Model 583 - Technical assistance

Skip information indexElectronic filing of form 583

Form 583 must be submitted online. The person filing the return must have a valid electronic certificate (from the declarant or from an entity authorized to file returns on behalf of third parties).

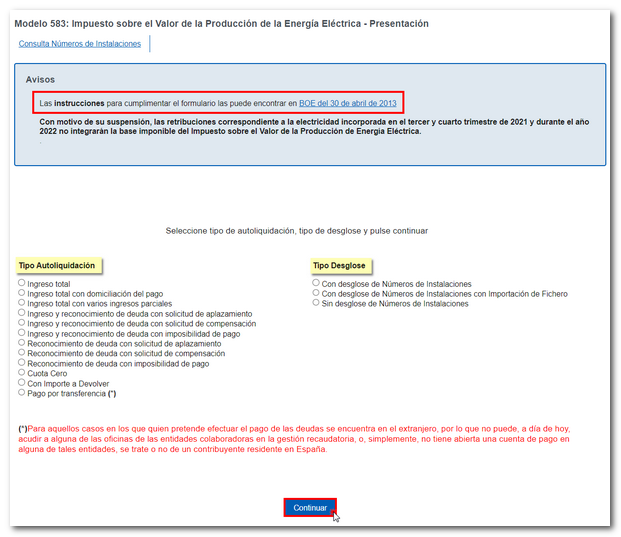

First, select the type of self-assessment and breakdown from the available options. Then click "Continue". If you have any questions regarding the completion of the declaration, you have access to the help link " BOE of April 30, 2013" which appears in the "Notices" box in the header. If you select a breakdown with file import, in the "Notifications" section you will find a link to the file record layout.

You can also get help with tax matters and completing the form by contacting the virtual counter " ADI Do you need help?", which opens when you enter the form, in the lower right corner.

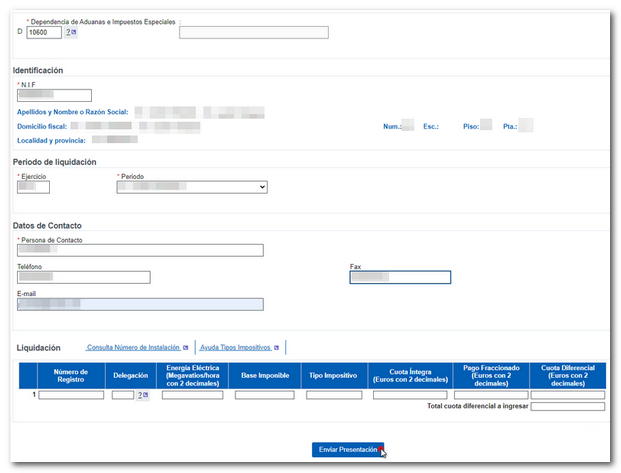

Next, fill in the requested information in the declaration. Remember that the amounts will be filled in in euros and with two decimals separated by a comma.

Once all the data has been entered, press the "Submit presentation" button.

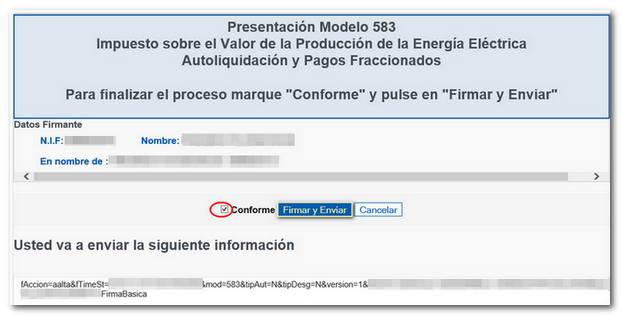

Then click "Sign and Send." A new window will display the presenter's data and a box with the encoded information being sent. Check the "I agree" box and press "Sign and Send" to complete the submission.

If the declaration is accepted, the AEAT will return a summary of the application validated with a secure 16-character verification code, the number of which begins with the fiscal year number plus the model number, 583 (for example, 2023583XXXXXXXXX). This number appears on the response sheet of a successfully submitted electronic submission along with the date of submission and the Secure Verification Code. If you have marked direct debit as "Self-assessment Type", a NRC will appear on the response sheet, which does not act as such, that is, there is no automatic charge, but rather it simulates a receipt number.