Functioning of Form 360

Skip information indexHow to save and retrieve data from Model 360 returns using the form

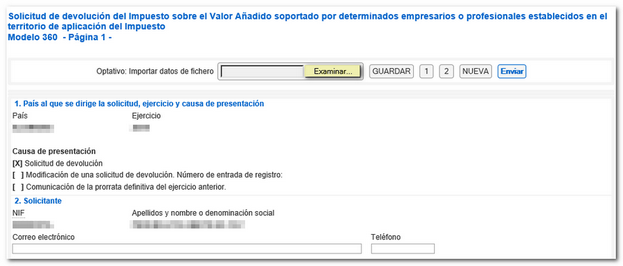

Completing the Model 360 form requires completing the initial screen, where the basic data of the application is captured. Complete the basic application details and click the "Accept" button.

At the bottom of the form are buttons with the available options. To save the information you have completed, click on "Keep", may contain warnings or errors and the declaration does not need to be fully completed.

It will be stored on the servers of the AEAT so that they can be retrieved in a later session. Please note that if a previously recorded statement already exists, it will be overwritten.

To retrieve a previously saved return, access the Form 360 submission form and complete the initial form with the same information as the return you wish to retrieve. Click "Accept".

With the 360 model loaded, click the button "Carry" located in the buttons at the bottom.

When you click "Upload," you'll receive a notice indicating that the data entered so far in the declaration will be deleted. Click "Yes" to continue uploading your saved return.

The stored statements are then displayed so you can choose the one you want. Select it and press "OK."