Paying debts

Skip information indexSelect any debt

The "Select a debt"management, available both on the Electronic Office and in the app of the AEAT, allows you to view the list of your outstanding debts and select those you wish to pay.

You can access as the owner or as an authorized person or entity. The specific power of attorney required is RA19008, included in the general power of attorney GENERALLEY58 (General power of attorney for procedures or actions related to article 46.2 of law 58/2003).

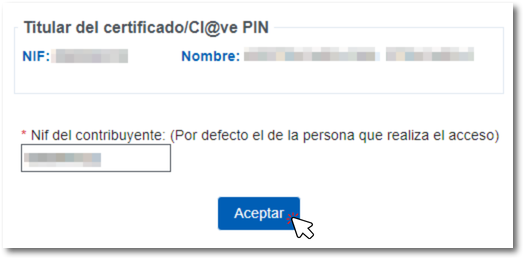

After identification with Cl@ve, with a certificate or electronic DNI or with the identification system for citizens of the European Union (eIDAS), check the taxpayer's NIF or modify it in the case of access with power of attorney on behalf of a third party, and click "Accept".

The list of outstanding debts will then appear, each with its settlement code, tax concept and outstanding amount.

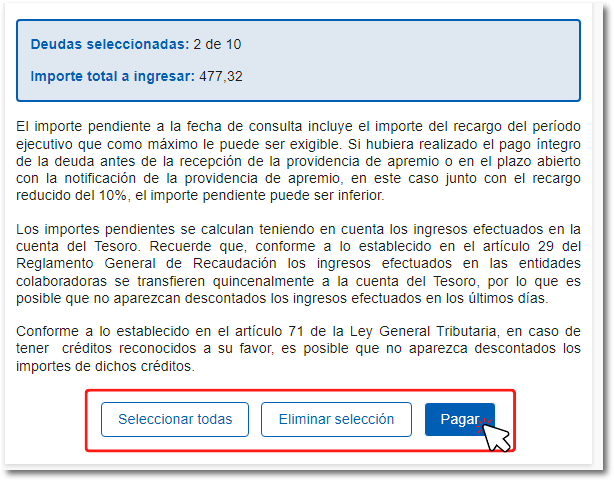

Check the box to the left of the debt or you want to pay. In the box above, the number of selected debts and their total amount will be calculated.

At both the top and bottom of the list, you will find the options to select all debts or to remove the selection and make a new one.

Once the corresponding debts have been selected, reviews the total of the selected debts and the total amount and press "Pay" .

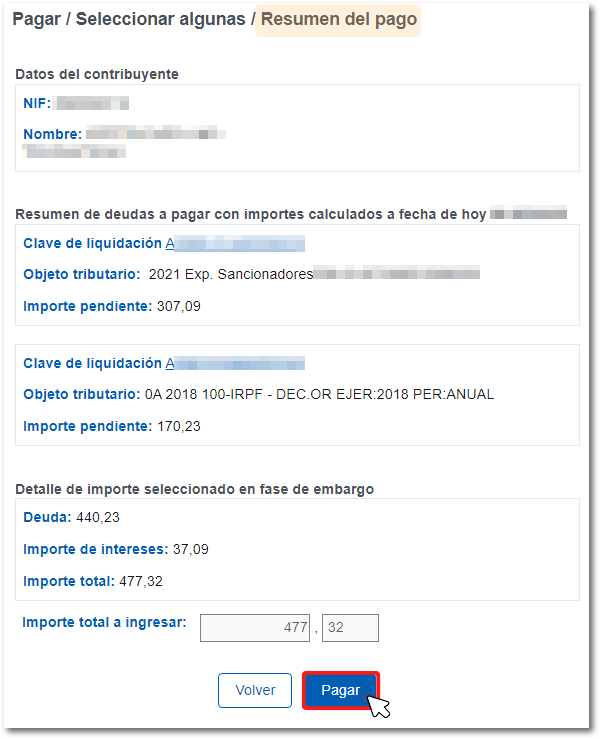

A summary of the selected debts and the total amount to be paid will be displayed. Click the "Pay" button again.

