Form 781 - Technical Assistance

For the electronic submission of model 781 you have an online form at the Electronic Headquarters of the AEAT, within the procedures for model 781. "Model 781. Tax on the interest margin and commissions of certain financial institutions. "Partial payment".

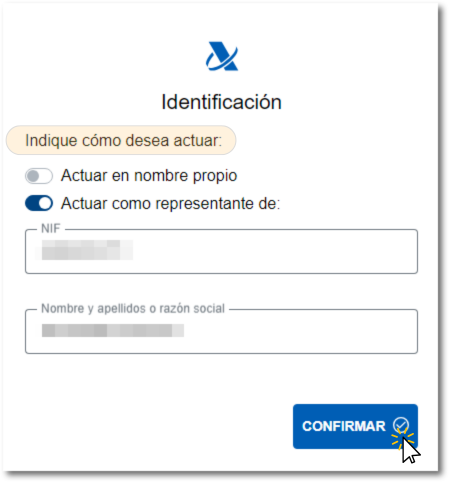

This procedure requires identification with an electronic certificate. If the declarant does not have an electronic certificate, it is necessary that the person making the submission be authorized to submit declarations on behalf of third parties, either by being registered as a collaborator or by being authorized to carry out this procedure.

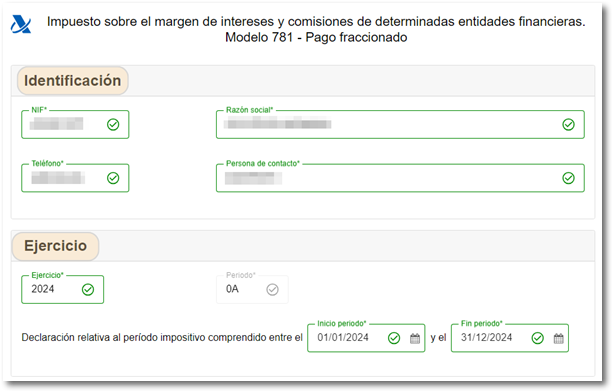

In the form, fill in the identification data, NIF, company name, telephone number and contact person. Next, fill in the fiscal year box. The default period is 0Y since this is an annual return. Choose the start and end dates for the period by clicking on the calendar icon or fill in the information directly in the dd/mm/yyyy box.

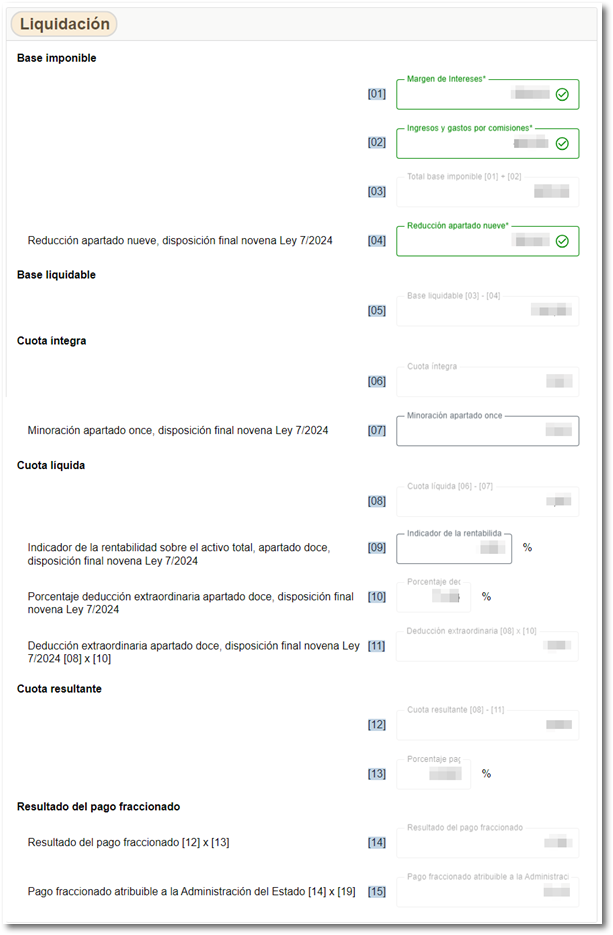

Enter the tax settlement information. Please note that some fields are automatically filled in, as indicated in the previous fields.

