Model 583 - Technical assistance

Skip information indexSubmission of a supplementary self-assessment of form 583

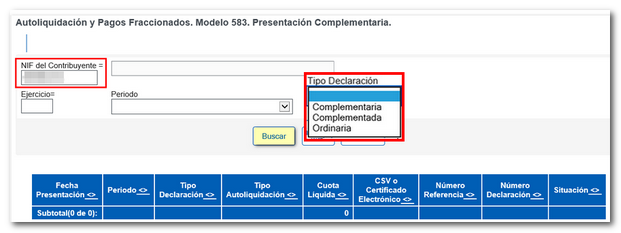

To file a supplemental return, you must first locate the original return that you will supplement. It is mandatory to enter the taxpayer's NIF to carry out the search. However, to narrow down the results you can indicate the year, period and type of declaration (ordinary, supplementary or complemented).

The table will display the localized statements; To access the submission of the supplementary declaration, click on the link in the "Submission Date" column.

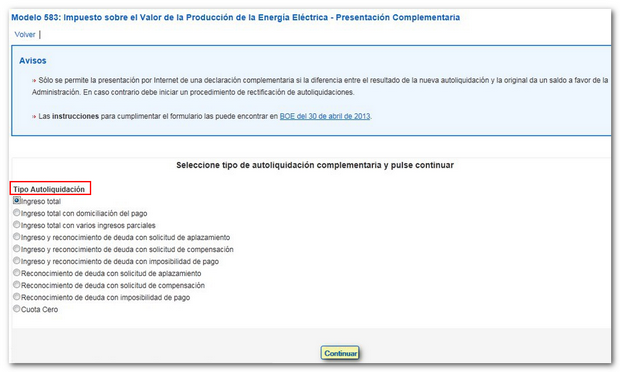

Please see the notice which provides information on the cases in which a supplementary declaration must be submitted. Next, select the type of supplementary self-assessment, depending on its result and the payment method, and click "Continue".

The form will be displayed with the data from the original declaration already loaded and you will only have to enter the data relating to the payment, if applicable, and those from the supplementary declaration. Remember that the amounts will be filled in in euros and with two decimals separated by a comma. Click "Submit Presentation" to finalize your presentation.