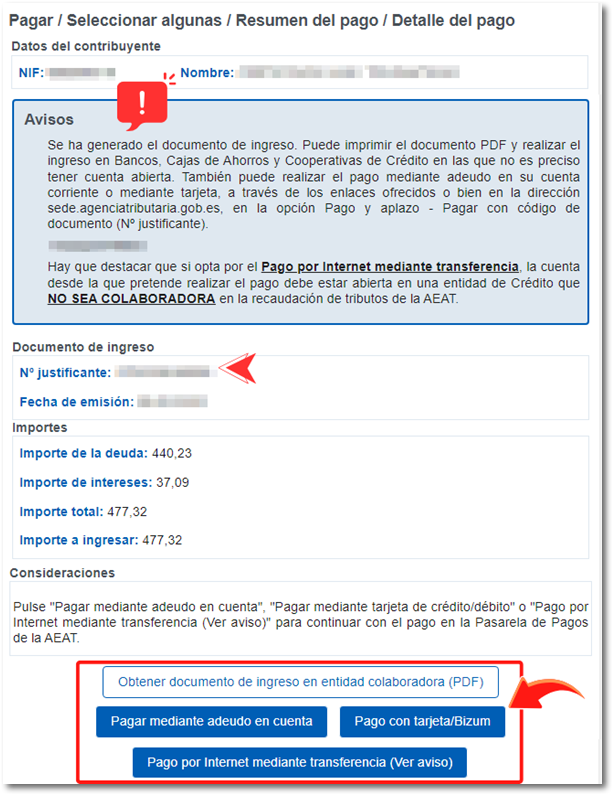

In the next window, check the notifications, verify the payment document, and the amounts. Payment options are listed below. You can make the payment by direct debit, by card/Bizum or by transfer, in addition, the option will be enabled "Obtain entry document from collaborating entity (PDF)", for in-person payment at a bank branch.

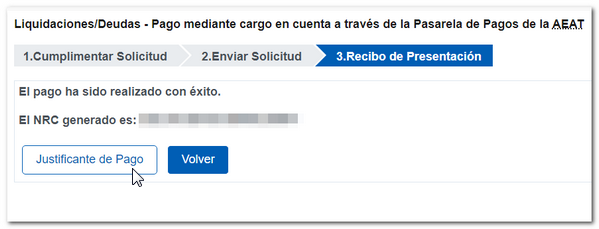

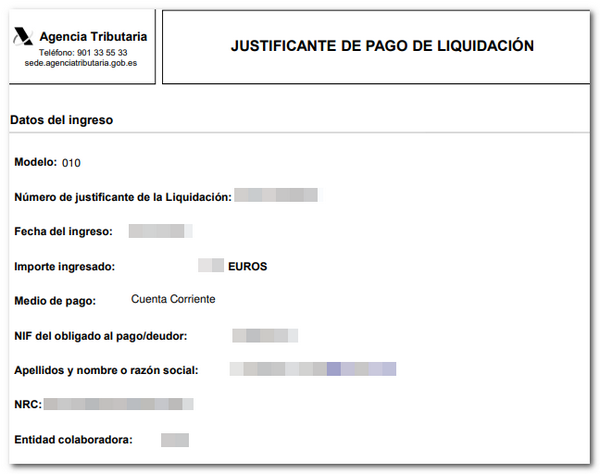

After making the payment by direct debit from a collaborating institution or by card/Bizum, you will receive the generated NRC and you will be able to download the transaction receipt.

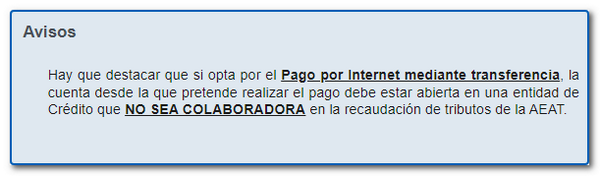

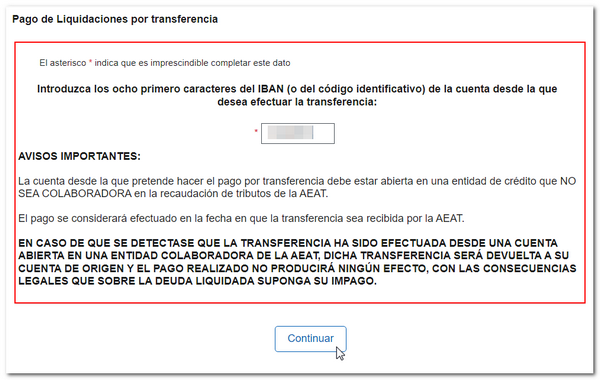

If you choose to pay by bank transfer, please note the notice above: The account must belong to an entity that does not collaborate with the AEAT .