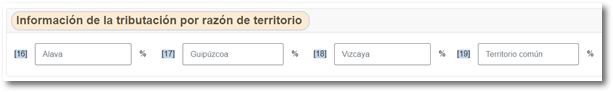

The "Common Territory" field in box 19 will only be completed if data is entered in the other boxes in the "Territory-Related Tax Information" section.

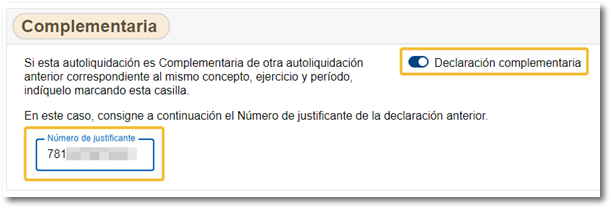

The declaration also allows supplementary declarations, in which case you must indicate the supporting document number of the previous declaration, beginning with form number 781.

At the bottom are the options available on the form.

"Show/Hide Information" to choose whether or not you want to see the results of the validations.

"Delete statement" leave all the boxes blank, deleting all the information entered up to that point.

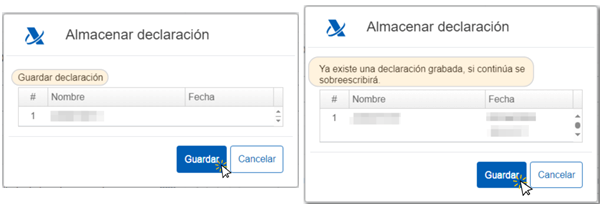

Load/Save. The "Save" option allows you to save the data already completed even if the declaration has not been validated correctly, this way you can keep the data and continue completing it at another time. The declaration will be saved on the server of the AEAT for later loading into the form using the button "Carry". Only one session is saved, so if there is a previously saved statement it will be overwritten and replaced by the current one.

From the button "Matter"You can import a file with the data adjusted to the record design published on the website in "Help", "Record Designs", "Other Models", "781 - Fiscal Year 2024 and following". You can also import a previously exported return from the same form. You'll find the "Export" button by clicking the "Formalize Income/Refund" button; therefore, the declaration should not contain any errors.

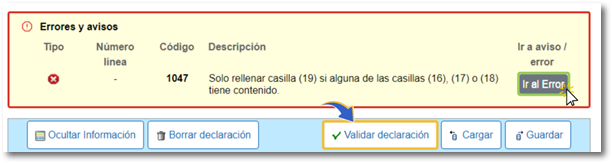

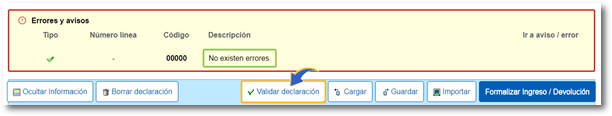

Using the button "Validate statement" You can check if there are any warnings or errors in the declaration. When validating the declaration, the list of errors and warnings detected will be displayed, which you can access for correction from the "Go to Error" or "Go to Warning" button next to the description of the fault.

If no errors are detected in the declaration, the description will state that there are no errors.

Once validated, you can formalize the settlement options from the button "Formalize Income/Refund".

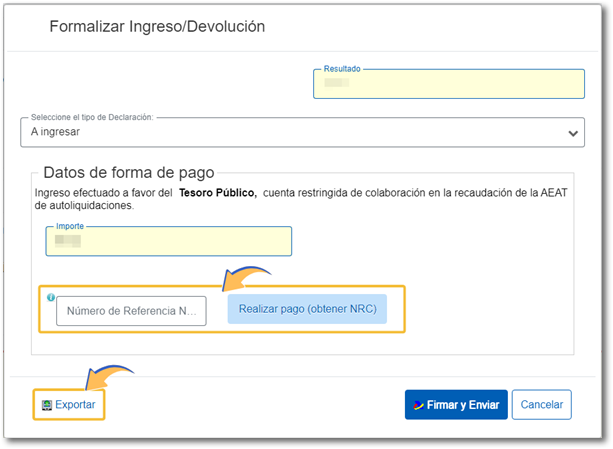

From this same window you can obtain a file in format BOE which follows the registration design in effect from the button "Export", the file will be named NIF of the declarant, the fiscal year, the period and by extension the number of the model 781.

