Paying debts

Skip information indexPay all my debts

The "Pay all my debts" ## management, available both on the electronic headquarters and in the AEAT app, allows you to pay all your outstanding debts at once and in the same operation.

You can access as the owner or as an authorized person or entity. The specific power of attorney required is RA19007, included in the general power of attorney GENERALLEY58 (General power of attorney for procedures or actions related to article 46.2 of law 58/2003).

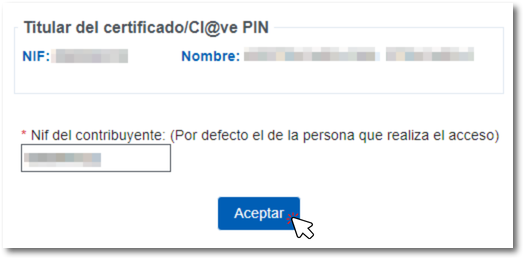

After identification with Cl@ve, with a certificate or electronic DNI or with the identification system for citizens of the European Union (eIDAS), check the taxpayer's NIF or modify it in the case of access with power of attorney on behalf of a third party, and click "Accept".

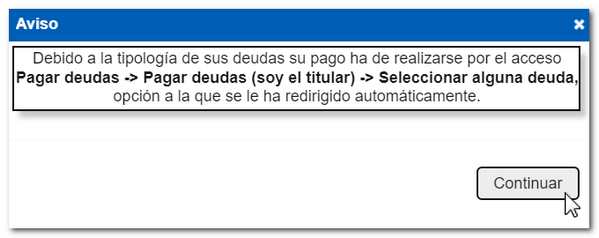

Note: It is possible that, due to specific circumstances of a debt, access to this full payment option may not be enabled. In this case, the corresponding notice will appear and the page will redirect to the specific "Select a debt" option.

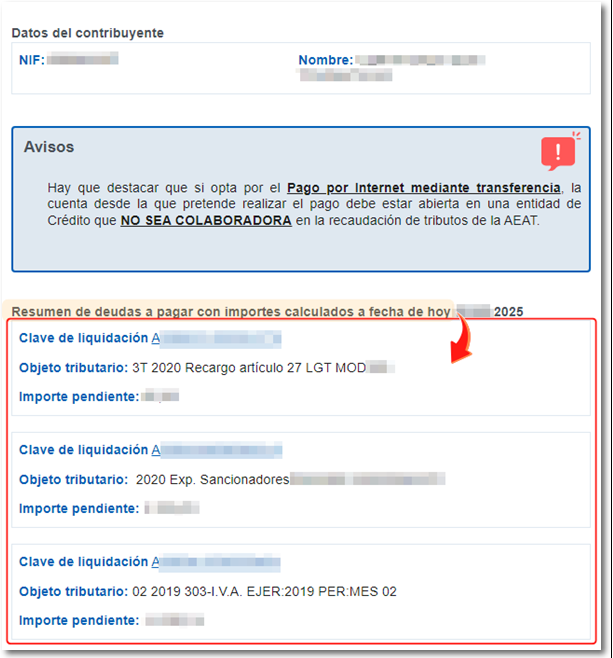

The list of outstanding debts will then be displayed, each with its settlement code, tax concept and outstanding amount. Select the key you want to liquidate. You can liquidate them all at once.

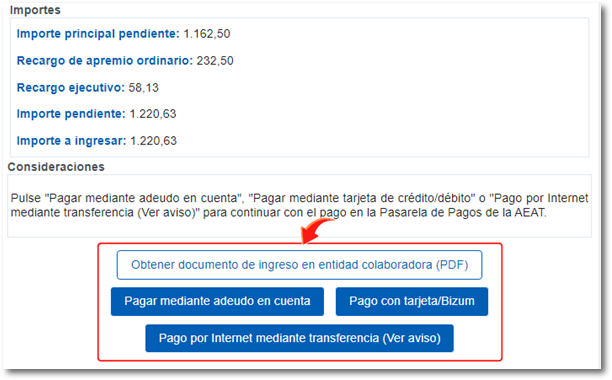

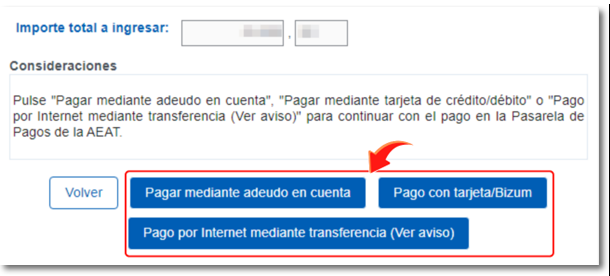

At the end of the list you will find the total amount and the available payment options: by direct debit, card/Bizum or transfer.

After making the payment by direct debit or by card/Bizum, you will obtain the generated NRC and you will be able to download the proof of the operation, along with the option to request a tax certificate of being up to date.

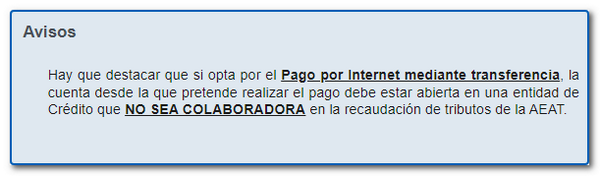

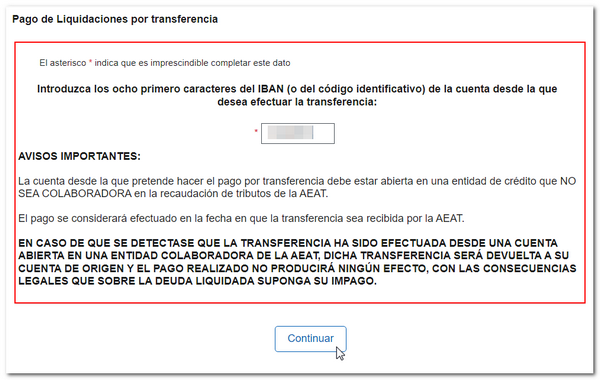

If you choose to pay by bank transfer, please note the notice above: The account must belong to an entity that does not collaborate with the AEAT .

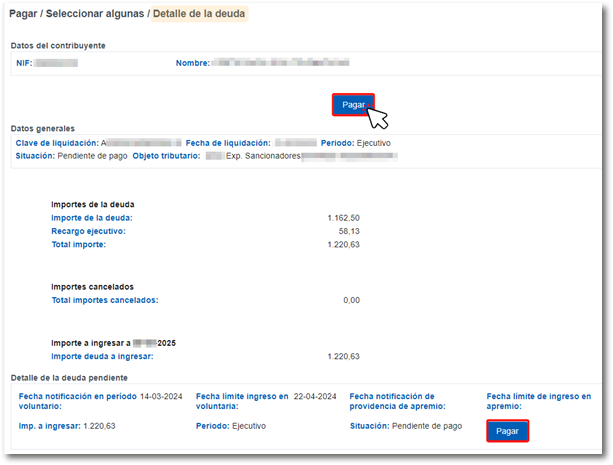

You can also access a settlement key from the list to obtain more details and to make payment only for that debt.

In this case, in addition to the online payment options (by direct debit, by card/Bizum and by transfer), the option will also be enabled "Obtain entry document from collaborating entity (PDF)", for in-person payment at a bank branch.