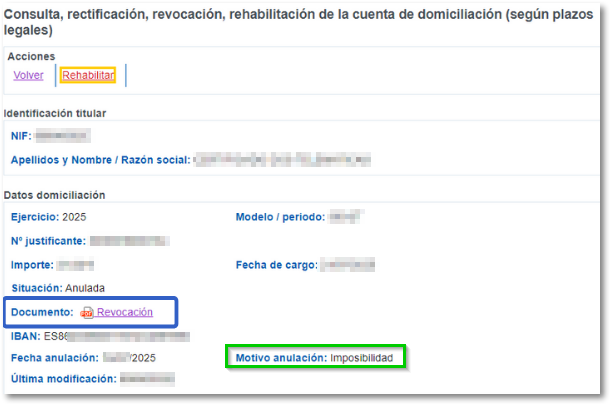

If you decide to undo the revocation, you can choose to reinstate the direct debit. This option will only be available for direct debits in the " Cancelled" situation and within the direct debit period.

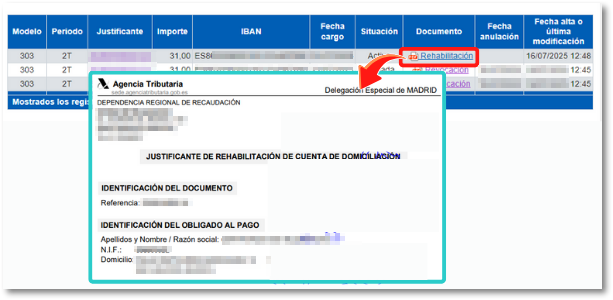

By accessing the details, you can see, among other things, the reason why the declaration was cancelled and who made that change.

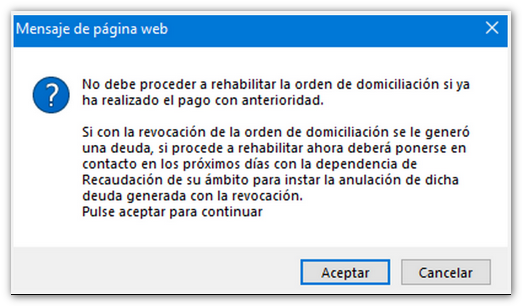

After accessing the link " Rehabilitate" the following warning will be displayed:

If the previous cancellation was made by payment with NRC, you should not re-establish the direct debit, as this would result in a double charge.

If the cancellation was made by acknowledging the debt, it must be taken into account that said debt is still active and must be cancelled if you wish to reinstate the direct debit. In this case, you can contact the corresponding Regional Tax Collection Department to regularize the situation.

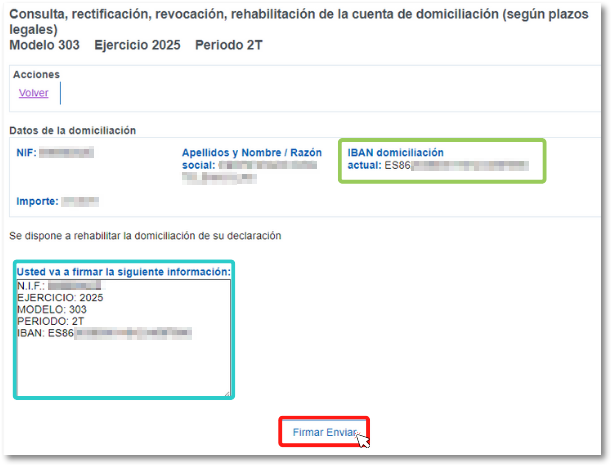

If you wish to proceed with the rehabilitation, you will see the bank details on the screen and you will be able to Sign and Send

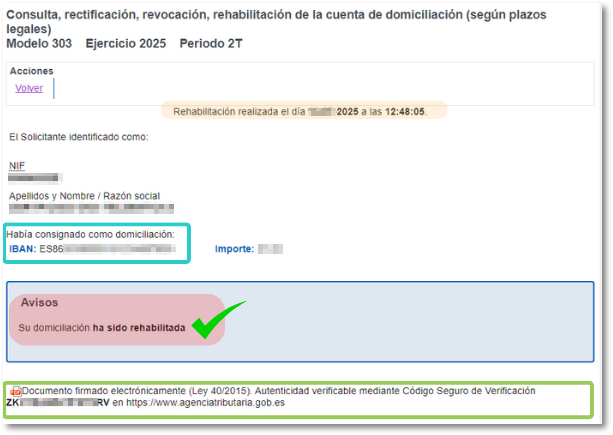

The following screen shows the confirmation of the rehabilitation with date and time and the CSV of the justification document

If you go back to the direct debit consultation, you will see the modified option and you will be able to see the PDF of the proof of having carried out the rehabilitation.