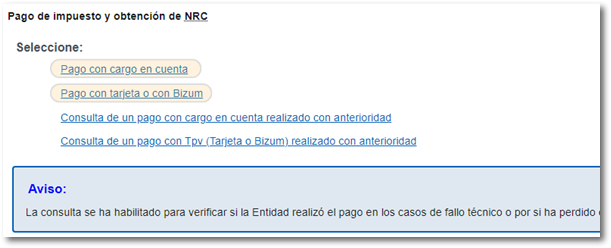

If the result is to be paid and you have not domiciled the amount, you must first obtain the NRC and then submit the self-assessment. The NRC is the Full Reference Number, a 22-character code that serves as proof of payment. From the form itself, in the "Make payment (get NRC )" button, you can connect to the payment gateway to automatically generate a NRC with the data contained in the declaration. Once you have obtained the NRC you must enter it in the "Reference Number NRC " field. You can pay by direct debit, card, or Bizum.

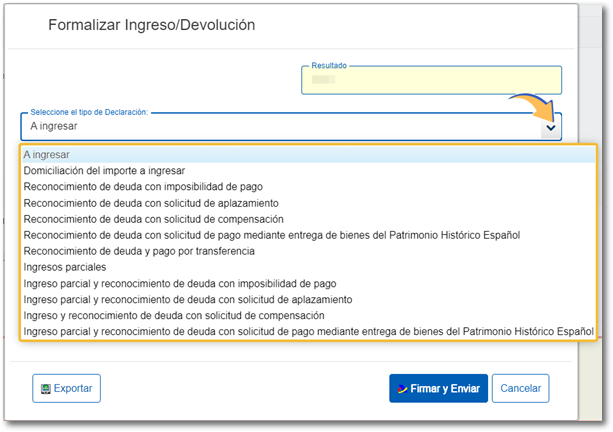

However, you can choose other forms of payment or recognition of the debt.

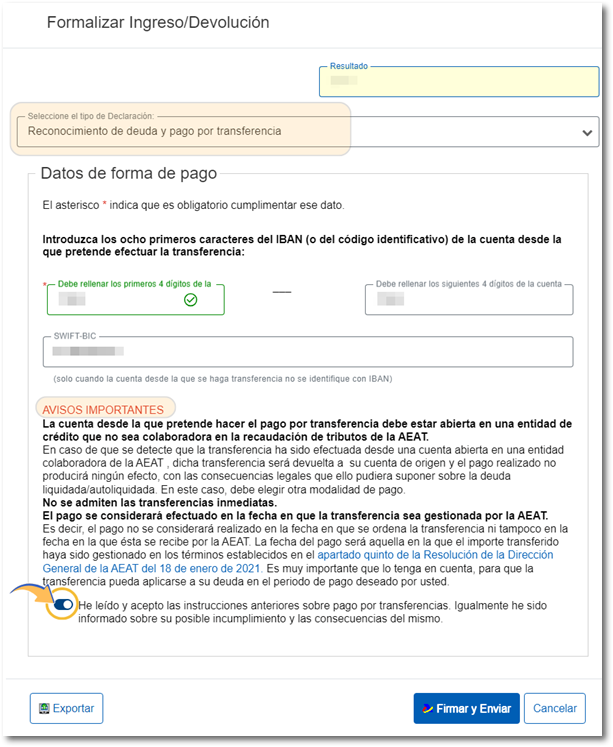

Form 781 also includes the option to pay by transfer from a bank account at a non-collaborating bank. Select "Acknowledgement of debt and payment by transfer" from the "Select the type of declaration" drop-down menu.

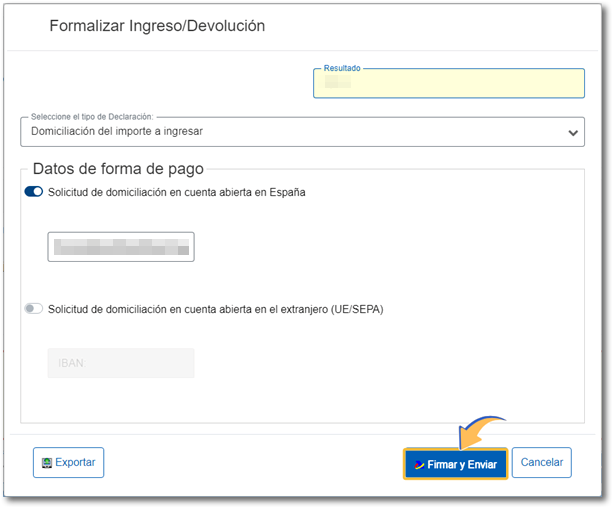

>In the "Formalize Income/Refund" window, submit the declaration using the option "Sign and Send".

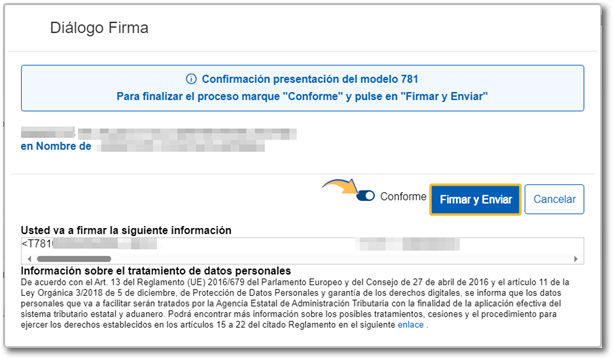

In the new window, check the "Accept" box to confirm the filing of the declaration. The text box will display the encoded content of the declaration. You can continue filing the return by clicking "Sign and Submit."

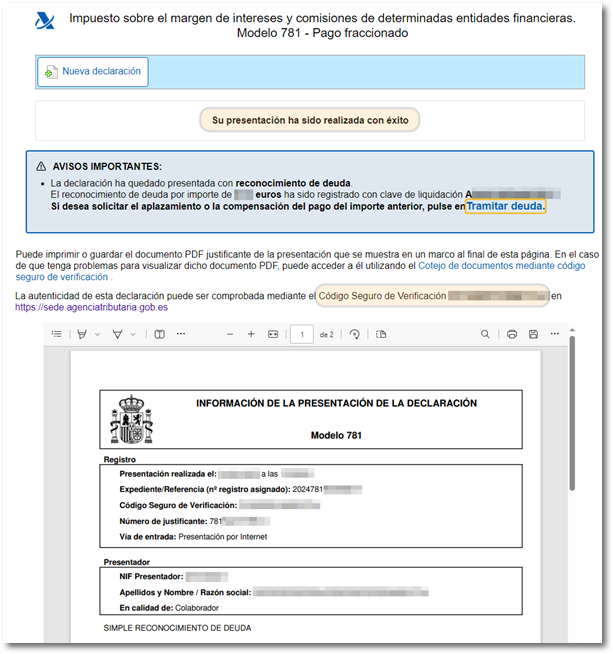

If everything is correct, you will receive the response sheet that will show "Your submission has been successfully completed" and a Secure Verification Code so that the authenticity of the declaration can be verified in the Electronic Office in the section "Document verification using a secure verification code" located in "Notifications and Document Verification" (in the highlighted blocks), in addition to aPDF embedded containing a first page with the submission information (registration entry number, Secure Verification Code, receipt number, day and time of submission and presenter details) and, on subsequent pages, the full copy of the declaration.

In cases where there is recognition of debt, a link will be displayed on the presentation response sheet to submit the deferral or compensation request. Click "Process debt".